What Mexico’s Investors Are Watching Ahead of Elections

(Bloomberg) -- Investors see Mexico’s presidential election as a foregone conclusion, but the real possibilities for market volatility are lurking elsewhere on the ballot.

Most Read from Bloomberg

World’s Largest Nuclear Plant Sits Idle While Energy Needs Soar

‘Not Gonna Be Pretty:’ Covid-Era Homebuyers Face Huge Rate Jump

Warning Signals Are Flashing for Homeowners in Texas and Florida

Insurers Sink as UnitedHealth Sees ‘Disturbance’ in Medicaid

American Air Fired Commercial Head After Sales Strategy Alienated Corporate Clients

The ruling party, Morena, is seeking to capitalize on support for frontrunner Claudia Sheinbaum and reach a supermajority in Congress, where every seat in the Senate and lower house is up for grabs. That would open the door to constitutional amendments that could upend Mexico’s institutions and unsettle markets. On the other side, opposition parties are vying to take away Morena’s congressional majority, providing a tougher check on the presidency.

“Congress is more difficult to forecast. The polls are not as accurate, but we think it’s still a tossup between a Morena majority and an opposition majority,” said Ernesto Revilla, chief Latin American economist at Citigroup Inc.

Both outcomes, or a status quo where Morena retains a simple majority, are plausible just a few days before the Sunday vote, adding a note of intrigue to investors’ otherwise serene election scenario. Their expectations for Sheinbaum — continuity, and perhaps even a little more market-friendliness than current President Andres Manuel Lopez Obrador — have helped the Mexican peso avoid losses seen in past votes and retain its post as best performing major currency in the world this year.

“Investors think Sheinbaum could lead into an AMLO 2.0 administration,” Gabriel Casillas, chief Latin America economist at Barclays, said, referring to Lopez Obrador by his widely used acronym. “It would be like AMLO, but with some improvements.”

Read More: Sheinbaum’s Lead Steadies in Final Days of Mexico Campaign

Mexico’s currency trades around the clock, so investors will be able to react on Sunday to early results. Due to Mexico’s complex system of distributing congressional seats, the exact tally of new legislators won’t likely be clear Sunday night. That, coupled with a drawn-out transition — the next presidential term starts Oct. 1 — and upcoming US elections may mean the real volatility for the peso may not emerge until later.

‘Unknown Quantity’

With just days to go until the vote, it’s unclear how far Sheinbaum will deviate from AMLO’s support for state-run energy companies and icy relations with the business elite if she wins. Some expect her to embrace private investment in the power sector and push to draw more factories to the country, the so-called nearshoring trend. Others think she could remain beholden to Lopez Obrador.

“She’s an unknown quantity,” said Verena Wachnitz, who manages Latin American stocks at T. Rowe Price. Sheinbaum, she added, is a candidate “campaigning under AMLO’s wing and trying to not confront him.”

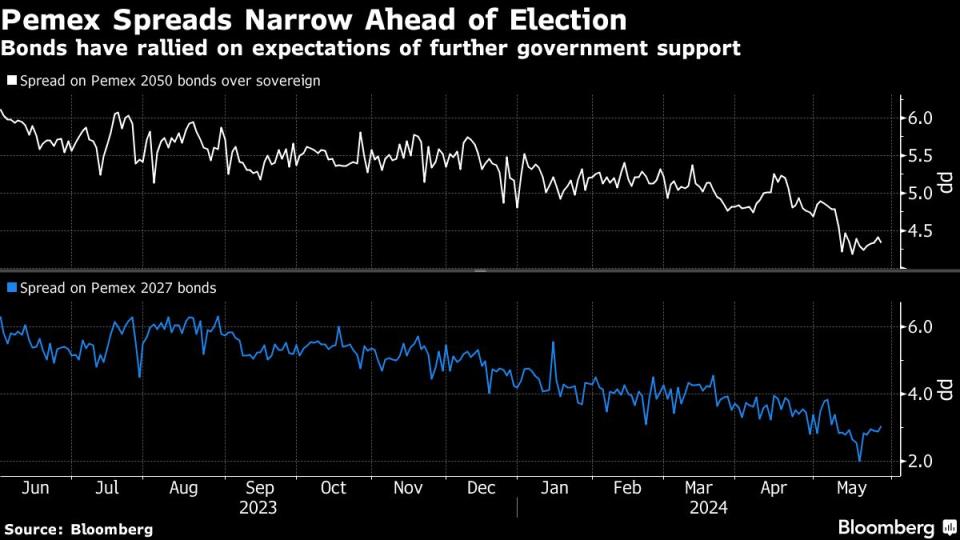

Read More: Mexico’s Sheinbaum Wants Debt-Laden Pemex to Go Green

Sheinbaum likely won’t be in any rush to spell out policy plans for reining in the deficit or tackling the $102 billion debt of state-owned oil firm Petroleos Mexicanos, and may delay naming her cabinet — a key indicator of whether she is taking a more technocratic or ideological tack — until closer to October, said Citigroup’s Revilla.

Strategists at Morgan Stanley, led by Nikolaj Lippmann, see potential upside in a more market-friendly Sheinbaum administration, where Mexican equities and bonds from Pemex would benefit.

“The election can act as a catalyst for assets that have traded structurally cheap,” Lippmann wrote in a report from late April.

Mexico’s next administration may face the prospect of credit downgrades if it doesn’t dial back spending next year, said Ganesh Ramachandran, an emerging markets portfolio manager at Lazard Asset Management. Lopez Obrador dispatched with his famous fiscal austerity in order to finish his landmark infrastructure projects, driving the deficit this year to the biggest since the 1930s.

