Amazon Prime may be reaching saturation in the US (AMZN)

BI Intelligence

This story was delivered to BI Intelligence "E-Commerce Briefing" subscribers. To learn more and subscribe, please click here.

Amazon Prime membership had flat growth in the US in the past year, according to a study of 1,000 US adults from Morgan Stanley, cited by Business Insider.

Although there was a 14% increase in Prime membership between Q4 2015 and Q4 2016 among respondents, the study found that 40% of those surveyed were Amazon Prime subscribers in both Q4 2016 and Q4 2017. Amazon Prime is very popular in the US, and 40% is still a healthy amount of subscribers, but these results suggest that the service may be reaching saturation in the market. This doesn’t mean Prime is a bad service, though, as the report found that most subscribers are happy with Prime and plan to renew their subscriptions. However, the issue of saturation remains.

Prime subscribers are a core part of Amazon’s business, so flat growth is a serious problem. Amazon rakes in approximately $9 billion annually from subscription fees, and Prime members spend an estimated $1,300 on Amazon each year, nearly double the $700 nonmembers spend. Failing to add more new subscribers prevents Amazon from getting the most out of its US consumers, and slows the growth of its dominance of US e-commerce.

If Amazon wants to draw in more domestic subscribers, it will need to expand its appeal beyond its affluent millennial base.

The e-commerce titan recently began offering Prime for $5.99 a month to consumers with an Electronics Benefit Transfer (EBT) card in an effort to bring in more low-income consumers.

Amazon’s acquisition of Whole Foods and its potential interest in entering the pharmacy space could add to Prime’s value, making it more attractive. By eventually making Prime the customer loyalty program at Whole Foods, and appealing to those who want easy and fast delivery of medications, in addition to other future value adds, Amazon could draw in new consumers.

In order to connect with Gen Zers, Amazon has launched a program to give teenagers their own accounts under their parents' in the hopes of locking in young consumers early on. Additionally, it's offering Prime for $5.49 a month to college students.

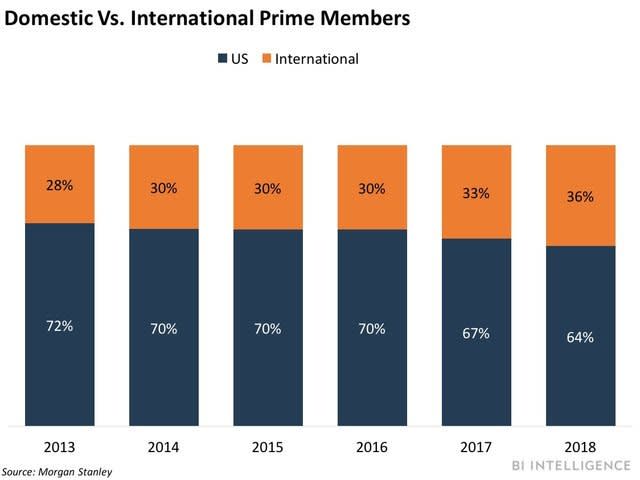

Amazon is also looking to foreign markets to boost its subscriber base, as membership is growing faster overseas, according to the survey. Amazon has been investing heavily in its overseas business and has been expanding to a number of new markets. The e-tailer needs to find ways to make Prime more appealing to international consumers, as the growth potential in other countries presents Amazon with the opportunity to bring in large numbers of new subscribers. Additionally, these customers would help make Amazon's international business profitable.

To receive stories like this one directly to your inbox every morning, sign up for the E-Commerce Briefing newsletter. Click here to learn more about how you can gain risk-free access today.

See Also:

Yahoo News

Yahoo News