How to invest £60,000 in Britain's most stable buy-to-let hotspots

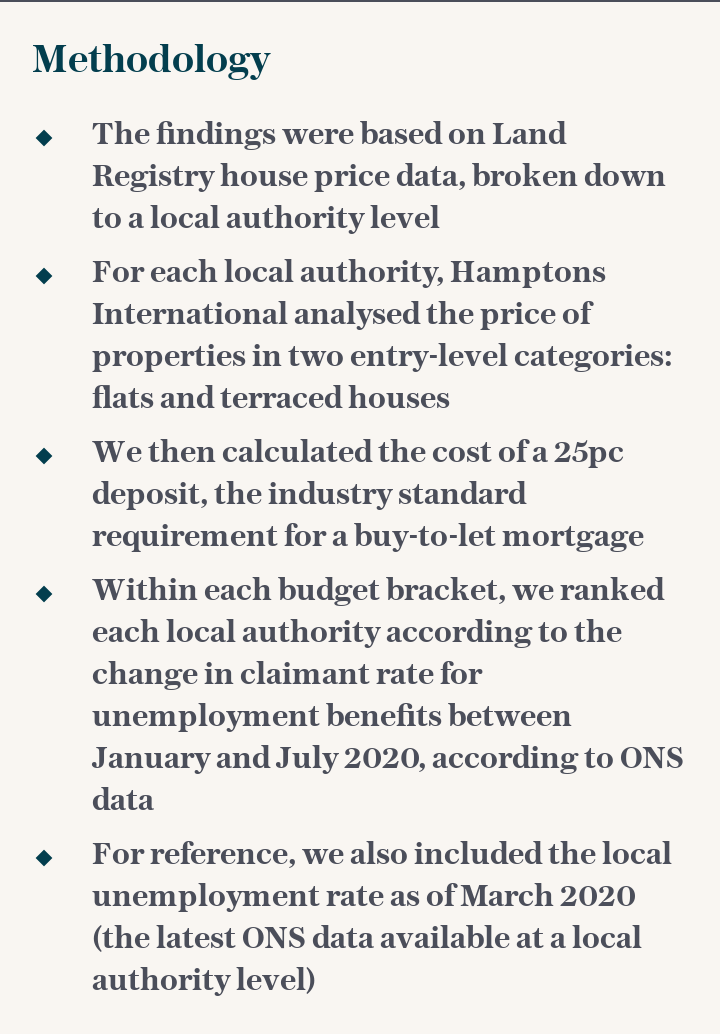

Do you want to invest in buy-to-let, but worry how the recession is affecting the market? In this three-part series, we investigate the hotspots where employment has been most resilient since March, working with three budgets: £25,000, £40,000 and £60,000.

In the third part in our buy-to-let investment series, we’re looking at where you can invest £60,000 in a property where the local employment markets that have been least affected by the pandemic.

This budget, which you can use for a 25pc deposit, opens up another 106 local authorities. But it also changes the kind of housing stock that you can buy.

Buying cheaper, smaller properties such as one-bedroom flats typically provides landlords with the highest yields relative to house price. But the pandemic has brought a new wave of demand for larger homes with extra bedrooms and outdoor space – both in the sales and lettings markets.

It is these larger properties that are in lowest supply, and rents are rising. Spending more on a buy-to-let property means you’re likely to get better, more reliable tenants.

Plus, there could be greater opportunity for capital appreciation – post-lockdown upsizers have already pushed house prices to record highs.

Richmondshire

No local authority in England and Wales has seen a smaller rise in unemployment during the pandemic than Richmondshire, which runs across the Yorkshire Dales to the outskirts of Darlington in Country Durham.

Between January and July, the unemployed claimant count here rose by just 1.8 percentage points. Fittingly, it is also home to Chancellor Rishi Sunak’s constituency.

Flats here cost an average of £179,000 while terraced houses cost £185,000, according to estate agency Hamptons International; the respective yields are 6.3pc and 5.4pc. Budget £45,000 or £46,000 for your deposit.

The unemployed claimant count was already high, a rate of 9.1pc in March, but this is not reflected in the lettings market.

Margi Irving, of Irvings, a local estate agent, said rents are rising. A four-bedroom house in Catterick, south of Richmond, North Yorks, that would have let for £800 per month last year will now go for £925 per month, she said. Upsizing after lockdown means demand is highest for family homes, she added.

