Ebbing Inflation to Keep Poland’s Rates Steady: Decision Guide

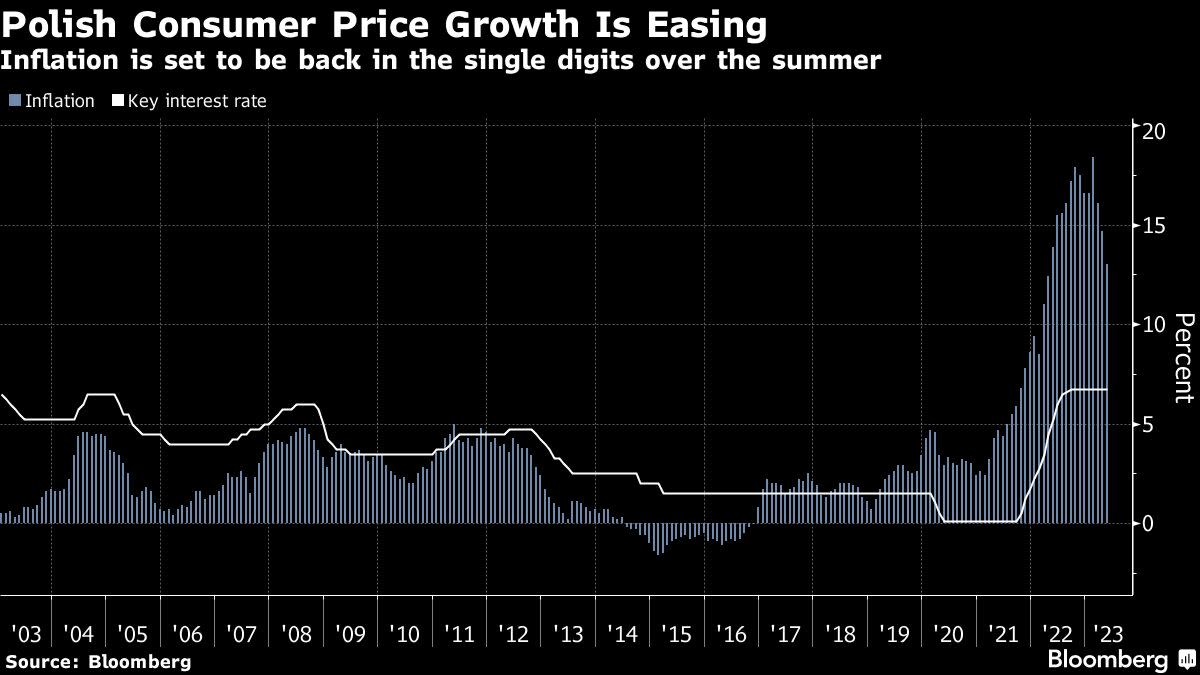

(Bloomberg) -- Poland will likely leave interest rates unchanged after inflation slowed for the third straight month and policymakers began positioning for a possible cut later this year to boost the recession-hit economy.

Most Read from Bloomberg

George Santos Loses Bid to Shield the People Who Guaranteed His $500,000 Bail

PGA Tour Bows to Saudi Rival in Shock Combination With LIV Golf

SEC’s Coinbase Lawsuit Heralds Deepening US Crypto Crackdown

Central bankers will keep the benchmark rate at 6.75% on Tuesday, according to all economists surveyed by Bloomberg. Investors are betting on a half-percentage-point cut over the next six months as forward rate agreements dropped to a 14-month low last week. Governor Adam Glapinski will brief media at 3 p.m. on Wednesday.

The European Union’s sixth-largest economy joined other member states in registering an easing in inflation last month, as consumer prices rose 13% — slower than economists had predicted and the weakest rate in more than a year. That prompted Henryk Wnorowski, a member of Poland’s rate-setting Monetary Policy Council, to predict single-digit inflation by August.

“The decision itself won’t bring any shift to the parameters of the monetary policy and the base rate, but changes in the central bank’s rhetoric can be expected,” ING Bank Slaski SA’s economists said in a note on Monday. “Perhaps Governor Glapinski will announce the formal end to the tightening cycle.”

Price pressures are easing across the region. Poland’s economy contracted in the first quarter as a yearlong cycle of rate hikes lifted borrowing costs to the highest level in two decades and squeezed consumer spending.

Still, higher prices are buoyed by wage pressure as Poland boasts one of the lowest unemployment in the 27-member EU. Another policymaker, Iwona Duda, told Bloomberg that the central bank needs more certainty that inflation will slow rapidly before it begins to cut interest rates.

The cautious stance contrasts with recent remarks from several peers on the 10-member MPC, including Glapinski, who said last month that he hoped for a rate cut in the fourth quarter. That time frame could put such a move close to a tightly contested election, expected in October.

The ruling party has already announced plans to increase benefit spending next year in a move that could add to inflation, although the central bank’s own estimates showed last month the impact would be negligible.

--With assistance from Maciej Martewicz.

Most Read from Bloomberg Businessweek

A $1.5 Trillion Backstop for Homebuyers Props Up Banks Instead

China’s BYD Is Racing Toward the Top of the Global EV Market

Giorgia Meloni Seeks to Cement Power by Remaking Corporate Italy

Google’s Top Lawyer Preps for Fights Over AI and Tech ‘Censorship’

©2023 Bloomberg L.P.

Yahoo News

Yahoo News