A hedge fund manager’s meeting with Uber’s CFO perfectly captures what’s wrong with corporate America

Mike Novogratz, President of Fortress Investments Some of Wall Street’s hedge fund community is becoming increasingly vocal about a serious problem with corporate America.

Mike Novogratz, president of $67 billion investment fund Fortress Investments, gave a perfect illustration of this problem at work on Sunday’s episode of Wall Street Week.

The anecdote was about a meeting he had with the former CFO of Uber, Brent Callinicos.

(Novogratz didn’t mentioned Callinicos by name, referring to him only as “Uber’s CFO.”)

The meeting took place as Uber was out raising money this past winter. Novogratz asked Callinicos how the company justified its $40 billion valuation. Callinicos walked Novogratz through the numbers.

According to Novogratz, Callinicos said that right now Uber drivers return between 20% and 25% of the fare they collect — but that in the future, Uber could easily raise that rate to somewhere between 25% and 30%. This would drastically improve Uber’s profit margin, Novogratz recalls Callinicos saying.

Novogratz said this answer prompted him to ask a “cheeky question.”

“‘You’ve got happy employees, you’ve got happy customers, you’ve got happy shareholders. The holy triumvirate are all really excited about your company. Why are you going to risk that and push the employees salary down 5%?’”

Without missing a beat Callinicos simply responded: “Because we can.”

In March, Novogratz and Fortress Investments put money into Uber’s chief rival, Lyft.

An Uber spokesperson said that such a comment would not reflect Uber’s values as a company.

This spokesperson said: “We aren’t aware of the conversation Mr. Novogratz is referring to, but the numbers he refers to are not new. Uber’s software licensing fee currently varies by product and city and ranges from 20-30%.”

Callinicos stepped down from the CFO position in March, and now serves as an advisor to Uber.

Regardless of what Uber pays its drivers right now, the most interesting part of Novogratz’s alleged conversation with Uber’s CFO was the part where the CFO said it might drivers more simply “because we can.”

That attitude is a problem.

Over the last thirty years the primacy of the shareholder has become the main tenet of American business. Read annual letters from CEOs or listen to a quarterly earnings conference call, and you might think companies were always formed with shareholders in mind first. But that’s not true.

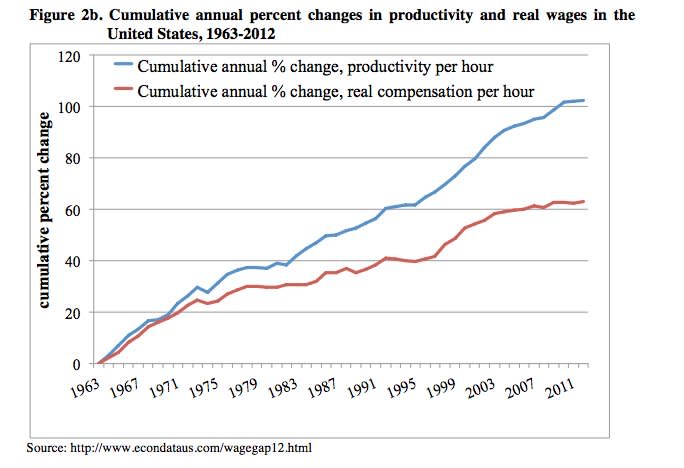

Americans are working more and making less. As Wall Street Week host Anthony Scaramucci pointed out, Ford Motor Company founder Henry Ford believed in paying his workers enough to buy the cars they made. For an economy that runs on consumer spending, like United States, that purchasing power means the difference between growth and stagnation.

At least, that’s what a number of academics think. They’ve been all over this topic for years. Check out ‘The Shareholder Value Myth,’ by Lynn Stout, a corporate and business professor at Cornell. In the book, Stout traces how the idea of why a company exists has changed over the years. Once upon a time, according to Stout, executives believed their companies existed to create good products and serve the community (in part by creating employment). The shift to shareholder primacy changed that, and put a company’s stock price above everything else.

That’s why Novogratz and others on the Street see this ‘shareholder’s first’ way of looking at labor and wages as a major problem — one that distorts incentives and leads to short-term thinking.

“Higher profit margins do not increase societal wealth. What they actually do is exacerbate income inequality, and that’s not a good thing,” said hedge fund billionaire Paul Tudor Jones in a TED Talk he gave back in March.

He told his audience that we’ve “ripped the humanity” from American companies. It’s why Jones formed a non-profit called JUST Capital. Its mission is to poll workers around the United States and find out what responsibility they believe companies have to their employees.

In the meantime, Wall Street is stuck on the troubling behavior that has come from this shareholder value trend. Instead of paying workers good wages, investing in R&D, or using cash for capital expenditures, companies are buying back more stock than ever in an effort to keep their share price high.

Larry Fink, the chairman and CEO of BlackRock, the world’s largest asset manager wrote an open letter to corporate America, also back in March, about this very issue.

“It concerns us that, in the wake of the financial crisis, many companies have shied away from investing in the future growth of their companies,” wrote Fink. “Too many companies have cut capital expenditure and even increased debt to boost dividends and increase share buybacks.”

Right or wrong, many companies have structured compensation to make executives want to push up stock prices too, as University of Massachusetts professor William Lazonick pointed out in the Harvard Business Review last fall:

Why are such massive resources being devoted to stock repurchases? Corporate executives give several reasons… But none of them has close to the explanatory power of this simple truth: Stock-based instruments make up the majority of their pay, and in the short term buybacks drive up stock prices. In 2012 the 500 highest-paid executives named in proxy statements of U.S. public companies received, on average, $30.3 million each; 42% of their compensation came from stock options and 41% from stock awards. By increasing the demand for a company’s shares, open-market buybacks automatically lift its stock price, even if only temporarily, and can enable the company to hit quarterly earnings per share (EPS) targets.

That quick boost isn’t just negligible in terms of the long term health of the company, if you believe what these anti-shareholder primacy people are saying, it’s bad for America too.

You can watch the full episode of Wall Street Week below. Novogratz talks Uber about 11 minutes into the episode:

NOW WATCH: Here’s what happens when you get bitten by a black widow

The post A hedge fund manager’s meeting with Uber’s CFO perfectly captures what’s wrong with corporate America appeared first on Business Insider.

Yahoo News

Yahoo News