By one measure, this is the cheapest investment trust in the UK

Shares in Finsbury Growth & Income, a £1.6bn former top-performer managed by Nick Train, have fallen 7pc below the value of its blue-chip consumer stocks, making it by one measure the cheapest investment trust in the UK.

Although a 7pc share price discount is not big when investment companies trail at an average 16pc below net asset value (NAV), it is larger than the 4pc average discount of rivals in its UK Equity Income sector.

Moreover, it is also wider than Finsbury’s own average one-year discount of 4.7pc.

Analysts use “Z-scores” to put investment trust discounts into historical context. A trust scoring -2 or below is considered to trade significantly below its normal range, presenting a potential buying opportunity.

Currently, Finsbury scores -2.4, the lowest and arguably cheapest rating of any London-listed fund.

But is Finsbury, which Questor last tipped as a defensive “buy” at 799p in October 2022, still a good prospect at 826p today?

Analysts and investors believe so, saying the de-rating of a trust that previously stood at a small premium above NAV affords a good chance to access the manager’s “quality growth” style ahead of a recovery.

If four years of volatile stock markets have taught investors anything, it is the importance of not being too exposed to one investment style.

In the 2020 pandemic, growth funds, such as Scottish Mortgage Trust, soared in the internet stock boom, only to crash as economies reopened and inflation and interest rates soared.

Meanwhile, value funds, such as Merchants Trust which Questor tipped in March, that seek to buy shares when they are cheap and out of favour, emerged from a long period in the doldrums.

The rollout of Covid-19 vaccines saw them rally as economically sensitive sectors, such as banks, roared back to life.

Amid the upheaval, Train’s approach of buying and holding high-quality companies with valuable brands and franchises, such as Dutch brewer Heineken, the London Stock Exchange or fund manager Schroders, was left out in the cold.

After a rebound from the Covid crash in March 2020, Train struggled to maintain the performance of the trust he has run since 2000.

The lack of energy companies held back the concentrated, 23-stock portfolio as oil and gas prices jumped following Russia’s invasion of Ukraine last year.

More recent obstacles have been a profits warning from Diageo, the Guinness to Johnnie Walker whisky group that makes up nearly 11pc of the trust. This follows concerns over prospects for some of its other key stocks, including credit rater Experian, consumer goods giant Unilever and snack maker Mondelez.

These setbacks have reduced the 2.3pc dividend yielder’s total returns to just 1.2pc and 17pc over three and five years. That puts Finsbury well behind peers returning an average 28pc and 68pc over the same periods. Even the UK’s unloved stock market has gained 23pc and 27pc.

However, the situation reverses over 10 years, with Finsbury the second-best performer in its sector after Law Debenture with a 105pc total shareholder return that beats the 68.5pc from the FTSE All-Share index.

A sign of a bottoming out in Finsbury’s fortunes came this year when 1607 Capital Partners, a US value investor that buys stakes in undervalued trusts, opened a position of over 3pc.

With the trust’s board regularly buying back shares to reduce the discount to under 5pc, Train has ploughed over £4m in the past 12 months to lift his personal stake to 2.6pc, worth £43.4m.

He thinks fears over the likes of Diageo, which has fallen 25pc this year, are “excessive”. The 64-year-old, who this year committed to another seven years as fund manager, has topped up his stake, pointing out the profits alert related to the group’s business in Latin America while the remaining 89pc continues to grow.

Train says he is avoiding the error of buying high and selling low, describing the outlook for the trust’s stocks as “excellent” and saying its combination of predictability and steady growth is good value priced at around 20 times forecast earnings.

Nick Wood, head of investment fund research at Quilter Cheviot, a wealth manager that owns 2pc of Finsbury, is also a buyer. While disappointed with this year’s performance, he says Finsbury’s long-term record merits a place along growth and value funds in investors’ portfolios.

“We’ve not had one constant trend and if interest rates peak and fall, we might see a shift in the market’s leadership,” said Wood.

Alan Brierley, an Investec analyst with a “buy” rating on Finsbury, agrees.

“We continue to believe that the manager and his distinct philosophy has a natural role in a diversified portfolio,” he says.

Questor says: buy

Ticker: FGT

Share price at close: 833p

Gavin Lumsden is editor of Citywire’s Investment Trust Insider

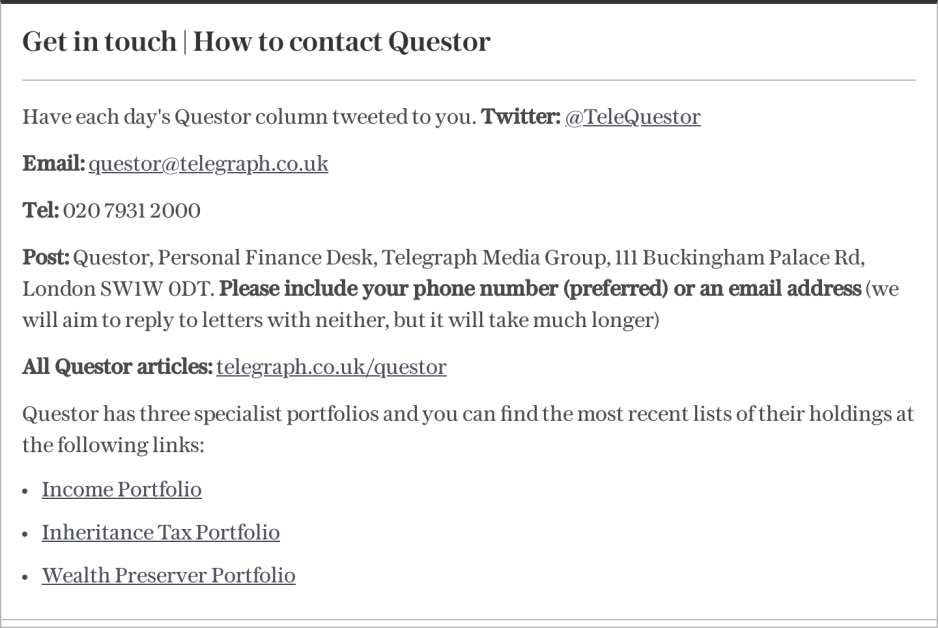

Read the latest Questor column on telegraph.co.uk every Monday, Tuesday, Wednesday, Thursday and Friday from 6am

Read Questor’s rules of investment before you follow our tips

Yahoo News

Yahoo News