Investors Who Bought Genes Tech Group Holdings (HKG:8257) Shares A Year Ago Are Now Up 22%

These days it's easy to simply buy an index fund, and your returns should (roughly) match the market. But one can do better than that by picking better than average stocks (as part of a diversified portfolio). To wit, the Genes Tech Group Holdings Company Limited (HKG:8257) share price is 22% higher than it was a year ago, much better than the market return of around 6.5% (not including dividends) in the same period. If it can keep that out-performance up over the long term, investors will do very well! Note that businesses generally develop over the long term, so the returns over the last year might not reflect a long term trend.

Check out our latest analysis for Genes Tech Group Holdings

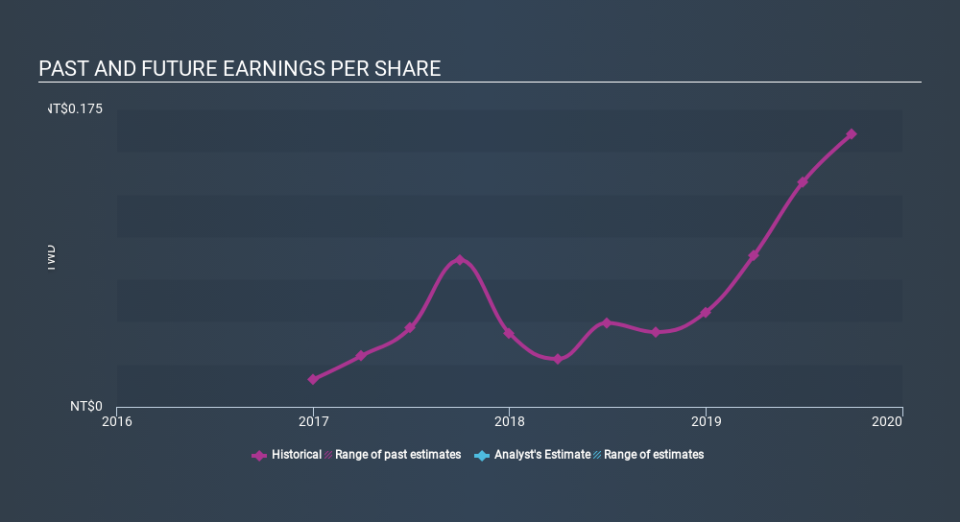

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Genes Tech Group Holdings was able to grow EPS by 265% in the last twelve months. It's fair to say that the share price gain of 22% did not keep pace with the EPS growth. So it seems like the market has cooled on Genes Tech Group Holdings, despite the growth. Interesting. This cautious sentiment is reflected in its (fairly low) P/E ratio of 5.86.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

Dive deeper into Genes Tech Group Holdings's key metrics by checking this interactive graph of Genes Tech Group Holdings's earnings, revenue and cash flow.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. As it happens, Genes Tech Group Holdings's TSR for the last year was 27%, which exceeds the share price return mentioned earlier. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

Genes Tech Group Holdings shareholders should be happy with the total gain of 27% over the last twelve months , including dividends . And the share price momentum remains respectable, with a gain of 8.4% in the last three months. This suggests the company is continuing to win over new investors. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. To that end, you should learn about the 4 warning signs we've spotted with Genes Tech Group Holdings (including 1 which is is a bit unpleasant) .

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo News

Yahoo News