Above-Goal Inflation Crushes Brazil Hopes for Bigger Rate Cuts

(Bloomberg) -- Brazil’s central bank poured cold water on expectations of bigger interest rate cuts, emphasizing risks to the monetary easing cycle it kicked off last month, including above-target inflation expectations that policymakers vowed to bring down.

Most Read from Bloomberg

China Puts Evergrande’s Billionaire Founder Under Police Control

Republican Moderates Turn to Rare Maneuver to Avoid Lengthy Government Shutdown

Indians Have Five Days to Deposit $3 Billion in Soon-to-Be-Withdrawn Banknotes

Trump Found Liable for Fraud in New York Attorney General’s Case

Swap rates rose across the board as the minutes of the bank’s latest monetary policy meeting, released early on Tuesday, led investors to trim expectations of a more aggressive easing cycle next year.

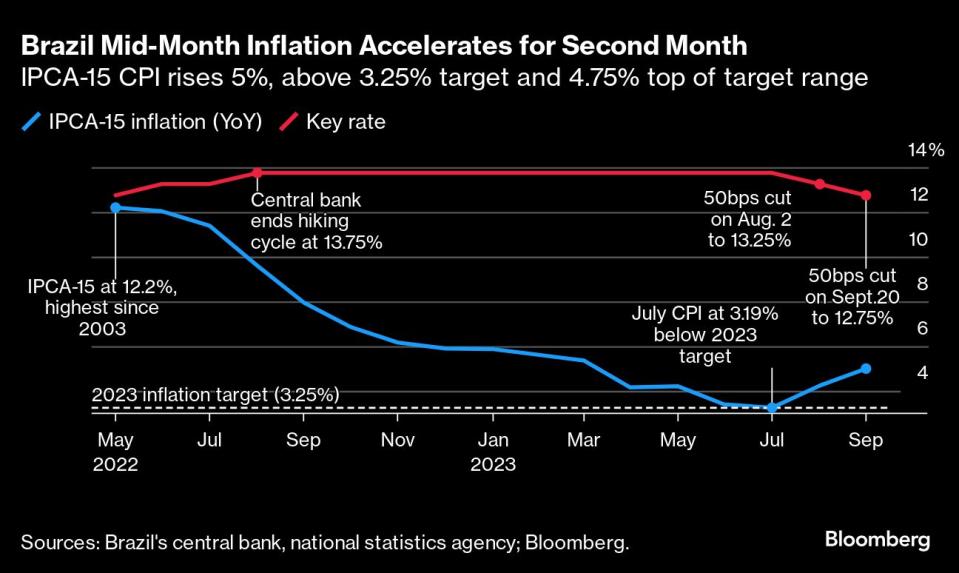

Following cuts of 50 basis points in both August and September, the swaps curve now prices in odds of five additional reductions of the same magnitude until May. After that, traders bet policymakers will slow their pace.

“There is low probability of an additional intensification in the pace of adjustment, since this would require substantial positive surprises that would raise even further the confidence in the prospective disinflationary dynamics,” central bankers wrote in the minutes of their Sept. 19-20 meeting, when they cut the Selic to 12.75%.

Policymakers led by Roberto Campos Neto started lowering borrowing costs in August as key inflation measures, including services costs, showed initial signs of abating. They have reaffirmed their plan to stick to half-point rate cuts at least through December, relaxing monetary policy gradually after an aggressive tightening campaign that had raised them to a six-year high. Other countries in the region have also launched easing cycles, including Peru, Chile, Uruguay and Paraguay.

Yet Brazil’s consumer prices rose at a faster pace for the second consecutive month in mid-September, reaching 5% from a year ago, according to a separate report from the national statistics institute released Tuesday. As more expensive fuel ripples through the economy, transportation prices and food away from home became costlier, driving headline inflation above the central bank’s tolerance ceiling for this year.

Services costs also accelerated again, although economists from XP Inc. said they will resume trending down in coming months.

Mid-September inflation benefited from easing food costs, while commodities had a mixed impact on prices and the labor market remained tight, Gabriel Galipolo, the bank’s monetary policy director, said during an event in Sao Paulo. He stressed that policymakers will cautiously analyze data to decide on future steps.

Read More: Brazil Delivers Half-Point Rate Cut, Reaffirms Steady Easing

What Bloomberg Economics Says

Brazil’s central bank used the minutes of its Sept. 20 meeting to illustrate why it’s unlikely to accelerate the pace of rate cuts. The document set out policymakers’ views on the growth and inflation outlooks and their implications for the rate path. Emerging from that debate, the minutes made it clear — all interpretations pointed to a cautious easing pace.

— Adriana Dupita, Brazil and Argentina economist

— Click here for full report

Central bankers said in the minutes they are pursuing “much more solid” improvement in inflation expectations, which remain above their 3% goal in place from 2024 to 2026. Some members of the board were “particularly concerned” about estimates for future price increases that have been steady at 3.5% for the last three months.

“The minutes were somewhat hawkish,” said Brendan McKenna, a strategist at Wells Fargo. “The balance of risks is more tilted toward a shallower easing cycle than a deeper easing cycle.”

As directors tapped by President Luiz Inacio Lula da Silva take a sit on the board following months of protests for lower interest rates voiced by the leftist leader, central bankers also discussed the perception that the institution could become more lenient toward inflation. Future expectations for consumer price increases will converge to target through a firm implementation of monetary policy, they wrote.

Potential Growth

Also posing a challenge to monetary policy is the fact that Brazil’s economic activity has been resilient despite high interest rates. A bumper harvest, a firm labor market and strong services demand helped to boost growth past most forecasts in the first half of 2023. Three years after the onset of the pandemic, policymakers still see uncertainty regarding measures of the economic slack, with Galipolo saying in Sao Paulo there are signs that Brazil may be able to grow faster with less price pressures.

“The persistence of a resilient growth over the next quarters with no inflationary impact might, in the future, lead to the reevaluation of the potential growth,” they wrote in the minutes. Central bankers see higher social transfers as part of the reason behind the strong economic performance.

Impacts from “El Niño” weather on Brazil’s activity were also debated, with central bankers highlighting uncertainty around its influence on food prices. They opted to incorporate only a small impact in their inflation projections, which rose in comparison to August estimates.

Fiscal Concerns

Investors are increasingly concerned about Brazil’s fiscal outlook, as the government pushes for measures to raise public revenue that are crucial to eliminate next year’s primary fiscal deficit, which excludes interest payments.

In the minutes, central bankers linked uncertainty in local financial markets to doubts over the execution of revenue and spending measures, underscoring the importance in fulfilling fiscal goals.

“The minutes were much more hawkish than I anticipated, with little room to discuss faster rate cuts,” said Mirella Hirakawa, an economist at AZ Quest. “They are saying that the only remedy they can give for above-target inflation estimates is to remain hawkish, and that’s what they intend to.”

--With assistance from Giovanna Serafim and Davison Santana.

(Recasts with market reaction in second paragraph, economist comments and more details from minutes throughout)

Most Read from Bloomberg Businessweek

Why Retiring in India No Longer Requires Living With the Kids

Bengaluru Grapples With Fallout From India’s Breakneck Growth

Why Dollar General Might Just Be the Worst Retail Job in America

©2023 Bloomberg L.P.

Yahoo News

Yahoo News