Facebook is helping advertisers get to people they can't reach on TV (FB)

BII

This story was delivered to BI Intelligence "Digital Media Briefing" subscribers. To learn more and subscribe, please click here.

A Facebook-commissioned Nielsen study found that ads on the social network reach an additional 5% of people that can't be reached on TV, The Drum reports.

The findings reinforce the belief that advertisers should take an integrated media strategy, combining TV, digital video, and social to reach as wide an audience as possible. The research analyzed the reach of 25 campaigns on Facebook and TV across 2014 and 2015, and found that one in six people were seeing campaigns on Facebook only.

The effect is most pronounced among the millennial audience, unsurprisingly, where Facebook reaches an additional 22.6% of 18-24 year olds and 14% of 25-34 year olds.

Facebook’s message is that it wants to share, not steal, media budgets from TV. There are a number of contextual factors that inform this amiable approach:

TV content is critical to Facebook's next stage of growth. The company needs TV-like content to enhance its video ambitions, and has met with broadcasters in recent months to convince them to commit more content to the social platform.

Facebook launched a big marketing campaign for Live. The company is running adson TV, web, billboard, and in airport baggage claims in the US and UK to promote its live streaming platform.

And the company is touting the effectiveness of Live video. Live broadcasts haveincreased four-fold since May, get watched three times longer, and have ten times the number of comments than non-live videos.

Facebook is inching closer towards the traditional TV screen. Earlier this month, the company launched a feature to stream videos from the platform on TV through AirPlay enabled Apple devices and the Google Chromecast.

Facebook is working on a version of Instant Articles for broadcasters. This product seems to be at a very early stage, but the social platform is adamant about working with media companies to develop a mutually advantageous solution.

Consumers continue to increase their time spent consuming digital media, while advertisers continue to increase their ad budgets into digital channels.

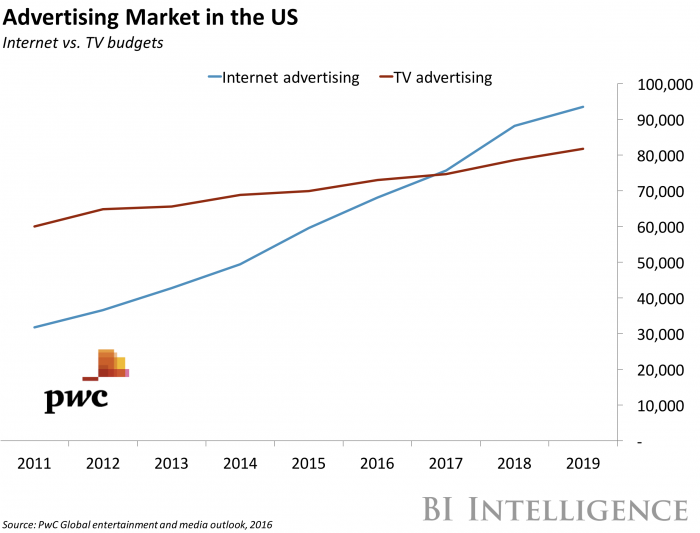

The influx is not expected to let up in the near future. The US digital advertising industry will continue to experience remarkable growth through 2021 to reach nearly $100 billion in annual revenue, driven primarily by the sustained migration of ad dollars from traditional TV to digital video and the continued increase of social spending.

Overall, the strong growth of the US digital ad market can largely be attributed to increased time spent by consumers on digital media and brands' increased comfort with allocating budgets to digital formats, particularly on digital video. In a recent 2016 survey of almost 400 US ad agencies and marketers, the IAB found that two-thirds of respondents plan on increasing spending on digital video in the next year.

Moreover, mobile will become the top destination for digital ad spending as advertisers continue to attempt to resolve the disconnect between the rapid growth in time spent on phones and tablets and the relatively small share of ad budgets that are allocated to such platforms — known as the mobile opportunity gap. In fact, mobile is set to eclipse desktop ad spend by 2018.

Dylan Mortensen, senior research analyst for BI Intelligence, Business Insider's premium research service, has compiled a detailed report on U.S. digital media ad revenue that forecasts revenue trends over the next five years and outlines the key growth drivers for overall digital ad revenue in the U.S.

Here are some key points from the report:

US digital ad revenue is expected to reach nearly $100 billion by 2021, according to BI Intelligence estimates. This represents compound annual growth of 8% from the $68.9 billion expected in 2016.

Mobile is positioned to become the top destination for digital ad spending as advertisers continue to attempt to close the "mobile opportunity gap."

Digital video advertising will grow faster than any other segment over the next five years, as consumers shift time spent online to phones and tablets. Revenue in this category is forecast to rise from $8.5 billion in 2016 to $23 billion in 2021.

Social advertising in all formats is gaining traction and will be among the key drivers of digital ad growth in the next five years. Social ad revenue is poised to climb to $30.8 billion by 2021, up from $15.5 billion this year.

Artificial intelligence, augmented and virtual reality, and sponsored content will help propel further digital ad growth in the next decade.

In full, the report:

Forecasts US digital ad revenue through 2021.

Highlights the rising popularity of digital media with consumers and brands.

Explores why digital video advertising growth will exceed all other formats over the next five years.

Outlines emerging technologies that will help propel ad growth in the next decade.

To get your copy of this invaluable guide, choose one of the following two options:

Subscribe to an All-Access pass to BI Intelligence and gain immediate access to this report and over 100 other expertly researched reports. As an added bonus, you'll also gain access to all future reports and daily newsletters to ensure you stay ahead of the curve and benefit personally and professionally. » START A MEMBERSHIP

Purchase & download the full report from our research store. » BUY THE REPORT

The choice is yours. But however you decide to acquire this report, you’ve given yourself a powerful advantage in your understanding of digital media ad revenue.

See Also:

Yahoo News

Yahoo News