Martin Sorrell named in US lawsuit against Grenfell cladding firm

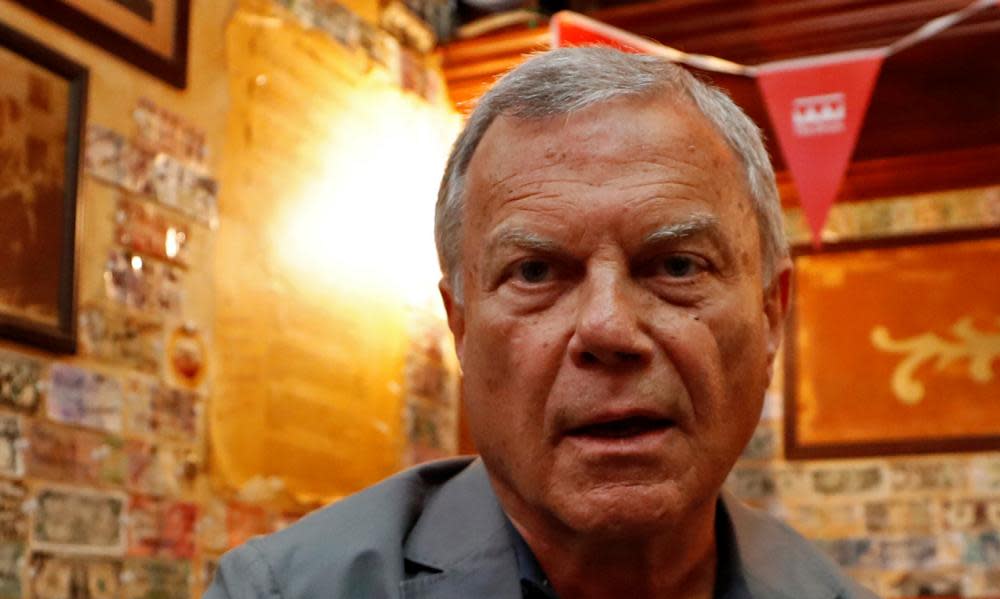

Sir Martin Sorrell and Royal Bank of Scotland have been named in legal action against the manufacturer of cladding installed on Grenfell Tower shortly before last year’s fatal fire.

Sorrell, the British businessman who built the advertising firm WPP into one of the world’s “big four”, was a non-executive director of Arconic and its predecessor business from 2012 until March 2017, three months before the fire which killed 72 people.

Arconic and its board are facing a class action in the US. Brought by investors, the lawsuit alleges that Arconic “knowingly or recklessly” supplied flammable cladding panels for use in highrises such as Grenfell Tower in west London. Other current and former board members named include the Indian industrialist Ratan Tata, the former president of Mexico Ernesto Zedillo and Stanley O’Neal, a former chairman and chief executive of the US investment bank Merrill Lynch.

The specialist law firm Pomerantz Law is lead counsel in the suit.

Arconic, which made revenues of almost $13bn (£10.3bn) in 2017, was created in 2016 when Alcoa Inc was separated into two independent companies - the other being Alcoa Corp.

The suit claims that the board of Arconic/Alcoa Inc “made false and/or misleading statements and/or failed to disclose”, that “Arconic knowingly or recklessly supplied its highly flammable Reynobond polyethylene (PE) cladding panels for use in highrise buildings”, as well as providing an inaccurate prospectus for a $1.3bn share issue in 2014.

In the suit, investors also allege that a “precipitous decline” in the company’s share price after the Grenfell fire lost them money.

First filed in 2017, the class action also targets banks who are alleged to have misled investors while performing their role as underwriters during the share issue. Those named include RBS’s US operations, Morgan Stanley, Credit Suisse, Citigroup, Goldman Sachs, JP Morgan, BNP Paribas, Mitsubishi UFJ, and RBC Capital Markets.

Grenfell Tower was refurbished between 2014 and 2016 at a cost of £10.3m, of £3.5m was spent on cladding.

Arconic has accumulated $28m in “external legal and other advisory costs” related to the fire, according to quarterly filings with the US Securities and Exchange Commission.

Arconic manufactured the external aluminium composite panels used in the refurbishment carried out by Rydon, a construction company contracted by the Kensington and Chelsea Tenant Management Organisation, which managed Grenfell on behalf of the local council.

The installation of the cladding and insulation is a key area for the public inquiry into the fire. It has heard hours of evidence from expert witnesses who claimed the panels were an important factor in the spread of the fire. Lawyers acting for Arconic told the inquiry that the panels were “at most, a contributing factor” and instead blamed the materials used in the windows.

Regulators in other countries, such as Germany and the US, have banned some forms of plastic-filled cladding, such as the Reynobond PE, on high buildings because of fire risk. New York Stock Exchange-listed Arconic discontinued sales of Reynobond PE in the aftermath of the fire.

The class action cites a Reuters report from June last year. The article said Arconic had known the products would be used in the construction of Grenfell Tower.

In its quarterly filing Arconic said it believed these cases were without merit and that it intended to challenge them vigorously.

The filing added: “The company cannot reasonably estimate at this time the likelihood of an unfavourable outcome or the possible loss or range of losses in the event of an unfavourable outcome.”

Sorrell said: “Like everyone, I am greatly saddened by the horrific events at Grenfell. However, I left the board of the company in March 2017 and I cannot comment on the legal actions to which you refer.”

Arconic declined to comment. All of the banks named in the lawsuit declined to comment, as did Tata and O’Neal. Zedillo did not respond to requests for comment.

Yahoo News

Yahoo News