Options Market Signals Volatility on French Vote Likely to Last

(Bloomberg) -- A surprise election in France, a UK vote and a contentious US presidential debate have brought politics to the attention of traders just as summer vacations are getting started.

Most Read from Bloomberg

BuzzFeed Struggles to Sell Owner of Hit YouTube Show ‘Hot Ones’

Jain Global Raises $5.3 Billion, Secures Cash From Abu Dhabi

Nvidia’s 13% Stock Rout Has Traders Scouring Charts for Support

How Long Can High Rates Last? Bond Markets Say Maybe Forever

Tech Hits Stocks as Nvidia Extends Selloff to 13%: Markets Wrap

French voters are going to the polls starting June 30, with UK elections July 4. Before that, US candidates Joe Biden and Donald Trump square off late Thursday ahead of their rematch in November.

The uncertainty around what the French election result will mean for economic policy has traders betting on more volatility and a weaker euro. Meanwhile, the US candidates’ answers on tariffs, globalization, the Federal Reserve or the dollar could shift expectations about the greenback’s trajectory.

The picture in European stock markets is split — local French volatility readings are stuck at elevated levels, while the wider region has already entered a path to normalization.

Implied volatility on the France’s CAC 40 Index rose to the highest since last year even as the gauge gained 1.7% last week. It created the highest volatility spread to Germany’s DAX Index in recent history. The CAC 40 was up 0.6% on Monday, but still down 4% since French President Emmanuel Macron shocked markets on June 9 by calling for the snap parliamentary election.

While the wobbles in France have pushed up the VStoxx Index, the European gauge of equity swings has been capped at about 20 points, a resistance level in the past that was breached during the brief banking crisis in March 2023. That means volatility may get compressed again unless the political landscape morphs into a much bigger mess.

Skews still suggest some premium of puts versus calls as hedging demand has replaced investors’ upside chasing. Yet positioning hasn’t changed drastically: Trading of bearish contracts is back near its average after briefly spiking to the highest in more than a year.

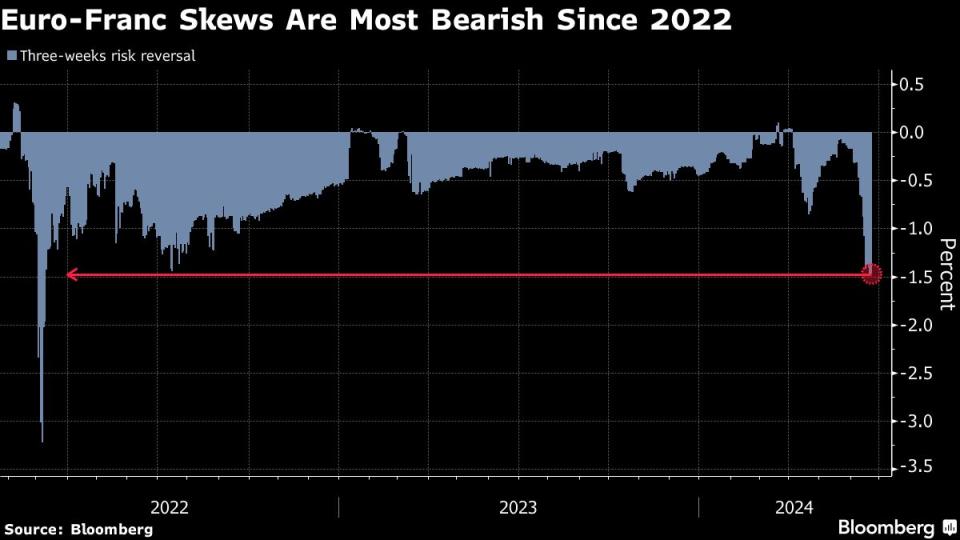

The additional premium for euro-dollar put options expiring after the July 7 French election results is at the highest level in 20 months. The cost for owning three-week, euro-Swiss franc options — the best vehicle to assess the political risk premium — is at its highest level since 2018 against their one-week counterparts, with skews on the tenor the most bearish for the euro since 2022.

European bond market volatility jumped across tenors right after Macron’s announcement, but has eased back. However, the French yield premium to the German bund ended the week at a 12-year high, which if sustained could bring another jump in overall European volatility.

Overall, nervousness in Europe far surpasses that in the US, outside of a premium for October VIX futures that’s been mostly stable for the past few months. While a similar “kink” has appeared ahead of past White House contests, this one showed up months earlier than it has in the past three election cycles.

That early pricing in of risk could be a function of early assumptions about candidates. In 2024, voters realized earlier than in typical election years that they could likely expect a rematch between Biden and Trump.

Traders are paying “a modest premium” for contracts expiring on Friday, according to Citigroup Inc.’s Stuart Kaiser. He added that since the event aligns with the end of the quarter, it’s challenging to parse exactly what risks options are eyeing. All told, the debate-related premium is “likely slight,” Kaiser said.

However, yuan options are already reflecting a level of angst about the prospect of US leaders calling for more protectionism. One-week risk reversals have turned bearish on the Chinese currency for the first time since early May even after the People’s Bank of China set its fix stronger to limit currency losses.

The concentration of political events in coming weeks is occurring during a normally quiet time of the trading year and after a number of spot-constraining options positions roll off. If markets become unsettled, traders will need to navigate limited liquidity and abnormally extreme positions in some currencies, potentially causing market dislocations.

--With assistance from Vassilis Karamanis and James Hirai.

(Updates with CAC 40 gains on Monday in fifth paragraph.)

Most Read from Bloomberg Businessweek

How Jeff Yass Became One of the Most Influential Billionaires in the 2024 Election

Why BYD’s Wang Chuanfu Could Be China’s Version of Henry Ford

©2024 Bloomberg L.P.

Yahoo News

Yahoo News