New Zealand Government Cuts Taxes as Budget Deficit Widens

(Bloomberg) -- New Zealand’s new center-right government delivered on its election promise to cut taxes in its first budget even as the Treasury Department forecast bigger deficits and a delayed return to surplus.

Most Read from Bloomberg

Donald Trump Becomes First Former US President Guilty of Crimes

World’s Largest Nuclear Plant Sits Idle While Energy Needs Soar

Insurers Sink as UnitedHealth Sees ‘Disturbance’ in Medicaid

‘Not Gonna Be Pretty:’ Covid-Era Homebuyers Face Huge Rate Jump

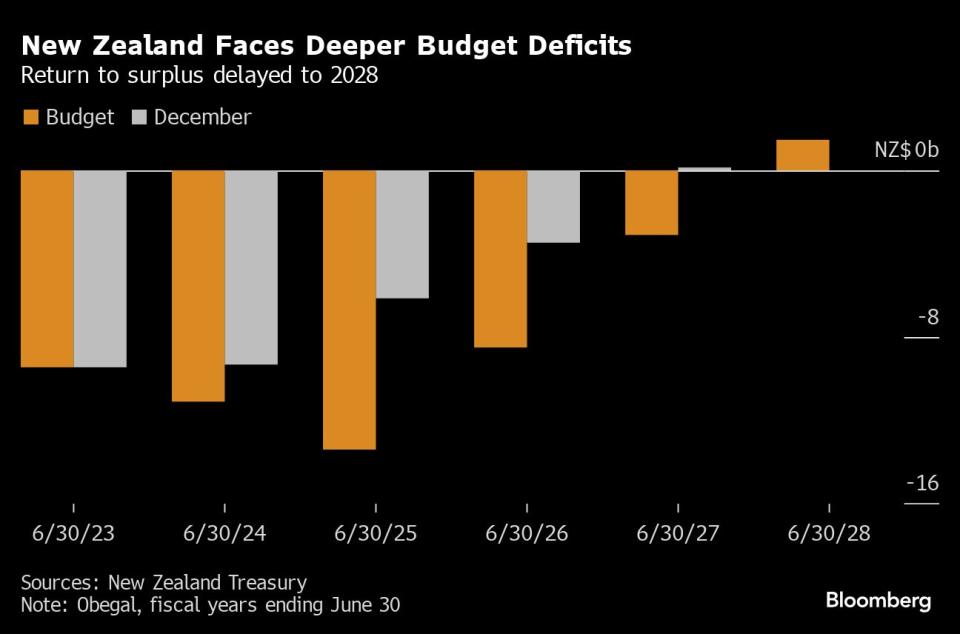

The tax package is worth NZ$14.7 billion ($9 billion) over four years and targets low and middle-income households, with young families benefiting the most, Finance Minister Nicola Willis said Thursday in Wellington. At the same time, Treasury projections show the government’s deficit will widen to NZ$13.4 billion next year and the budget won’t return to the black until 2028, a year later than previously expected.

“Our government was elected to give a fairer deal to hardworking New Zealanders and the tax package we are confirming today delivers on that promise,” Willis said. “The changes will be fully paid for with offsetting savings and revenue initiatives, meaning tax relief won’t require additional borrowing and won’t add to inflation pressure.”

The tax cuts are almost identical to what Prime Minister Christopher Luxon’s National Party pledged ahead of the October election, despite some expectation that they could be scaled back as the weak economy curbs revenue. The government is also slashing spending and cutting thousands of jobs in the public sector as it seeks to reduce debt and get its books back in order.

Read More: New Zealand Budget 2024: Winners and Losers

The budget has delayed the start of fiscal tightening, which will be of concern to the central bank as it keeps its Official Cash Rate high to tame inflation, said Mark Smith, senior economist at ASB Bank in Auckland.

“The risk is that OCR cuts we expect for early 2025 get pushed further back, undoing much of the support that the tax cuts were trying to deliver,” he said.

The fiscal outlook has deteriorated significantly since Treasury’s half-year update in December, with the deficit in the 12 months through June this year widening to NZ$11.1 billion from the $9.3 billion previously expected. Next year’s estimated shortfall is more than double the NZ$6.1 billion gap projected six months ago.

That’s because Treasury expects to collect some NZ$28 billion less in tax revenue over the forecast period due to weaker economic growth and the government’s tax reductions.

The economy, which was in recession in the second half of 2023, will contract 0.2% this fiscal year on an annual average basis, Treasury now projects. That’s down from 1.5% growth expected in December. The nominal size of the economy has been revised down every year through 2028.

Deeper Downturn

“What has become apparent over the last six months is that the downturn started earlier, has been deeper, and is likely to last for longer than previously thought,” Willis said. Lower nominal gross domestic product “means that reducing expenses and debt as a proportion of GDP becomes more difficult,” she said.

Net debt is forecast to peak at 43.5% of GDP next year and is seen barely declining over the period through 2028. The government’s goal is to get debt below 40% of GDP.

“An anemic economy and forecasts for subdued tax receipts are further delaying New Zealand‘s post-Covid fiscal consolidation,” S&P Global Ratings sovereign analyst Martin Foo said in response to the budget. “We still expect the country’s fiscal deficit to gradually narrow over the next few years, though net general government debt could stabilize at a higher level than we previously predicted.”’

The government will borrow NZ$12 billion more over the next four years than it anticipated in December, according to bond issuance plans published by New Zealand Debt Management with today’s budget.

Willis has reduced the government’s operating allowance – the amount allocated for new spending – to NZ$3.2 billion this budget and to NZ$2.4 billion in each of the following three.

Income Thresholds

The budget includes targeted investment in health, education and law and order as well as new infrastructure, but the tax reductions take center stage.

They will be delivered from July 31 through lifting the income thresholds at which higher tax rates kick in, by giving tax credits to certain households and by subsidizing the costs of early childhood education. Restoring interest deductibility for residential rental property is also part of the overall tax package.

Households with children will benefit by about NZ$40 a week on average, with some better off by about NZ$125 a week, the government said. Overall, around 1.9 million households will benefit by NZ$30 a week, it said.

“We had the choice to break our promise to New Zealanders, we chose not to do that,” Willis said.

Any further tax reductions won’t be considered until the budget is back in surplus, she said.

Willis delivered her budget as indigenous Maori held protests in several cities around the country, including outside parliament in Wellington. They are upset at what they see as the government’s “anti-Maori” stance including moves to reduce the influence of the Treaty of Waitangi, New Zealand’s founding document, in public policy.

(Updates with economist comment in sixth paragraph)

Most Read from Bloomberg Businessweek

Disney Is Banking On Sequels to Help Get Pixar Back on Track

Why Dave & Buster’s Is Transforming Its Arcades Into Casinos

The Secret Ozempic Recipe Behind Novo’s Race to Boost Supplies

©2024 Bloomberg L.P.

Yahoo News

Yahoo News