Brazil Sells $2 Billion in Sustainable Global Bonds

(Bloomberg) -- Brazil returned to global capital markets for the second time this year with a $2 billion sustainability bond, joining a string of developing nations selling new debt.

Most Read from Bloomberg

At Blackstone's $339 Billion Property Arm, the Honeymoon Is Over

CDK Tells Car Dealers Their Systems Will Likely Be Down for Days

Putin’s Hybrid War Opens a Second Front on NATO’s Eastern Border

The nation sold seven-year notes at a yield of 6.375%, down from initial price talk in the 6.625% area, according to people familiar with the matter who asked not to be identified because they’re not authorized to speak about it. The notes will be used to repay public debt and to finance projects under its sustainability framework.

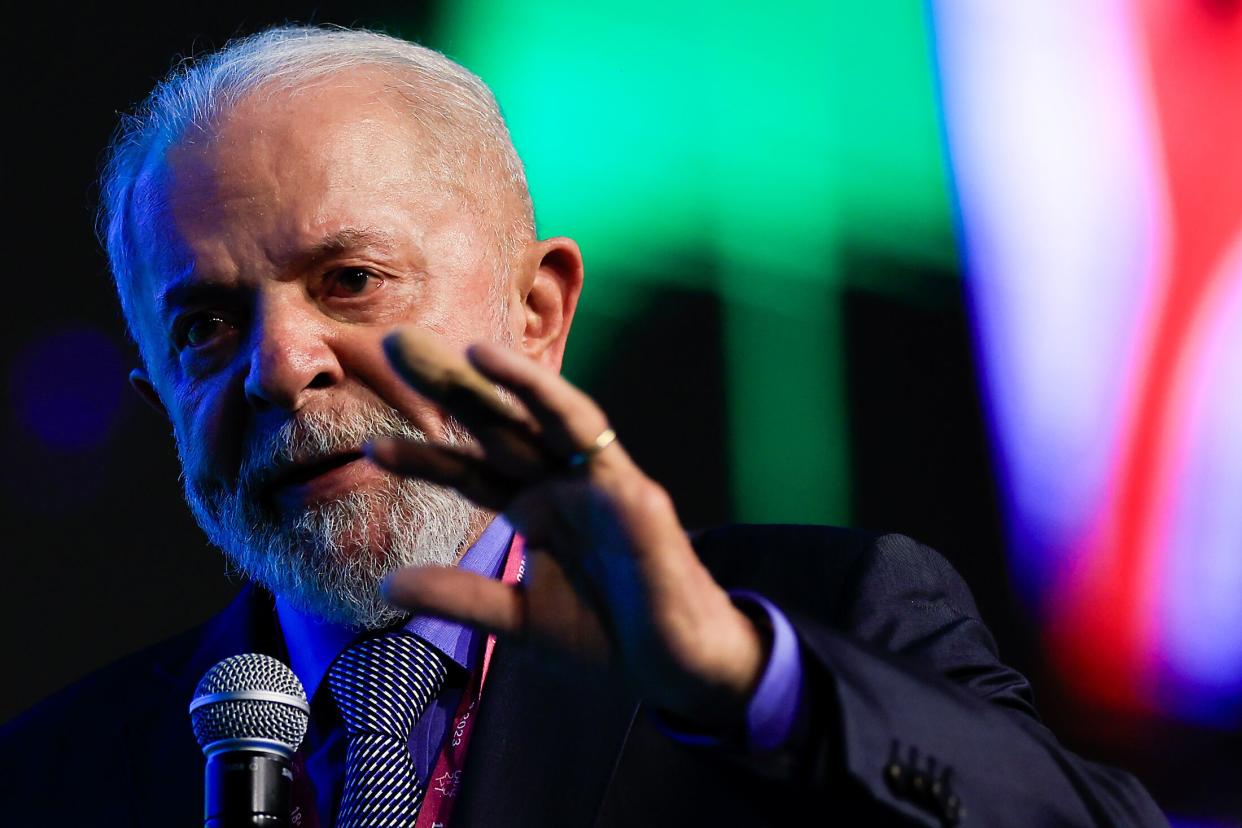

The sale comes during a tumultuous run for Brazilian markets, which sank after President Luiz Inacio Lula da Silva made it clear he’s not considering spending cuts to address growing fiscal concerns. His government has struggled to get proposals to boost public revenue through Congress. Policymakers on Wednesday kept the Selic rate unchanged at 10.5% in a unanimous vote aimed at soothing investors who had grown skeptical over the government’s plans.

“The country’s fiscal outlook is slowly deteriorating and the underlying fundamentals are looking less bullish than 12 months ago, so we would have liked a higher new issue premium,” said Anders Faergemann, a senior money manager at Pinebridge Investments.

Brazil is the latest emerging-market sovereign to take advantage of subdued volatility in global markets as investors bet cooling inflation will force the Federal Reserve to cut interest rates sooner. This week, South Korea hired banks for a potential bond sale, while the Dominican Republic and Peru are issuing new bonds to refinance outstanding debt. Elsewhere, Trinidad and Tobago sold a 10-year note on Tuesday.

Latin America’s largest economy sold $4.5 billion in dollar bonds in January, a record offering. In November it sold $2 billion of sustainability bonds, marking a long-awaited deal to support Lula’s environmental agenda.

“It has been notable to see Brazil shift from only issuing Eurobonds once every 5 years to now 2-3 times per year,” said Guido Chamorro, a senior portfolio manager at Pictet Asset Management in London

Treasury Secretary Rogerio Ceron said last month that Brazil’s plan is to issue notes — both regular and ESG — at least twice a year.

The country’s dollar bonds have lost 0.7% so far this year, trailing the 3% return for a Bloomberg index of peers.

(Updates with pricing details in headline, first deck and second paragraph.)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Yahoo News

Yahoo News