JEFFERIES: 'Chinese money is going cold on London'

REUTERS/Jon Woo

LONDON – Investment in prime office space in London is taking a double hit from both Brexit and a slowdown in interest from Chinese and Hong Kong-based buyers.

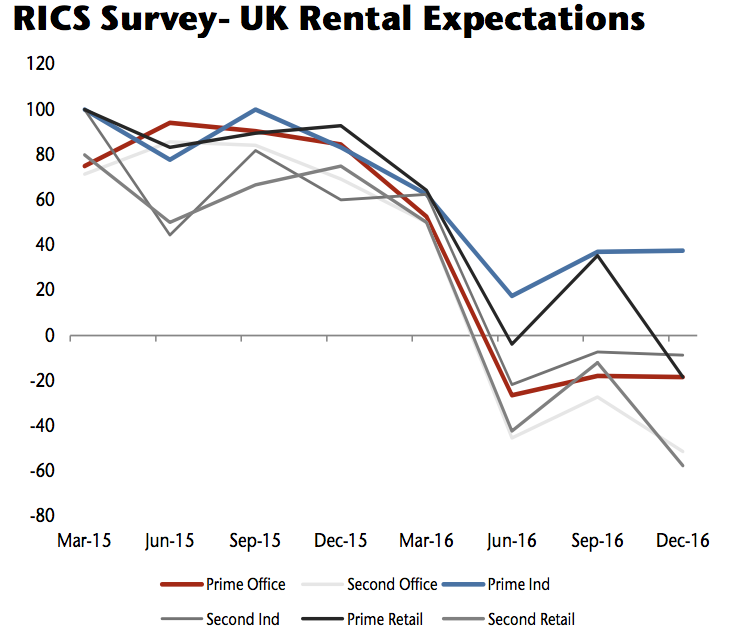

Jefferies analysts Mike Prew and Andrew Gill said in a note to clients that rental expectations for commercial real estate such as industrial, retail and office space are shrinking with a drop in demand following the Brexit vote in June.

"Since the Brexit vote there was some initial movement back into expected rental growth of nil or slightly positive, but this has slipped back with the government focused on a hard Brexit outside of passporting and the customs union, and the potential tightening of consumer belts as cost-led inflation puts pressure on household spending," they said.

Here's the chart, based on RICS survey data:

Jefferies

Jefferies said that take-up of central London office space "is nearly -25% below the 10 year average at 2.2 million sq ft vs. 2.8 million sq ft," giving a smaller pool of renters "increasing choice of available space as the pipeline market takes off."

At the same time, the flow of money from China is weakening, which is likely to depress prices further. A depreciating yuan and curbs on capital outflows are making it more expensive to invest.

"Chinese capital export restrictions are tightening with the yuan facing further depreciation," Jefferies said. "London office buyers are almost exclusively from Hong Kong and China, and with signs rents are falling the pricing support looks increasingly precarious.

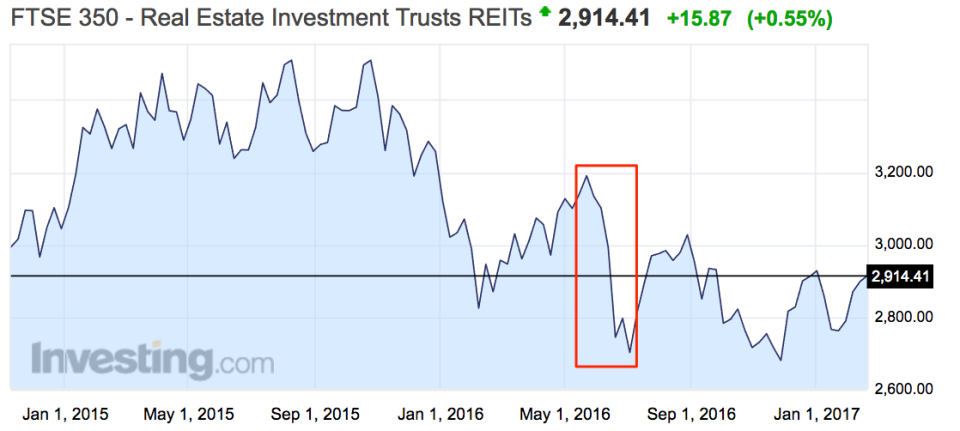

Shortly after the Brexit vote, at least seven investment firms suspended trading in their property funds, freezing £15 billion ($19.4 billion) of assets, out of a total of £24 billion sunk into UK open-end real estate funds.

The value of real estate investment trusts, or REITs, took a beating in the process.

Here's the chart:

Investing

NOW WATCH: This behavior could kill your chances in a Goldman Sachs interview

See Also:

Oxford University is in talks to set up a campus in Paris to keep EU links post-Brexit

MORGAN STANLEY: The pound is actually undervalued since the Brexit vote

YANIS VAROUFAKIS: Trump is risking a US debt crisis with 'skyrocketing deficits'

SEE ALSO: China will suspend all coal imports from North Korea after Pyongyang’s missile test

SEE ALSO: Here is Tony Blair's full speech on blocking Brexit

Yahoo News

Yahoo News