Ameriprise Financial (NYSE:AMP) Shareholders Booked A 20% Gain In The Last Five Years

If you buy and hold a stock for many years, you'd hope to be making a profit. Better yet, you'd like to see the share price move up more than the market average. Unfortunately for shareholders, while the Ameriprise Financial, Inc. (NYSE:AMP) share price is up 20% in the last five years, that's less than the market return. Meanwhile, the last twelve months saw the share price rise 0.8%.

Check out our latest analysis for Ameriprise Financial

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

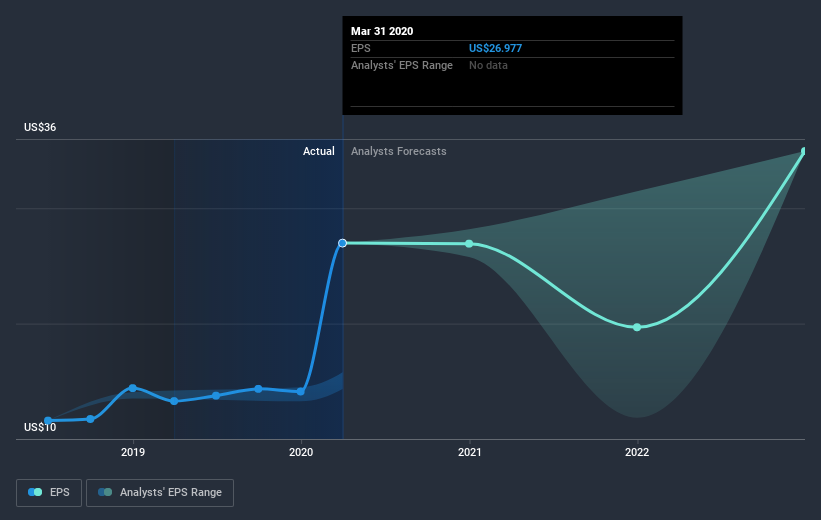

Over half a decade, Ameriprise Financial managed to grow its earnings per share at 26% a year. The EPS growth is more impressive than the yearly share price gain of 3.7% over the same period. Therefore, it seems the market has become relatively pessimistic about the company. This cautious sentiment is reflected in its (fairly low) P/E ratio of 5.57.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

It is of course excellent to see how Ameriprise Financial has grown profits over the years, but the future is more important for shareholders. This free interactive report on Ameriprise Financial's balance sheet strength is a great place to start, if you want to investigate the stock further.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. In the case of Ameriprise Financial, it has a TSR of 37% for the last 5 years. That exceeds its share price return that we previously mentioned. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

Ameriprise Financial shareholders gained a total return of 3.6% during the year. But that return falls short of the market. On the bright side, the longer term returns (running at about 6.5% a year, over half a decade) look better. It may well be that this is a business worth popping on the watching, given the continuing positive reception, over time, from the market. It's always interesting to track share price performance over the longer term. But to understand Ameriprise Financial better, we need to consider many other factors. Even so, be aware that Ameriprise Financial is showing 4 warning signs in our investment analysis , and 1 of those is concerning...

Of course Ameriprise Financial may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

Yahoo News

Yahoo News