“Regardless of who wins, there will need to be some reconciliation,” Ramachandran said.

Read More: AMLO Spends Like Never Before to Set Up His Successor’s Victory

Congress

Congressional races may be the ones sparking asset moves following the June 2 election.

Polls may be overestimating support for Morena, which captured a lesser share of votes in mid-term elections in 2021 as well as in governor races during the last two years compared to 2018, when Lopez Obrador won, said Marco Oviedo, a strategist at XP Investimentos. He said a tighter-than-expected vote would translate into a more powerful opposition in congress.

“If this is the case, it would be very positive for Mexican assets,” Oviedo wrote in a note this month, forecasting that the peso could head to 16 per dollar — it currently trades around 16.80 per dollar.

Majority Win

The base case for analysts across Wall Street is for Morena to win a simple majority in congress — largely a continuation of current conditions, and unlikely to move assets. Consumption stocks could see a lift in this scenario, which ensures continued support for higher minimum wage policies and AMLO’s cash aid programs, according to strategists at Bradesco BBI.

Read More: Policy Continuity an Election Risk for Economy

A Sheinbaum win backed by a congressional majority would leave the new government in control of the budget but likely restrained from passing a set of constitutional reforms laid out by Lopez Obrador in February. Those bills include plans to reduce the number of lawmakers and allowing for the election of Supreme Court justices, both of which could erode checks on the ruling party’s power and sap appetite for Mexico assets.

Super Majority

With a super majority, or two-thirds of seats in both houses, the governing coalition could more easily pass those more ambitious, constitutional reforms, an outcome that could rattle investors, sending the peso sliding amid concerns the next government could turn more radical, analysts say.

Those bills include eliminating independent regulators, like the antitrust commission, as well as establishing new pension obligations and mandatory minimum wage hikes. A super majority would also make approving nominations to the central bank and supreme court easier, allowing the next administration to stack both bodies with loyalists.

Opposition Surprise

On the other hand, a stronger-than-expected showing by the opposition on the Congress vote could restrain Morena from making any rash moves and give assets a boost. Stocks in regulated sectors that had come under fire from AMLO could be the big winners, like miner Grupo Mexico as well as airport stocks.

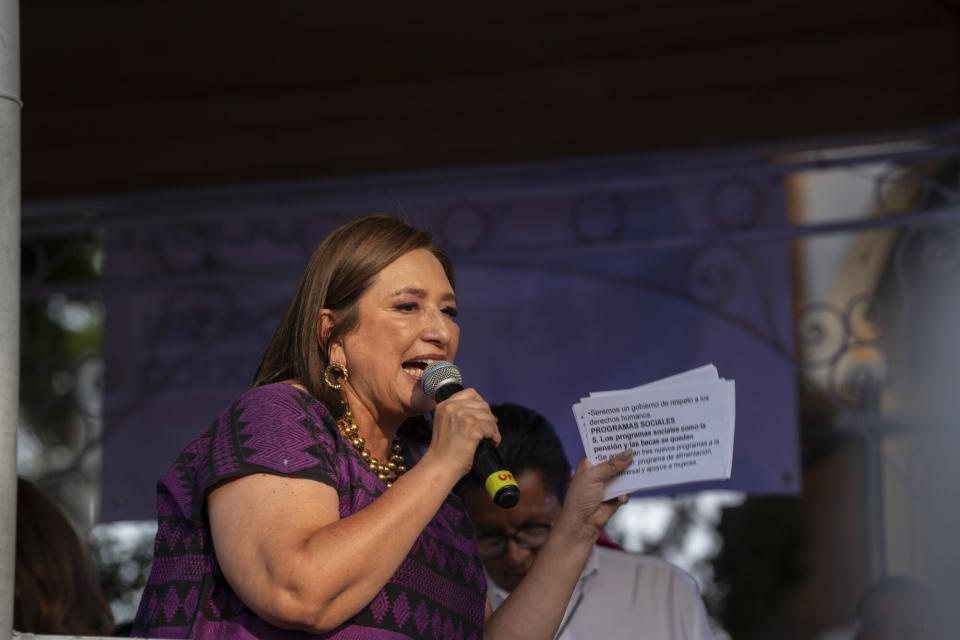

The unlikely event of victory by presidential candidate Xochitl Galvez could be viewed positively by investors due to her more market-friendly stance. Galvez, herself a businesswoman, has supported the idea of more private investment in Mexico’s oil industry.

Still, a slim opposition victory could test Mexico’s democratic institutions and the peso’s strength. Lopez Obrador refused to accept defeat in 2006, bogging down the capital with a protest camp for months.

The Other Vote

Others say the next big driver for Mexican assets will come from the outcome of a different vote altogether: the US presidential election in November.

That’s a far bigger worry for investors, with Mexico potentially coming into a negative focus amid rhetoric about migration, drug trafficking and concerns about Chinese investments in the country, said Alejandro Silva, chief investment officer at Silva Capital Management in Chicago.

“The US election could all of a sudden become about who’s gonna be tougher on Mexico,” Silva said. “If that is the case, then come August until November, those are going to be really tough months for the peso.”

--With assistance from Vinícius Andrade.

(Adds investor comment on fiscal consolidation in paragraph 12.)

Most Read from Bloomberg Businessweek

Disney Is Banking On Sequels to Help Get Pixar Back on Track

Why Dave & Buster’s Is Transforming Its Arcades Into Casinos

The Secret Ozempic Recipe Behind Novo's Race to Boost Supplies

©2024 Bloomberg L.P.

Yahoo News

Yahoo News