Callon Petroleum (CPE) Q2 Earnings Beat on Higher Oil Output

Callon Petroleum Company CPE reported second-quarter 2020 adjusted earnings of a penny per share against the Zacks Consensus Estimate of a loss of 2 cents. However, the bottom line fell from earnings of 19 cents per share a year ago.

Operating revenues of $157.2 million lagged the Zacks Consensus Estimate of $202 million. Also, the top line declined from the year-ago quarter’s $167.1 million.

The better-than-expected earnings can be attributed to higher oil and gas production volumes, as well as decreased lease operating expenses, partially offset by lower natural gas and oil price realizations.

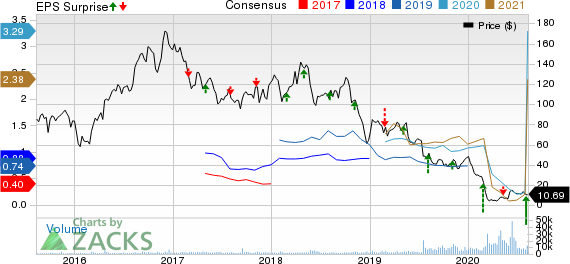

Callon Petroleum Company Price, Consensus and EPS Surprise

Callon Petroleum Company price-consensus-eps-surprise-chart | Callon Petroleum Company Quote

Reverse Stock Split

The company opted for a 1-for-10 reverse stock split, which took effect on Aug 7, after market close. Through the move, the number of outstanding shares reduced from 397,476,674 (as of Jul 31) to almost 39,747,667. The move is expected to boost its opportunity for institutional ownership.

Production

For the quarter, net production volumes averaged 108,664 barrels of oil equivalent per day (Boe/d), up from the year-ago period’s 40,516 Boe/d. The improved volumes were supported by operations in the Delaware and Midland Basins. Of the total second-quarter production, 65% was oil.

Oil production for the quarter was 6,396 thousand barrels (MBbls), higher than the year-ago level of 2,848 MBbls. Natural gas production rose to 11,009 million cubic feet (MMcf) from 5,031 MMcf in second-quarter 2019. Also, NGLs production for the quarter under review was recorded at 1,657 MBbls.

Price Realizations (Without the Impact of Cash-Settled Derivatives)

The average realized price per barrel of oil equivalent was $15.90. The figure declined from the year-ago quarter’s $45.31 a barrel. Average realized price for oil was $20.41 per barrel compared with $56.44 a year ago. Meanwhile, average realized price for natural gas came in at $1.11 per thousand cubic feet, down from $1.26 in the prior-year quarter. Notably, average realized price per barrel for NGLs was $8.74.

Total Expenses

Total operating expenses of $1,518.9 million surged from the year-ago level of $108.5 million. Gathering, transportation and processing costs were recorded at more than $20 million compared with no charges in the year-ago period. Notably, the company incurred an impairment charge of $1,276.5 million in the second-quarter 2020.

However, lease operating expenses decreased to $5.14 per Boe for the reported quarter from $6.18 a year ago.

Capital Expenditure & Balance Sheet

Capital expenditure for the reported quarter was $206.1 million, higher than the year-ago figure of $166.2 million. It generated free cash flow of $18 million.

As of Jun 30, 2020, the company’s total cash and cash equivalents amounted to $7.5 million, down from the first quarter’s $14.8 million. Long-term debt totaled $3.4 billion, up from $3.2 billion in the first quarter. It had a total debt to capitalization of 64%.

Guidance for 2020

For 2020, Callon’s total production is expected in the range of 99-101 MBoe/d. Of the total production, 64% is expected to be oil, while natural gas and NGLs will likely be 18% each.

Total operational capital view for the ongoing year is expected in the range of $500-$525 million. It expects gross operated wells drilled in the band of 87-89 for 2020.

Moreover, the company expects 2021 production to be 90-95 MBoe/d and operational capital spending of $400 million, per the maintenance plan.

Zacks Rank & Stocks to Consider

The company currently has a Zacks Rank #3 (Hold). Some better-ranked players in the energy space include Noble Energy, Inc. NBL, EOG Resources, Inc. EOG and Concho Resources Inc. CXO, each holding a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Noble Energy’s bottom line for 2021 is expected to rise 61.7% year over year.

EOG Resources’ bottom line for 2021 is expected to soar 190.7% year over year.

Concho Resources’ bottom line for 2020 is expected to surge 35.4% year over year.

Zacks’ Single Best Pick to Double

From thousands of stocks, 5 Zacks experts each picked their favorite to gain +100% or more in months to come. From those 5, Zacks Director of Research, SherazMian hand-picks one to have the most explosive upside of all.

With users in 180 countries and soaring revenues, it’s set to thrive on remote working long after the pandemic ends. No wonder it recently offered a stunning $600 million stock buy-back plan.

The sky’s the limit for this emerging tech giant. And the earlier you get in, the greater your potential gain.

Click Here, See It Free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Noble Energy Inc. (NBL) : Free Stock Analysis Report

EOG Resources, Inc. (EOG) : Free Stock Analysis Report

Concho Resources Inc. (CXO) : Free Stock Analysis Report

Callon Petroleum Company (CPE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo News

Yahoo News