Labour ‘future chancellor’ called for income tax and capital gains rises

Labour’s “future chancellor” called for income tax and capital gains tax increases, it has emerged.

Torsten Bell, a think-tank boss who once advised Ed Miliband, was unveiled as the candidate for a safe seat last month and is tipped to become a leading figure in a future Labour government.

Addressing MPs in 2021, he said: “Most people like me, who come at the tax system from either a technocratic or an economics perspective, would like to see a straightforward rise in income tax, capital gains and dividends across the board.”

Mr Bell, who was chief executive of the centre-Left think-tank the Resolution Foundation, made the remarks while giving evidence to the Treasury select committee.

He had been invited to take part in the committee’s inquiry into whether the Covid-19 pandemic exacerbated inequality in the UK, and what the Treasury could do to mitigate this.

Call for capital gains to be expanded

He made the comments while answering a question about how the health and social care levy would impact low-paid workers. The levy, which had been championed by Boris Johnson while he was prime minister along with Rishi Sunak, his then chancellor, was scrapped by Liz Truss, his successor.

Elsewhere in the hearing, Mr Bell appeared to call for capital gains to be expanded so that it was applied on people’s estates after they had died.

During a discussion about how much variations in home ownership contribute to wealth inequality, he said: “The ratio of household wealth to income has gone from three times to seven times since the 1980s, and the amount we raise in wealth-related taxes is completely flat across that whole period, and that is madness. We need to be dealing with that system.

“Secondly, it is not just about the scale of them; they need to be suitable for that. The capital gains tax system actually has to work to do that.

“At the moment, for example, capital gains is completely ignored once someone passes away, even if they have had huge capital gains on a thing. That makes no sense at all.”

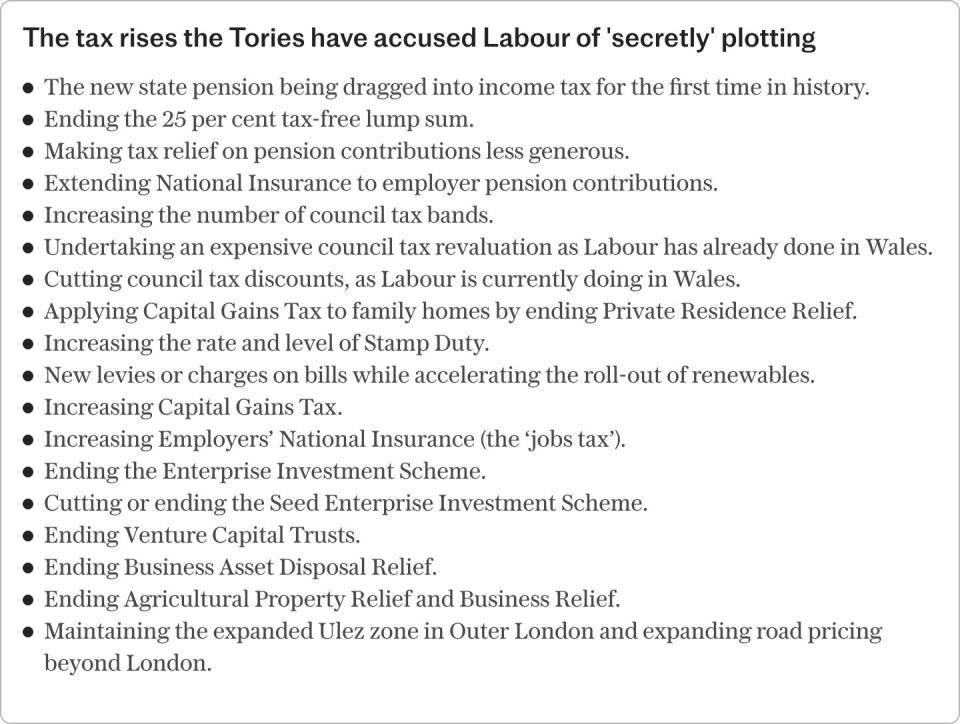

The Conservatives have looked to hammer home warnings that Sir Keir is planning to unveil massive tax rises once he gets the keys to No 10.

Labour has repeatedly promised not to increase income tax, VAT or National Insurance if it wins the election.

