Alibaba is about to spend big to upgrade logistics network (BABA)

This story was delivered to Business Insider Intelligence Transportation and Logistics Briefing subscribers hours before it appeared on Business Insider. To be the first to know, please click here.

Chinese e-commerce giant Alibaba announced earlier this week that it will invest $720 million in Huitongda Network, a subsidiary of Jiangsu Five Star Appliances, to build new logistics and supply chain networks in rural China, according to The Asia Times.

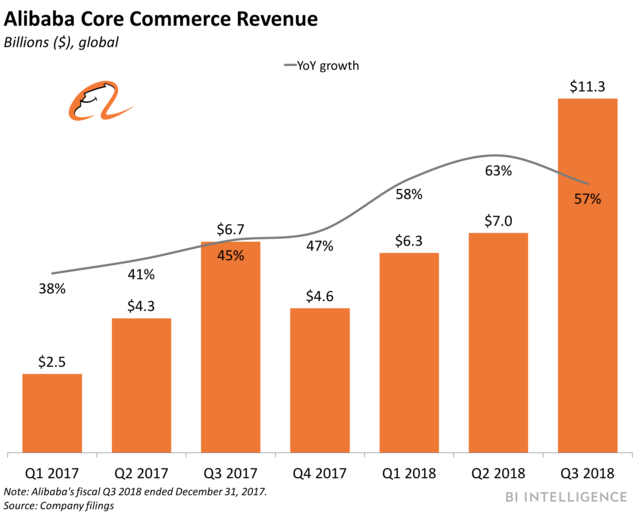

BI Intelligence

While the companies didn't release specifics, they could potentially build new fulfillment centers and warehouses, as well as order more delivery trucks, to help Alibaba tap into Huitongda's largely rural customer base.

Huitongda counts more than 80,000 franchised stores, which cover about 200 million rural residents, or about 14.5% of the world's largest country by population.

The investment is part of Alibaba's larger effort to spend aggressively to upgrade its logistics capabilities and access millions of potential new customers. The World Bank estimates that 43% of Chinese consumers lived outside of urban areas in 2016, with many in remote, rural areas inaccessible via highways and challenging to access via road. To reach these consumers, e-commerce and logistics companies need to spend big on new logistics infrastructure.

This is why Cainiao, the third-party platform that coordinates all of Alibaba's deliveries, is aggressively piloting drone deliveries — it hopes these efforts can grow its customer base, which is currently concentrated in urban and suburban settings. Chinese logistics companies handled 13.9 million parcels in the second half of 2017 alone, and Alibaba expanding its operations will only drive volume higher in the years ahead.

Fortifying its logistics capabilities will likely help Alibaba defend its turf against chief rival JD.com.Analysys International Enfodesk estimates that Alibaba controlled 51.3% of the Chinese e-commerce market at the end of Q2 2017, while JD.com controlled only 32.9%. JD.com, however, boosted its market share 15% between 2015 and 2017, according to Analysys' estimates.

Expanding its logistics operations could allow Alibaba to stave off this threat by promising faster deliveries than its competitor in rural China, thereby meeting Chinese consumers' expectations for speedy deliveries and helping to peel away these customers.

That said, JD.com operates its own, third-party logistics arm, which has invested billions of dollars to upgrade its capabilities and explore new technologies like warehouse robotics and drones to cut costs and make further inroads into Alibaba's market share. Moreover, JD.com will likely counter this move by Alibaba in the future, only intensifying the logistics war between the two companies.

Business Insider Intelligence, Business Insider's premium research service, has written a detailed report on the AI in supply chain and logistics that:

Details the factors driving adoption of AI systems in the supply chain and logistics field.

Examines the benefits that AI can deliver in reducing costs and shipping times for supply chain and logistics operations.

Explains the many challenges companies face in implementing AI in their supply chain and logistics operations to reap the benefits of this transformational technology.

Interested in getting the full report? Here are two ways to access it:

Subscribe to an All-Access pass to Business Insider Intelligence and gain immediate access to this report and over 100 other expertly researched reports. As an added bonus, you'll also gain access to all future reports and daily newsletters to ensure you stay ahead of the curve and benefit personally and professionally. >> Learn More Now

Purchase & download the full report from our research store. >> Purchase & Download Now

See Also:

Yahoo News

Yahoo News