North East deals of the week: key contracts, acquisitions and investments

North East independent holiday group Hays Travel snapped up 19 new shops as part of a major acquisition.

The Sunderland based business has swooped for Miles Morgan Travel, a Chepstow based company with branches across the South West and South Wales. The company had been a member of Hays’ Independence Group consortium for 18 years.

Hays said it has no plans to rebrand the 19 Miles Morgan Travel branches – the first of which was opened by Miles Morgan in 2006 – and the move brings around 130 new staff members into the wider group.

Company chair Dame Irene Hays said: “Miles Morgan is a legend in travel for a reason; he and his brilliant team have created an exceptional business that they can be very proud of. We will always be grateful to Miles, who as a member of our group’s board for many years has been instrumental in Hays Travel’s growth and success.

“We are all excited about this latest acquisition and look forward to welcoming the Miles Morgan Travel team to our Hays Travel family and learning from each other. Everyone at Hays Travel wishes Miles the very best success.”

Tyneside tech firm SoPost is gearing up for major growth after sealing a deal with one of the biggest beauty firms in the world. The growing Newcastle firm has been helping brands run powerful product sampling campaigns for the last 12 years, harnessing data and analytics to help boost their clients’ market share. SoPost already works with global companies such as L’Oreal, Estee Lauder, Reckitt, and Coty, sends one sample every couple of seconds and last year also announced the launch of voice-activated sampling campaigns through Amazon Alexa.

The company, which has 65 staff members and turned over £13.88m in most recent accounts for 2022, has now launched a partnership with Shiseido UKI, a luxury cosmetics company with roots in Japan. As the fifth largest beauty company in the world with brands now sold in over 120 countries and regions, Shiseido Group’s partnership with SoPost is set to accelerate SoPost’s growth.

Shiseido has partnered with SoPost as their local digital sampling platform, to drive their UK product sampling strategy and market share. SoPost will be powering nine of Shiseido’s brands’ sampling strategies across social, direct-to-consumer and retailers in the UK market, including Shiseido, Serge Lutens, Drunk Elephant, Narciso Rodriguez, Tory Burch, Ulé, Issey Miyake, NARS and Zadig & Voltaire.

North East construction tech firm Clixifix is set for growth after being snapped up by Norwegian group SmartCraft ASA.

The Houghton-le-Spring based ‘software as a service’ firm has seen strong growth on the back of its cloud-based platform, which allows its customers in the UK housing industry to track the progress of repairs and speeds up the reporting process. Clixifix CEO James Farrell said the firm’s acquisition by SmartCraft signifies its robust growth trajectory and also enhances its market opportunities, by integrating with SmartCrait’s expansive European presence.

Mr Farrell said: “Joining forces with SmartCraft marks a pivotal chapter in our journey. With SmartCraft’s proven excellence in developing top-tier SaaS solutions, we are poised to accelerate our innovation, enhancing our offerings to better serve our ever-growing customer base across the UK. This synergy ensures that Clixifix will continue to lead the way in transforming construction defect management and customer service.”

Northumberland developer Redfoot Developments is set to build new luxury homes near Alnwick on the back of a £1.5m investment. The firm, based in Alnwick, has received the seven-figure sum from North East Property Fund (NEPF) to develop four new four-bedroom family homes on the outskirts of the market town, in a scheme called Greensfield Farm. The business is a new housebuilding company specialising in homes in prime locations, with Alnwick marking its first development.

Greensfield Farm is being marketed by Northumberland Properties with prices starting from £695,000, with the homes expected to be completed in spring or summer this year. Funding has been provided by FW Capital from the North East Property Fund (NEPF), an investment programme backed by the North East Local Enterprise Partnership.

Charlie Maling-Dunn, director at Redfoot Developments, said: “This is our first development but as a team we have extensive experience in the house building industry. Our focus is bringing high quality small developments to the area and Greensfield Farm is very well located in a picturesque setting. The land was previously a caravan park that we are regenerating to meet the local demand for quality new homes in this desirable market town. We’ve been very happy with the support from FW Capital whose backing is helping us to complete our first development as Redfoot Developments.”

Accountancy company RMT is growing its presence in the rural and agricultural sector after snapping up a longstanding North East specialist.

Gosforth-based RMT Accountants & Business Advisors has acquired McCowie & Co for an undisclosed sum in its first acquisition since becoming part of Sumer, the UK’s fastest-growing accountancy group, earlier this year. Founded in 1970 by George McCowie, who still acts as a consultant to the firm today, McCowie & Co has offices in Hexham and Newcastle, and acts for a range of agricultural, farming and contracting businesses across the North East, Scotland and North Yorkshire.

It has an eight-strong team and is also very active within the creative sector, with film, television and media clients based in the North East, North West and London. McCowie & Co will operate as a subsidiary of RMT, with the same team continuing to service its existing clients, but with the benefit of access to additional resources and expertise from its new owners. RMT’s management team also has several further regional acquisition opportunities under consideration.

