Here's Why I Think Kforce (NASDAQ:KFRC) Is An Interesting Stock

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

In contrast to all that, I prefer to spend time on companies like Kforce (NASDAQ:KFRC), which has not only revenues, but also profits. While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

View our latest analysis for Kforce

How Quickly Is Kforce Increasing Earnings Per Share?

As one of my mentors once told me, share price follows earnings per share (EPS). That means EPS growth is considered a real positive by most successful long-term investors. It certainly is nice to see that Kforce has managed to grow EPS by 23% per year over three years. If the company can sustain that sort of growth, we'd expect shareholders to come away winners. And for those who like the finer details, I'll add that the EPS growth has been helped by share buybacks, demonstrating that the business is positioned to return capital to its shareholders.

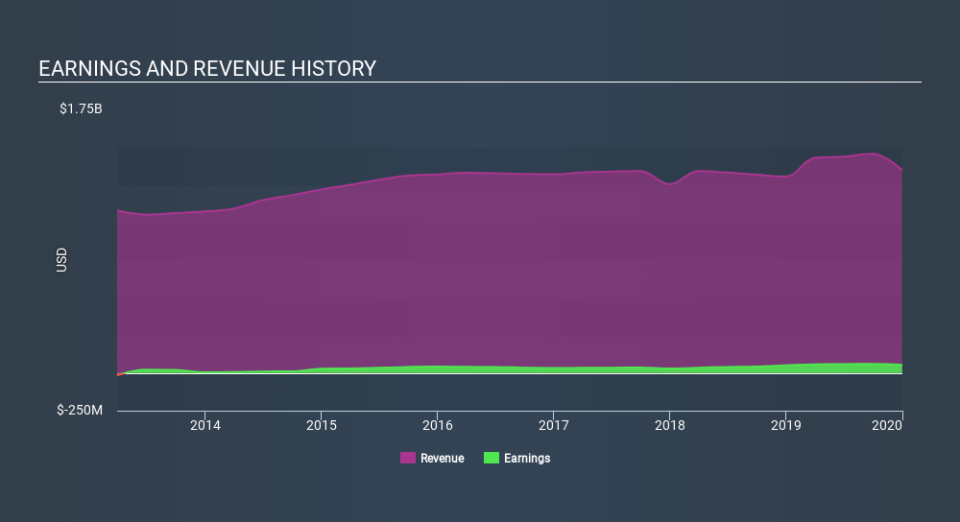

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Kforce maintained stable EBIT margins over the last year, all while growing revenue 3.3% to US$1.3b. That's progress.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for Kforce.

Are Kforce Insiders Aligned With All Shareholders?

It makes me feel more secure owning shares in a company if insiders also own shares, thusly more closely aligning our interests. As a result, I'm encouraged by the fact that insiders own Kforce shares worth a considerable sum. Given insiders own a small fortune of shares, currently valued at US$80m, they have plenty of motivation to push the business to succeed. That holding amounts to 12% of the stock on issue, thus making insiders influential, and aligned, owners of the business.

Does Kforce Deserve A Spot On Your Watchlist?

You can't deny that Kforce has grown its earnings per share at a very impressive rate. That's attractive. Further, the high level of insider ownership impresses me, and suggests that I'm not the only one who appreciates the EPS growth. So this is very likely the kind of business that I like to spend time researching, with a view to discerning its true value. While we've looked at the quality of the earnings, we haven't yet done any work to value the stock. So if you like to buy cheap, you may want to check if Kforce is trading on a high P/E or a low P/E, relative to its industry.

You can invest in any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo News

Yahoo News