National Fuel Gas (NFG) Beats on Q3 Earnings, Cuts EPS View

National Fuel Gas Company NFG posted third-quarter fiscal 2020 operating earnings of 57 cents per share, which beat the Zacks Consensus Estimate of 48 cents by 18.8%. However, earnings declined 19.7% from the year-ago figure of 71 cents per share.

Total Revenues

Total revenues of $323 million missed the Zacks Consensus Estimate of $376 million by 14.1%. The top line also dropped 9.6% from the prior-year figure of $357.2 million.

Highlights of the Release

Total operating costs for the reported quarter decreased 0.7% from the year-ago level to $242.6 million, owing to lower purchased gas expenses.

It incurred interest expenses of $27.1 million, up 7.1% from the year-ago figure.

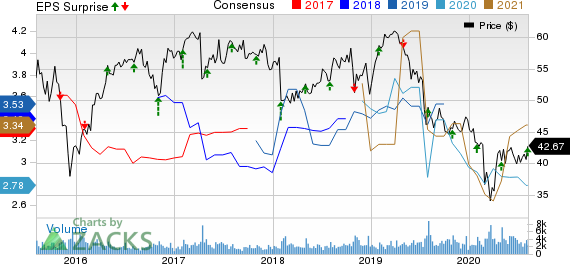

National Fuel Gas Company Price, Consensus and EPS Surprise

National Fuel Gas Company price-consensus-eps-surprise-chart | National Fuel Gas Company Quote

Financial Highlights

As of Jun 30, 2020, National Fuel Gas had cash and temporary cash investments of $555.3 million compared with $20.4 million on Sep 30, 2019.

Long-term debt (excluding current maturities) was $2,628.8 million as of Jun 30, 2020 compared with the Sep 30, 2019 level of $2,133.7 million.

The company’s cash flow from operating activities for the first nine months of fiscal 2020 was $623.9 million, up from $570.6 million recorded in the comparable year-ago period.

Total capital expenditure for the first nine months of fiscal 2020 was $551 million, down from $587.4 million in the comparable year-ago period.

Guidance

National Fuel Gas downwardly revised its fiscal 2020 earnings guidance to the range of $2.75-$2.85 from the prior expectation of $2.75-$2.95. The mid-point of the new guidance is higher than the Zacks Consensus Estimate of $2.78. The company expects fiscal 2021 earnings per share in the range of $3.40-$3.70.

National Fuel Gas reiterated its fiscal 2020 capital expenditure guidance in the range of $680-$740 million. Capital expenditure for fiscal 2021 is expected in the range of $660-$770 million.

The company lowered fiscal 2020 net production expectation to the range of 240-245 billions of cubic feet equivalent (Bcfe). Fiscal 2021 production is expected in the range of 305-335 Bcfe.

Zacks Rank

Currently, National Fuel Gas has a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Upcoming Releases

Atmos Energy Corporation ATO posted third-quarter fiscal 2020 earnings of 79 cents per share, which surpassed the Zacks Consensus Estimate of 76 cents by 3.9%.

Plains All American Pipeline PAA posted second-quarter 2020 operating earnings of 25 cents per unit, which lagged the Zacks Consensus Estimate by 10.7%.

ONEOK Inc. OKE posted second-quarter 2020 operating earnings of 32 cents per share, which missed the Zacks Consensus Estimate of 50 cents by 36%.

Just Released: Zacks’ 7 Best Stocks for Today

Experts extracted 7 stocks from the list of 220 Zacks Rank #1 Strong Buys that has beaten the market more than 2X over with a stunning average gain of +24.3% per year.

These 7 were selected because of their superior potential for immediate breakout.

See these time-sensitive tickers now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Plains All American Pipeline, L.P. (PAA) : Free Stock Analysis Report

ONEOK, Inc. (OKE) : Free Stock Analysis Report

National Fuel Gas Company (NFG) : Free Stock Analysis Report

Atmos Energy Corporation (ATO) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo News

Yahoo News