Did You Manage To Avoid Sun Cheong Creative Development Holdings's (HKG:1781) Devastating 85% Share Price Drop?

It's not a secret that every investor will make bad investments, from time to time. But it should be a priority to avoid stomach churning catastrophes, wherever possible. So we hope that those who held Sun Cheong Creative Development Holdings Limited (HKG:1781) during the last year don't lose the lesson, in addition to the 85% hit to the value of their shares. That'd be enough to make even the strongest stomachs churn. Because Sun Cheong Creative Development Holdings hasn't been listed for many years, the market is still learning about how the business performs. Furthermore, it's down 40% in about a quarter. That's not much fun for holders.

While a drop like that is definitely a body blow, money isn't as important as health and happiness.

See our latest analysis for Sun Cheong Creative Development Holdings

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Even though the Sun Cheong Creative Development Holdings share price is down over the year, its EPS actually improved. It's quite possible that growth expectations may have been unreasonable in the past.

By glancing at these numbers, we'd posit that the the market had expectations of much higher growth, last year. But looking to other metrics might better explain the share price change.

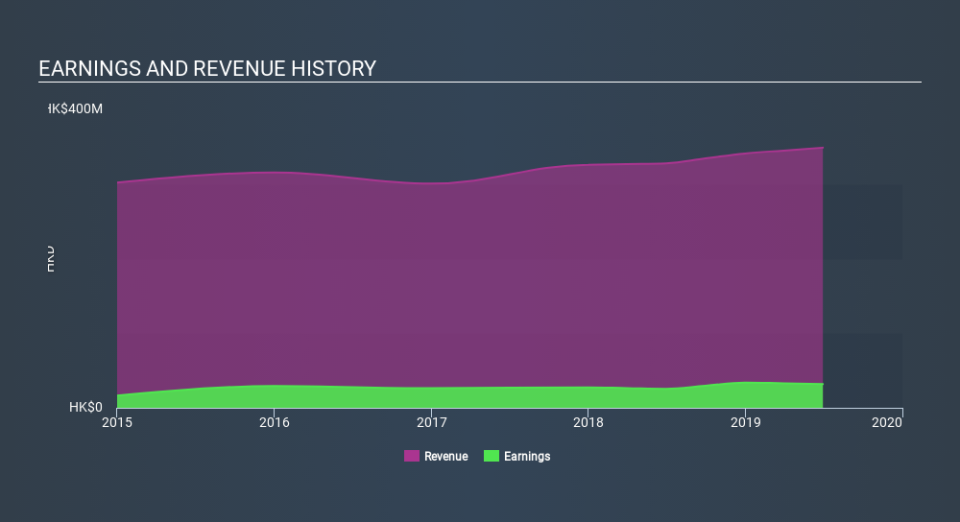

We don't see any weakness in the Sun Cheong Creative Development Holdings's dividend so the steady payout can't really explain the share price drop. From what we can see, revenue is pretty flat, so that doesn't really explain the share price drop. Of course, it could simply be that it simply fell short of the market consensus expectations.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We consider it positive that insiders have made significant purchases in the last year. Even so, future earnings will be far more important to whether current shareholders make money. This free interactive report on Sun Cheong Creative Development Holdings's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

Sun Cheong Creative Development Holdings shareholders are down 84% for the year (even including dividends) , even worse than the market loss of 4.1%. There's no doubt that's a disappointment, but the stock may well have fared better in a stronger market. The share price decline has continued throughout the most recent three months, down 40%, suggesting an absence of enthusiasm from investors. Given the relatively short history of this stock, we'd remain pretty wary until we see some strong business performance. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Case in point: We've spotted 6 warning signs for Sun Cheong Creative Development Holdings you should be aware of, and 2 of them are potentially serious.

Sun Cheong Creative Development Holdings is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo News

Yahoo News