An exclusive study shows the huge wealth gap between London and the rest of Britain

It is perhaps unsurprising to hear that the average Londoner is richer than others who live across the rest of the UK. But we’re not just talking about wages — we’re talking about investable assets.

London generates over 20% of Britain’s GDP. As Britain’s capital, Londoners have enjoyed wages that are much higher than the national average. Of course, London has a higher cost of living, but according to a report from the not-for-profit trade body EIS Association (EISA), given exclusively to Yahoo Finance UK, that’s not enough to dramatically drive down the average value of investable assets, excluding properties and pensions.

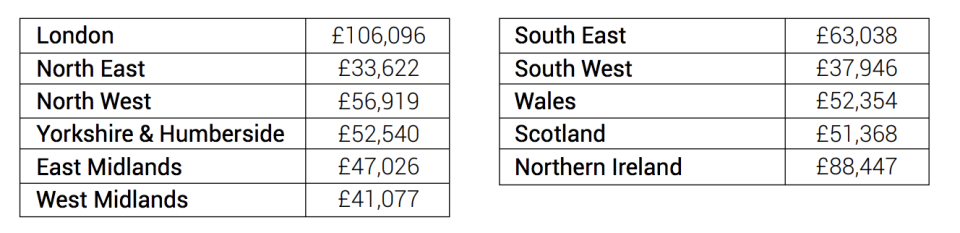

If you look at this table, you can see the huge difference between London and a majority of the remainder in Britain.

EISA surveyed 2,007 people weighted-representatively to different regions and demographics. The report was aimed at gauging the wealth, work, and entrepreneurial aspirations, as well as the overall investor profile of the British population.

The survey shows that 46% of Londoners feel they are more entrepreneurial than their parents and grandparents versus 30% in the North East and 24% in the North West. It also showed how 45 % of Londoners feel they have more investible assets that their parents & grandparents versus 27% in the East of England and 35% in the North.

“British people in the workforce today are looking at the world of work differently to both their parents and grandparents. They are more disillusioned with the corporate ladder and see opportunities to work for themselves as a more attractive prospect,” said Mark Brownridge, director general of the EISA.

“A decade ago, workers would have witnessed the global financial crash, and since then, they have realised that a traditional career path may not necessarily be the route that they would like to take. Therefore, working for themselves, becoming an entrepreneur, and having a more flexible working structure is a popular alternative to corporate career pathways.”

Yahoo News

Yahoo News