Dalian Wanda slips on Hong Kong debut as strong AsiaPac listings year winds down

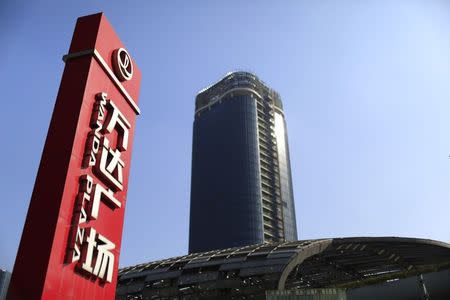

By Elzio Barreto HONG KONG (Reuters) - Chinese developer Dalian Wanda Commercial Properties Co Ltd saw its shares skid in Hong Kong's biggest market debut since 2010 on debt doubts and valuation concerns, bringing a banner year for Asia-Pacific listings toward a muted close. Stock in the world's second-largest developer of shopping malls and office buildings fell as much as 8.8 percent before regaining ground. The shares closed 2.6 percent below the initial public offering price of HK$48.00 late in the afternoon while the benchmark Hang Seng index was off 0.3 percent. Dalian Wanda raised about $3.7 billion (2.4 billion pounds) after pricing its IPO near the top of its marketing range. That helped lift IPO proceeds in the region outside Japan to $66.6 billion so far this year, Thomson Reuters data showed, a 46.8 percent surge from a year earlier that makes 2014 the best year for equity capital markets since a record set in 2010. Hong Kong took the biggest chunk of IPO proceeds in the region with $26.7 billion (17 billion pounds) as investors flocked to giant-sized listings in unique sectors such as nuclear power and meat production. Consulting firm EY expects new listings in the city to be little changed at HK$200 billion ($25.8 billion) in 2015. For Dalian Wanda, led by billionaire tycoon Wang Jianlin, the damp squib market debut, which raised proceeds to fund new development projects, represents a rare reversal after a decade-long expansion drive. That growth has left the company well placed to benefit from lower interest rates in China and an expected rebound in its property market, but has come at the price of a hefty debt pile - about 179.7 billion yuan (18.5 billion pounds). "Retail investors weren't so keen for this Wanda IPO," said Jasper Chan, corporate finance officer at Hong Kong brokerage Phillip Securities. "The issue price was a bit higher than (real estate) competitors." The company had already scaled back its ambitions in the IPO, having first planned to raise as much as $6 billion, as some investors were put off by the scale of its debt, analysts said. GF Securities analyst Dennis Yao said in a Dec. 12 report the outlook for Dalian Wanda's post-IPO performance was "bearish" because of the company's high valuation compared to peers and "its low earnings visibility for 2015". (Additional reporting by Clare Jim; Editing by Kenneth Maxwell)

Yahoo News

Yahoo News