Next fears impact of new Covid lockdowns

Next has warned that sales could fall by a fifth if Christmas trading is wrecked by a second lockdown.

The retailer said a round of local lockdowns sales could send sales down by 8pc in the fourth quarter, while a nationwide "circuit breaker" would slash them by 20pc if stores are forced to shut again.

It came as the firm unveiled a 4.1pc increase in full-price sales during the three months to Oct 24, with online sales soaring more than a fifth compared with the same period last year.

This offset an 18pc decline in retail sales as footfall remained lower across town and city centres. Total sales rose by 2.8pc.

The company said: "There remains a very high degree of uncertainty in our estimates, and much will depend on the progress of the pandemic along with the Government and consumer reaction to developments.

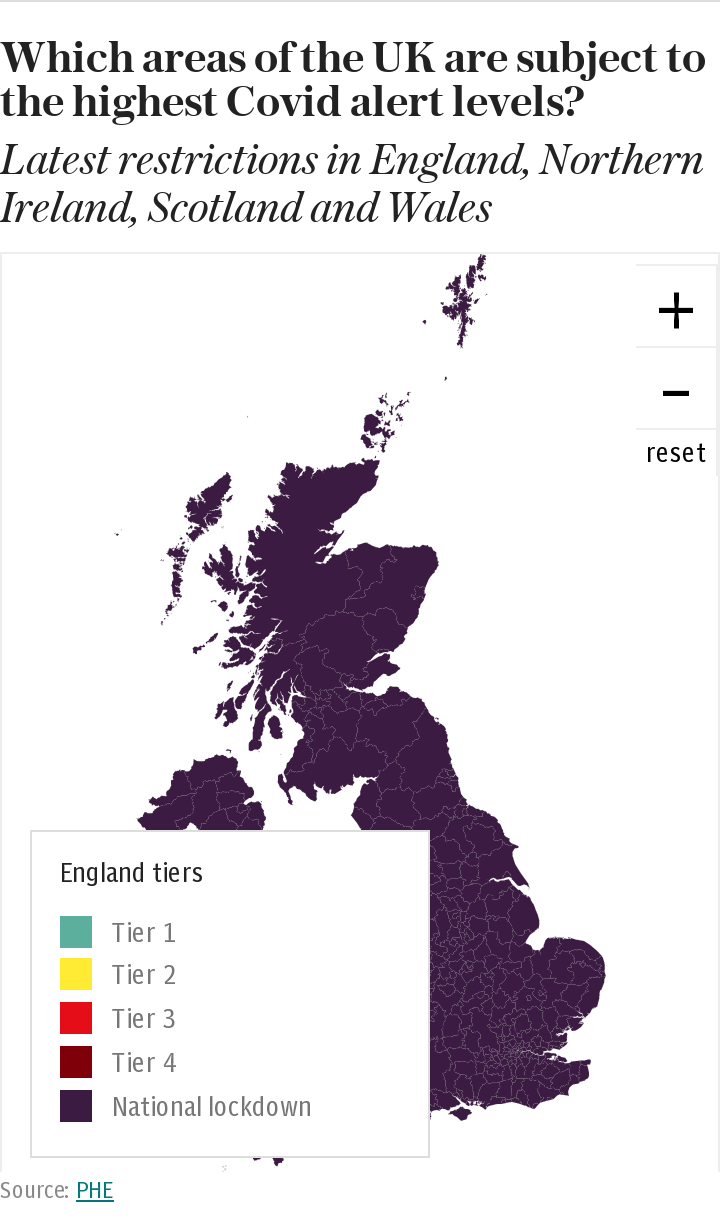

"The biggest single unknown is whether England, Scotland and Northern Ireland will follow Wales' decision to shut non-essential retail shops."

Chief executive Simon Wolfson, who voted to leave the European Union, also called for the liberalisation of tariffs on goods as the post-Brexit transition period ends on Dec 31.

He said: "In the event of no deal, one of the biggest opportunities is to revise the tariffs rates on goods where there is no domestic production. It seems crazy.

"What would make sense, we think, is for the Government to cut tariffs on goods where Britain has little or no domestic production because that would provide a boost to the consumer."

Lord Wolfson previously predicted that Next would cut prices by about 2pc if the UK crashes out of the EU without a deal, but it now expects a slight increase that were not likely to be passed on to shoppers.

He added this would be negligible, equating to £13m on sales of £4bn or 15p on a £50 garment.

Next upgraded its profit forecast for the year again after sales beat expectations in the third quarter following the boom in online orders.

The high street bellwether said under its central scenario, it expects pre-tax profit for the year to be £365m – which is £65m higher than it forecast last month.

Lord Wolfson said: "The health of the high street will depend as much on what happens to rents as what happens to sales. If rents can come down then lots of shops will still be viable, there are very few shops that we've got that at the right level of rent and rates would not be viable."

Richard Lim, chief executive of Retail Economics said: "These are impressive results given the hugely challenging backdrop. While the apparel sales continue to suffer, the retailer is leaning on growth across home products and utilising its sophisticated multichannel operations.

"Next remains ahead of the curve when it comes to weathering the storm. Its strong online proposition, the spread of physical shopping destinations and strategic partnerships give customers more options to buy in the way they feel most comfortable.

"This will prove critical during Christmas trading as Government restrictions play havoc with the natural flow of festive spending."

Shares rose 1.7pc to £61.94, valuing the company at £8.2bn.

Yahoo News

Yahoo News