The Government’s previous curbs on the buy-to-let sector, such as cutting tax relief on landlords' mortgages, mean many have sold up in recent years. Supply levels are down 30pc compared to the beginning of the year, Ms Irving said. “There are now 20 people after one house, but it used to be three or four.”

Richmondshire’s relatively stable employment level is due in part because it is home to Britain’s largest military base, the Catterick Garrison. It is home to 6,000 military personnel and marked to expand to become a “super-garrison”.

Otherwise, local employment is centred primarily around the schools and the pharmaceuticals company GlaxoSmithKline, which has a factory in nearby Barnard Castle. In May, Amazon also opened a warehouse in Darlington, bringing 1,000 jobs to the North East.

The local buy-to-let market also benefits from strong commuter links to Leeds, Harrogate and Newcastle, said Ms Irving.

Prospective investors will find better value in Catterick, where a three-bedroom semi-detached house costs between £160,000 and £180,000, than in Richmond, where the same property would cost £220,000.

Rushcliffe

On the eastern outskirts of Nottingham, stretching towards Newark-on-Trent to the north and Loughborough to the south, the district of Rushcliffe has a strong employment outlook.

Between January to July, the unemployed claimant count rose by two percentage points, but in March it was at 4.4pc – a much lower rate than that in Richmondshire. It is also well-placed for commuters.

Flats here cost £195,000, so budget £49,000 for your deposit and expect yields of 5.9pc, according to Hamptons. Terraced properties cost £215,000 (so allow for a £54,000 deposit) and you can achieve a 4.8pc yield.

Rutland

Rutland sits between Leicester and Peterborough. It is one of five local authorities in this budget bracket where the claimant count has risen by 2.2 percentage points between January and July, but of these it had by far the most stable employment market before the pandemic. The unemployment rate in March was 7.2pc.

Budget £53,000 for a flat deposit and £56,000 for a terraced house – they cost £212,000 and £225,000 respectively, according to Hamptons. Flats achieve much higher yields of 7.2pc compared to 4.5pc for terraces.

Kirsty Allan, of Leaders estate agents, said that local rents have jumped by between 5pc and 10pc in the last 12 months. “Tenants are making quick decisions. There’s definitely more urgency now. We listed a property that went live an hour ago and we have already got inquiries,” she said.

Most tenants work locally in schools, business and nearby city hospitals (Stamford and Rutland Hospital and the Rutland Memorial Hospital are also in the district), but a growing share are moving in from out of the area for the rural lifestyle now that they can work from home, said Ms Allan. Some even commute to London.

Many tenants are upsizing because they want to have outdoor space after lockdown, she added. She recommends buying a three-bedroom house in Oakham for £220,000 to £300,000, which will rent out for £800 per month.

Mid Suffolk

Mid Suffolk, which sits between Ipswich and Bury St Edmunds close to the east coast, recorded a 2.3 percentage point jump in the local unemployed claimant count between January and July. Other local authorities have seen marginally smaller changes, but Mid Suffolk stands out because it also had the second lowest unemployment rate in March in this budget bracket, at just 2.3pc.

Andrew Brown, of Maxwell Brown Independent Property Agents, said that recent tenant demand has been “unbelievable”; one property had 60 applicants.

There is a huge lack of supply in the area: “Normally we have 40 or 50 properties listed, at the moment we have seven,” he added.

“People’s relationships have broken down, we have first-time buyers who were saving while they lived with Mum and Dad and have now decided that they have to move out and will rent instead,” said Mr Brown. Others are selling up while the sales market is booming and are moving into rentals while they house hunt.

As a result, rental rices are rising. A one-bedroom flat that would have let for £575 six months ago will now fetch £625, said Mr Brown. “And it will let straight away.”

Most tenants who lives in this area commute to work in Cambridge, Bury St Edmunds, Colchester and Felixstowe, where the docks are a hub for haulage and logistics work. And Londoners are moving in, drawn by the train link to Liverpool Street station, said Mr Brown.

Where should an investor spend £60,000? There is a shortage of three-bedroom rental properties in Stowmarket, said Mr Brown. Pick one up for between £230,000 to £250,000 and it will fetch as much as £1,000 per month.

Yahoo News

Yahoo News