Mexican Peso Sinks Further as Election Shock Reverberates

(Bloomberg) -- Mexico’s peso sank for a second session after an unexpected landslide election win by the ruling party injected local political risk into one of the world’s top carry trades.

Most Read from Bloomberg

Modi Vows to Retain Power Even as Party Loses India Majority

Short Sellers in Danger of Extinction After Crushing Stock Gains

BlackRock, Citadel Back Texas Stock Exchange in Challenge to NYSE

Bonds Rally as Traders Reload Fed Bets After Data: Markets Wrap

The peso shed as much as 2.9% to 18.1936 per dollar by 11:45 a.m. in London, adding to its 3.8% loss on Monday that was its worst one-day tumble since June 2020. Mexico’s benchmark stock index sank 6.1%, the most since the onset of the pandemic.

Read More: Mexico Peso Falls as Ruling Party Landslide Spooks Investors

President Andres Manuel Lopez Obrador’s Morena party and its allies got very close to clinching a supermajority in congress. They obtained two-thirds of the seats in the lower house and nearly two-thirds in the senate. The result would potentially let the ruling coalition pass amendments to the constitution, which has triggered investor concern about increased state interference in the economy and checks on power.

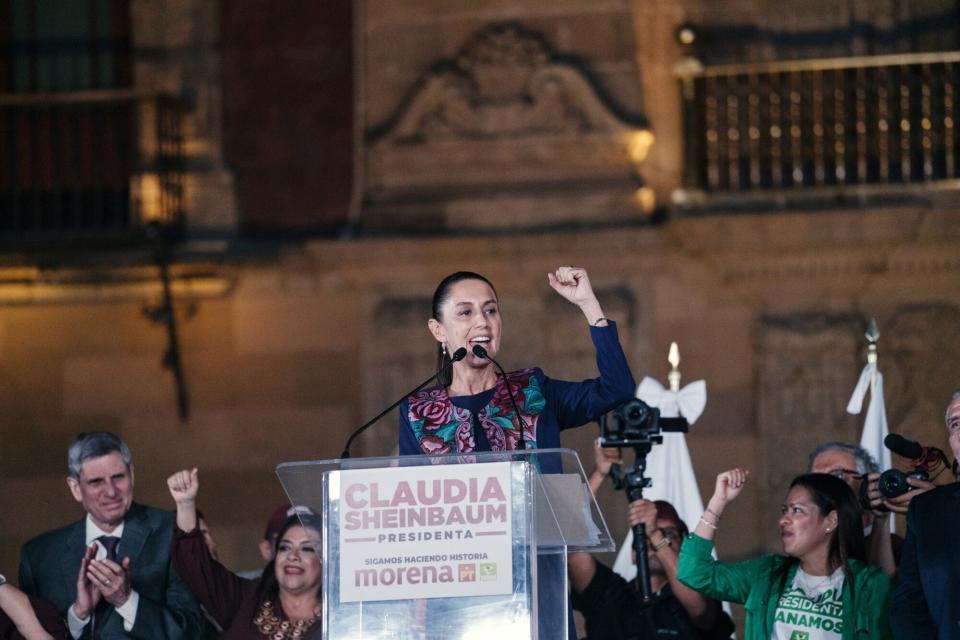

Lopez Obrador’s protege Claudia Sheinbaum was expected to easily win the vote.

Market participants’ fears of the consequences of such a “super-majority“ seem to have gained the upper hand over the benefits of political continuity, Michael Pfister and Ulrich Leuchtmann, analysts at Commerzbank AG, said in a note to clients.

The analysts said Sheinbaum is likely to calm the markets in the coming weeks. During the campaign, she made it clear that she intends to set her own accents that differ from those of her mentor, they said.

“In practice, she is likely to try to reassure the market that she will hold off on some of the more controversial issues for the time being, i.e. that she does not plan any major constitutional changes or the like for the time being. If the market believes her, the peso is likely to stabilize again.”

Mexico’s currency had been one of the top-performing major currencies this year and last, boosted by high interest rates and the country’s ties to the US economy.

Some analysts expected Sheinbaum to take a more market friendly tack than her predecessor and mentor, but the prospect of constitutional changes injected fear into the market, said Gabriela Siller, head of economic research at Mexican bank Grupo Financiero Base.

“Markets are going to have to stabilize,” Siller said. “The thing is where.”

--With assistance from Maria Elena Vizcaino and Tugce Ozsoy.

(Updates throughout)

Most Read from Bloomberg Businessweek

Startup Brings New Hope to the Pursuit of Reviving Frozen Bodies

The Budget Geeks Who Helped Solve an American Economic Puzzle

Disney Is Banking On Sequels to Help Get Pixar Back on Track

©2024 Bloomberg L.P.

Yahoo News

Yahoo News