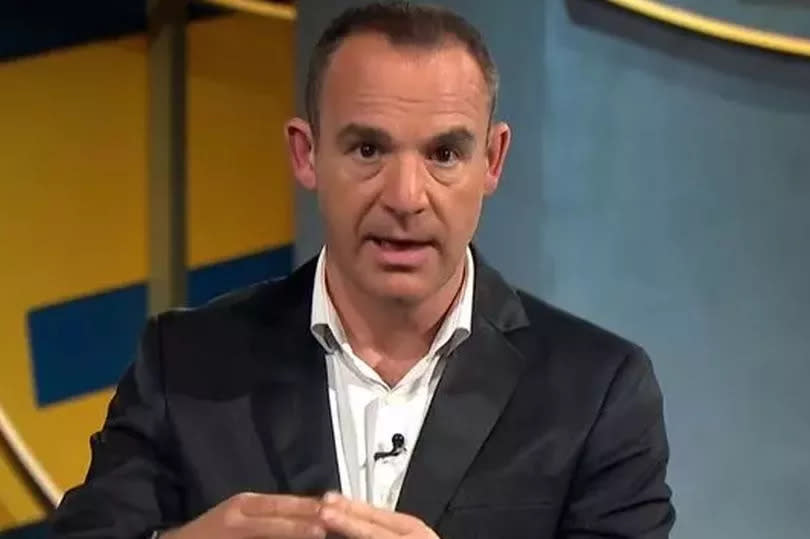

Martin Lewis warns of “little-known tax” charge on savings that goes above £1,000 interest cap

Martin Lewis tackled tax in the latest episode of the Not the Martin Lewis Podcast, briefing listeners on the number of fan-led questions he would be looking at with his panel of experts. The Money Saving Expert highlighted one “little known” tax he’d be explaining: The starting rate of tax for savings.

He added: “No, it’s not the ‘you can earn £1,000 a year’, there’s another one too,” referring to the £1,000 of interest on savings Brits can earn every year completely tax-free. Additionally, Martin clarified that it’s also not the personal savings allowance, which is currently £12,570 that every Brit can earn in a tax year without paying income tax on it.

“This is for anyone who has relatively low earned income and high interest, effectively you may be able to get up to £18,570 without paying tax on it,” he explained. When one fan, Angus from Derby, called in with his personal predicament having just recently retired before the state pension age, Martin noted he is in a “sweet spot” to make the most of this rate.

Angus admitted he’d “never heard of” this tax allowance before weighing up whether he should take money out of his savings or private pension until his state pension kicks in. His current situation also means he is on a low income, allowing him to benefit from the starting rate so long as the income he takes from his savings doesn’t go above the £18,570 threshold.

The starting rate for savings is aimed at people with low income, earning less than £18,570 a year from both earnings and savings combined. Rebecca Benneyworth explained on the BBC podcast: “The first £5,000 worth of savings income is subject to the starting rate which is a lovely round number…of zero.”

Trying to “not make it too complicated”, the tax guru noted that savers can combine all three of these tax exemptions. While Martin tried to take a backseat on the topic, to allow his panel of experts to lead the advice, he did chime in to summarise: “In the right circumstance, you can earn up to £18,570 if you have the right combination of savings, interest and earnings.”

Yahoo News

Yahoo News