What Does Morguard North American Residential Real Estate Investment Trust's (TSE:MRG.UN) CEO Pay Reveal?

This article will reflect on the compensation paid to Kuldip Sahi who has served as CEO of Morguard North American Residential Real Estate Investment Trust (TSE:MRG.UN) since 2012. This analysis will also evaluate the appropriateness of CEO compensation when taking into account the funds from operations and shareholder returns of the company.

See our latest analysis for Morguard North American Residential Real Estate Investment Trust

Comparing Morguard North American Residential Real Estate Investment Trust's CEO Compensation With the industry

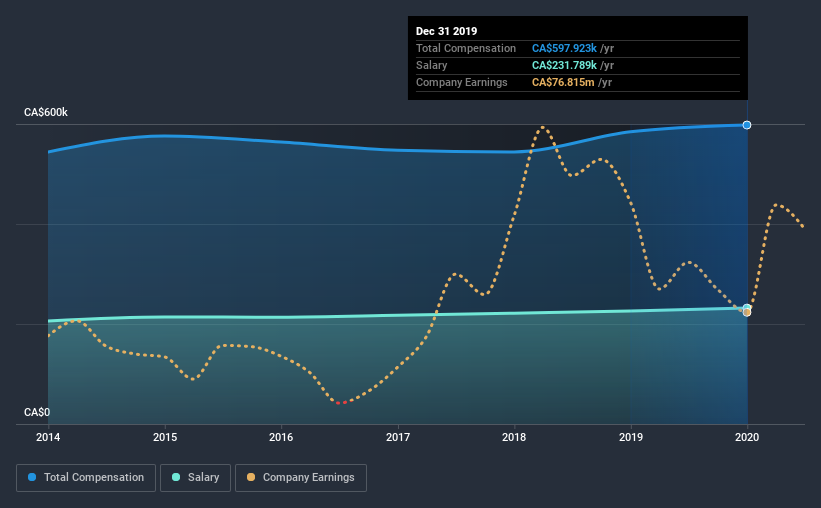

At the time of writing, our data shows that Morguard North American Residential Real Estate Investment Trust has a market capitalization of CA$839m, and reported total annual CEO compensation of CA$598k for the year to December 2019. This means that the compensation hasn't changed much from last year. While we always look at total compensation first, our analysis shows that the salary component is less, at CA$232k.

On comparing similar companies from the same industry with market caps ranging from CA$526m to CA$2.1b, we found that the median CEO total compensation was CA$1.6m. In other words, Morguard North American Residential Real Estate Investment Trust pays its CEO lower than the industry median. What's more, Kuldip Sahi holds CA$10m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

Component | 2019 | 2018 | Proportion (2019) |

Salary | CA$232k | CA$226k | 39% |

Other | CA$366k | CA$358k | 61% |

Total Compensation | CA$598k | CA$584k | 100% |

On an industry level, around 32% of total compensation represents salary and 68% is other remuneration. Morguard North American Residential Real Estate Investment Trust pays out 39% of remuneration in the form of a salary, significantly higher than the industry average. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

A Look at Morguard North American Residential Real Estate Investment Trust's Growth Numbers

Morguard North American Residential Real Estate Investment Trust has seen its funds from operations (FFO) increase by 4.9% per year over the past three years. It achieved revenue growth of 1.3% over the last year.

We'd prefer higher revenue growth, but it is good to see modest FFO growth. So there are some positives here, but not enough to earn high praise. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Morguard North American Residential Real Estate Investment Trust Been A Good Investment?

Morguard North American Residential Real Estate Investment Trust has not done too badly by shareholders, with a total return of 9.9%, over three years. But they probably don't want to see the CEO paid more than is normal for companies around the same size.

To Conclude...

As we noted earlier, Morguard North American Residential Real Estate Investment Trust pays its CEO lower than the norm for similar-sized companies belonging to the same industry. But, shareholder returns and FFO growth have been unimpressive recently. Consequently, despite CEO compensation being reasonable by all accounts, shareholders will likely want to see more growth before they agree to a potential bump.

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. In our study, we found 3 warning signs for Morguard North American Residential Real Estate Investment Trust you should be aware of, and 1 of them doesn't sit too well with us.

Important note: Morguard North American Residential Real Estate Investment Trust is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

Yahoo News

Yahoo News