Netflix is finding a way into China (NFLX)

BII

This story was delivered to BI Intelligence "Digital Media Briefing" subscribers. To learn more and subscribe, please click here.

In a partnership that provides access to China, Netflix has signed a content licensing deal with video platform iQiyi, Tech in Asia reports.

The licensing agreement covers Netflix's original shows, allowing the US streaming service to distribute content in China for the first time, and by extension build its brand and audience in that territory.

China is a notoriously difficult market for Western companies to enter because of protectionist regulations, but it’s also one of the most lucrative internet markets. It has:

The world’s biggest internet population. In March 2017, internet users totaled 730 million, or a little over half of the country’s total population. Digital TV Research expects China to have 74 million SVOD subscribers by 2021, up from an estimated 40 million subscribers in 2016. And according to Media Partners Asia, China will account for 76% of the $35 billion in projected revenue that Asia Pacific’s online video sector will generate in 2021.

A growing, free-spending middle class. Total household income in China is higher than in other emerging markets — including Brazil, Mexico, and Indonesia — and discretionary spending in the country is on the rise, according to Credit Suisse and World Bank data cited by McKinsey. Internet penetration is also rising as rural China comes online and increases its purchasing power. In 2015, rural China accounted for 64% of online purchases, according to Credit Suisse.

The online video market in China is also mature and fiercely competitive. As you’d expected, it’s dominated by the country’s big three consumer internet companies. Baidu, Alibaba, and Tencent (BAT) — which altogether account for nearly 70% of online video watch time. Baidu’s iQiyi commands 35% of the monthly time spent watching online video in China, compared to Alibaba’s Youku-Tudou at 22% and Tencent Video at 13%, according to iResearch data cited by Jefferies.

Some of Netflix’s content is already quite popular in mainland China too, so Baidu’s iQiyi also stands to benefit from this partnership. Netflix's original cartoon Bojack Horseman has amassed a cult following in China, and translated screenshots from the show are routinely relayed on the Chinese social network Weibo. The hit series House of Cards has also become popular in China, via a distribution deal with the internet company Sohu.

Growth of subscription-video-on-demand (SVOD) services in the US has slowed considerably over the last year as competition in the online video streaming space intensifies. Heavy hitters like Netflix, Hulu, and Amazon Prime are increasingly squeezed by new competitors with exclusive content and niche video offerings.

International markets, and specifically, the Asia-Pacific (APAC) region will be paramount for both established SVOD players and new entrants looking to establish themselves in the successful video space.

The SVOD market in the APAC region is poised for explosive growth over the next five years due to increased mobile adoption, amplified broadband expansion, and enhanced purchasing power.

Dylan Mortensen, senior research analyst for BI Intelligence, Business Insider's premium research service, has compiled a detailed report on subscription video on-demand that explores how slowing SVOD growth in the US will lead to a surge in the APAC region.

Here are some of the key takeaways from the report:

While SVOD services are increasingly rooted among US households, growth is beginning slow. Growth in North American SVOD subscriptions is set to fall from 30% in 2014 to 4% by 2018.

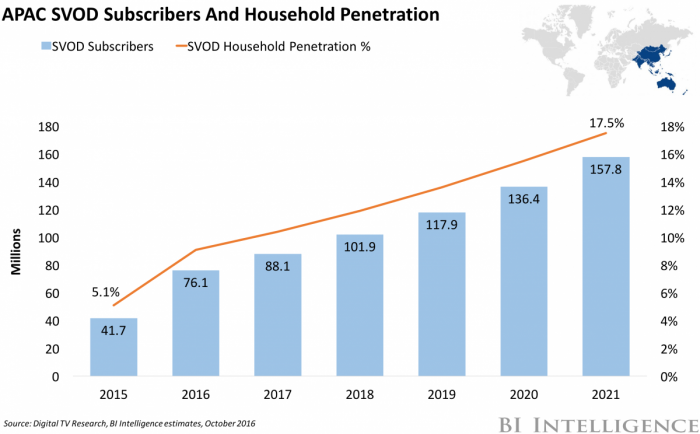

The best opportunity for continued growth lies in the Asia-Pacific (APAC) region. The region had nearly 42 million SVOD subscribers in 2015, but could have up to 158 million by 2021.

The increasing adoption of smartphones and mobile data is propelling growth in mobile video viewing across APAC, which is poised to outpace the rest of the world.

Rising purchasing power in APAC underlines the opportunity for online video services. China and emerging Asian economies represent nearly two-thirds (63%) of global economic growth.

Content creators and marketers stand to gain from SVOD’s push into the APAC region. Content creators can benefit from the surge in short-form video, while marketers can capitalize on advanced product placements.

In full, the report:

Forecasts SVOD subscribers in the APAC region.

Explores the factors behind SVOD’s slowing growth in the US.

Breaks down reasons why APAC is ripe for massive online video growth.

Discusses who will benefit from SVOD growth in APAC.

Interested in getting the full report? Here are two ways to access it:

Subscribe to an All-Access pass to BI Intelligence and gain immediate access to this report and over 100 other expertly researched reports. As an added bonus, you'll also gain access to all future reports and daily newsletters to ensure you stay ahead of the curve and benefit personally and professionally. » START A MEMBERSHIP

Purchase & download the full report from our research store. » BUY THE REPORT

See Also:

Yahoo News

Yahoo News