Here Are the Assets to Watch for Mexico’s Sunday Election

(Bloomberg) -- Investors are going into Mexico’s presidential election fully expecting a win by ruling party candidate Claudia Sheinbaum, but surprise outcomes to congressional races could fuel volatility in Mexican assets.

Most Read from Bloomberg

Key Engines of US Consumer Spending Are Losing Steam All at Once

GameStop Shares Surge as Gill’s Reddit Return Shows Huge Bet

Mnuchin Chases Wall Street Glory With His War Chest of Foreign Money

Homebuyers Are Starting to Revolt Over Steep Prices Across US

AMLO Protege Sheinbaum Becomes First Female President in Mexico

The base case — President Andres Manuel Lopez Obrador’s Morena party clinching majorities in Congress — may have little impact on markets. But if the leftist party wins in a landslide and gets a two-thirds majority in Congress, that could raise worries over more state interference in the economy.

On the flip side, a surprisingly strong showing by the opposition coalition that is backing challenger Xochitl Galvez for the presidency could give Mexican assets a boost. If the opposition manages to unseat Morena majorities in Congress, they would offer a stronger check on the presidency and stronger resistance to more radical reforms.

The results of congressional races may not be totally clear on Sunday night since nearly a third of seats are awarded based on the total percentage of votes that parties capture.

Here are the main assets to watch for reactions to the Sunday vote:

Peso

Unlike most other developing-nation currencies, the peso trades around the clock — and will be the first asset to move on the results. It was up 0.4% versus the dollar in early Sunday trading in Asia, one of the best performances in emerging markets in what was shaping up to be a positive session for risk assets.

Mexico Voters Face Delays at Polls, Reports of Violence: TOPLive

The prospect of continuity under Sheinbaum has helped keep the peso steady in the run-up to the vote, avoiding selloffs seen in past elections. The Mexican peso has been one of the best-performing major currencies in the world this year, also supported by the country’s links to the US and by high interest rates.

This week, the peso underperformed most peers as some investors cashed in and moved to the sidelines ahead of the vote in case of a surprise outcome.

If elections deliver a Sheinbaum win and a slim majority for Morena, the currency should bounce back 1% as “lingering uncertainty is priced out,” Barclays strategists led by Erick Martinez said in a note on Wednesday.

The peso could lose 3% to 4% if Morena and its allies look set to win two-thirds of Congress, Martinez wrote. The weakness may be short-lived since “candidates typically moderate rather than radicalize early in the presidency,” he said.

If opposition parties strip Morena of its majority in the house or the senate, the peso could rally toward 16 per dollar on expectations a Sheinbaum presidency could be constrained, said XP Investimentos’ Marco Oviedo.

USDMXN

Pemex

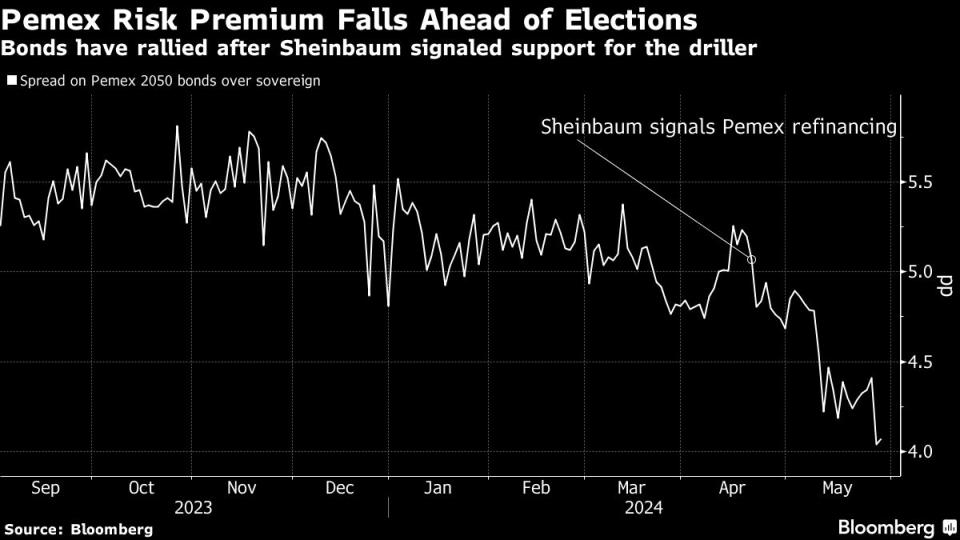

Bonds in state-owned oil firm Petroleos Mexicanos have rallied this year after Sheinbaum signaled continued support for the driller and a top finance official said the government was looking at ways to absorb $40 billion of the company’s debt.

Sheinbaum, an environmental scientist by training, has said she wants to push Pemex to embrace new and cleaner technologies. Concrete signs of such plans could lead to a rally in Pemex bonds, said Carlos de Sousa, an emerging market debt portfolio manager with Vontobel Asset Management.

“It would be a welcome upside scenario for investors if the next administration improves the company’s poor environmental track record,” de Sousa wrote in a note. An improved ESG record could draw in more investors and reduce the company’s borrowing costs, he added.

Read More: As Deadly Accidents Piled Up, Bond Investors Got Tough on Pemex

Morgan Stanley credit strategist Simon Waever said there was a bull case for Pemex if Sheinbaum opens up the energy sector to more private investment. A Galvez win could also fuel a rally since she pledged to revive oil block auctions to private companies that were halted under Lopez Obrador.

Here are some of the most liquid Pemex bonds:

Pemex 2050

Pemex 2032

Pemex 2026

Equities

A Sheinbaum victory would support consumption stocks on the expectation of continued cash aid programs and minimum wage hikes. Restaurant operator Alsea is a top pick from strategists at Citigroup and Morgan Stanley to benefit. Department store chain Liverpool is also set to gain from stronger consumption, which has also been fueled by record remittances and new factory jobs.

Stocks in regulated sectors that have been hurt by concerns about Morena interference — miners and railways, namely Grupo Mexico, as well as airport and toll road operators — could be winners if Galvez manages a surprise win. Those same names could suffer if Morena wins a supermajority, which could also weigh on banks amid worries the government could force them to lower fees.

Morgan Stanley’s Nikolaj Lippman said the new government could embrace more private investment in the power sector to boost the country’s potential to absorb more manufacturing capacity. In such a case, Mexico could begin to generate a similar buzz to countries like India that are mounting major reforms, lifting multiples on the MSCI Mexico index to 20 times forward earnings, from around 13 times now.

Alsea

Liverpool

Grupo Mexico

OMA

GAP

Asur

Pinfra

Most Read from Bloomberg Businessweek

Disney Is Banking On Sequels to Help Get Pixar Back on Track

The Budget Geeks Who Helped Solve an American Economic Puzzle

Israel Seeks Underground Secrets by Tracking Cosmic Particles

How Rage, Boredom and WallStreetBets Created a New Generation of Young American Traders

©2024 Bloomberg L.P.

Yahoo News

Yahoo News