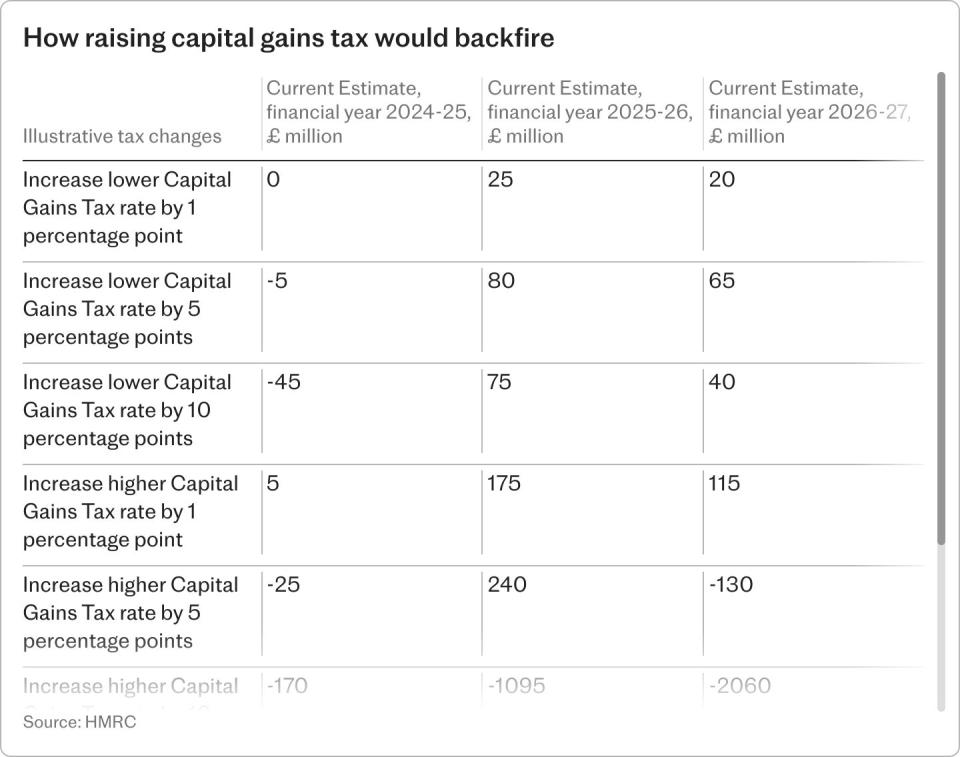

But some, including Angela Rayner, the deputy leader, have previously suggested equalising income tax and capital gains tax, meaning the latter would be doubled.

Rachel Reeves, the shadow chancellor, is among those opposed to a rise having argued that one would hammer many small business owners. But she is said to be under growing internal pressure to change her tune.

Capital gains tax has to be paid on the profit made on assets including second homes, shares and business resources such as land and buildings.

It is charged at a basic rate of 20 per cent – half the 40 per cent higher rate income tax level – which some Labour politicians have suggested is unfair.

Bim Afolami, Economic Secretary to the Treasury, said: “Torsten Bell, a man who is tipped as a future Labour chancellor, has suggested a whole host of policies that seek to saddle hardworking families with a higher tax bill.

“His suggestions include a hike in income tax, cuts to pensioner benefits and a property revaluation that would send council tax through the roof.

“People are already fearful of Labour’s £2,094 tax raid, and this further demonstrates that Labour will spend far more than the country can afford.”

Dame Harriet Baldwin, who chaired the Treasury select committee from 2022 until the election was called last month, said: “When I was chair of the Treasury committee, Torsten Bell outlined a range of different tax hikes he would like to see on the UK economy, including capital gains.”

She said this was concerning as “he is clearly going to be influential in terms of influencing any Labour Treasury thinking”.

Last month Mr Bell was announced as the Labour candidate for Swansea West, a seat held by the party since 1964 and one in which it achieved an 8,116 majority in 2019.

At the Resolution Foundation, Mr Bell has argued for tax raising measures. He has said ISA saving pots should be capped at £100,000 and he criticised the Chancellor’s decision to increase the threshold for VAT registration from £85,000 to £90,000 in the Budget.

A Labour spokesman said: “This is not Labour Party policy and does not reflect the plans set out in our manifesto.”

Yahoo News

Yahoo News