Peter McCowie, partner at McCowie & Co, said: “We’ve been operating successfully for more than 50 years and have built a very strong reputation for the firm in specific markets. We looked at a number of options for the future of the firm and felt that becoming part of RMT made a great deal of sense for everyone involved.

“It gives our respective clients access to significant new resources and expertise, and we’re excited to now be part of a North East business that’s got big plans for the future.”

Tyneside fintech firm Noggin HQ secured £710,000 in seed funding to launch a new price comparison platform aimed at those who are “credit invisible”.

The Newcastle-based business was launched by childhood friends Evangeline Atkinson and Laura Mills to help the millions of people who are prevented from borrowing money when they need it because of their credit score, or the fact they don’t have one. The pair, who received FCA authorisation last December, want to improve access for the excluded group, which is disproportionately made up of young people, recent immigrants and renters, because credit checks rely heavily on credit history data which doesn’t exist for people who have never borrowed money before.

Noggin HQ has raised the six-figure sum from investors including Oxford Capital, Bethnal Green Ventures and SyndicateRoom, to accelerate the launch of the first product, a price comparison platform where people can purchase products with fair and transparent credit terms. After originally founding the company in London, Ms Atkinson and Ms Mills quickly moved Noggin back to their home city, set on creating jobs in the region.

Evangeline Atkinson, CEO, said: “When I was rejected for a mobile phone contract, what stuck with me was the extreme lack of transparency and control. With one in three UK adults now estimated to have difficulty accessing products from mainstream lenders, a solution is much needed.”

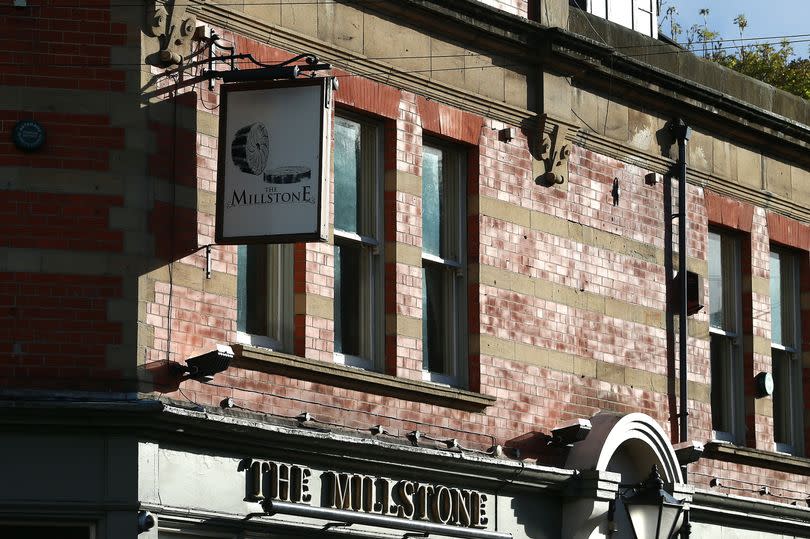

The former Wear Inns portfolio of 24 pubs across the North East and Yorkshire was snapped up from administrators in a multimillion-pound rescue deal. Administrators at Interpath Advisory were last November called into Milton Portfolio Property 3 Ltd – the owner of the Millstone Hotel in Gosforth, The Black Bull in Morpeth, The Cross Keys in Washington and 22 other pubs – as the business hit financial difficulties.

All 264 staff were kept on as the portfolio continued to trade, while agents Avison Young and Watling Real Estate were appointed to market the pubs, officially launching a sales process in February. Punch Pubs & Co, based in Burton-on-Trent in the West Midlands, has acquired 24 of the 25-strong portfolio in a deal reported to be worth around £15m. The list of pubs include The Dirty Habit in Whitley Bay and The New Inn in Wetherby.

Administrators at Interpath Advisory were last November called into Milton Portfolio Property 3 Ltd – the owner of the Millstone Hotel in Gosforth, The Black Bull in Morpeth, The Cross Keys in Washington and 22 other pubs – as the business hit financial difficulties. All 264 staff were kept on as the portfolio continued to trade, while agents Avison Young and Watling Real Estate were appointed to market the pubs, officially launching a sales process in February.

Now Punch Pubs & Co, based in Burton-on-Trent in the West Midlands, has acquired 24 of the 25-strong portfolio in a deal reported to be worth around £15m. The list of pubs include The Dirty Habit in Whitley Bay and The New Inn in Wetherby.

Clive Chesser, CEO, said: “We are delighted to have acquired these excellent pubs, and we are excited about the future as we welcome them into the Punch family. I would especially like to thank Kamran Aziz and the Queensway Advisory team, who continue to provide their management services as the pubs and their teams transfer into the Punch business.

Yahoo News

Yahoo News