Poland to Consider Gradual Easing Only in 2025, Policymaker Says

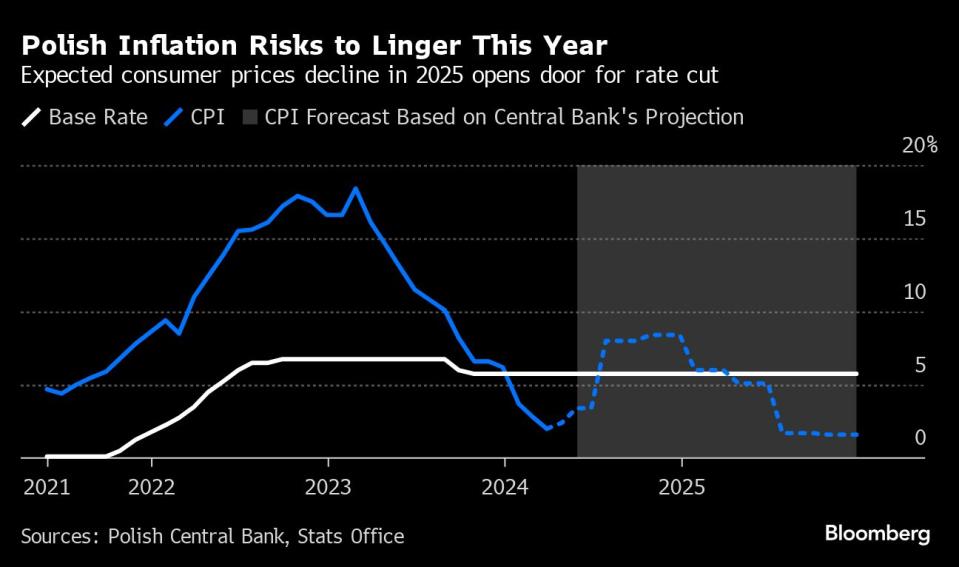

(Bloomberg) -- Poland’s central bank will maintain its benchmark rate this year as inflation risks linger and only consider gradual easing in 2025, according to a member of the nation’s rate-setting panel.

Most Read from Bloomberg

Nvidia Delivers on AI Hopes, Igniting $140 Billion Stock Rally

Citi Trader Got 711 Warning Messages Before Sparking Flash Crash

Harvard Defies Faculty Vote to Block 13 Students From Graduating

US Justice Department to Seek Breakup of Live Nation-Ticketmaster

Iwona Duda, who sits on the central bank’s Monetary Policy Council, said policymakers will only begin discussing rate cuts at the end of the year. The central bank’s 5.75% rate is “adequate” for now — and any hasty move away from restrictive policy would pose risks, she said.

“If we start considering rate cuts, this will be very gradually, while analyzing all the conditions,” Duda told Bloomberg News in an interview in Warsaw, adding that its too early to discuss the scope of cuts in 2025.

The National Bank of Poland hasn’t budged from its main rate since last fall, when Governor Adam Glapinski threw off market expectations with a 75 basis-point cut in September — followed by a quarter-point reduction the following month ahead of the nation’s Oct. 15 election.

The unexpected move triggered a selloff in the zloty — and a wave of criticism in Warsaw that Glapinski was using his perch to help his nationalist allies in the Law & Justice party in the election. Prime Minister Donald Tusk, who secured a majority to oust the nationalists from power, has made Glapinski one of his top political targets.

Glapinski has rejected any wrongdoing as the ruling coalition seeks to set up a special tribunal to try the central bank chief. He’s since shifted course on monetary policy, insisting that rate cuts will hold steady through the end of the year despite ebbing inflation.

Duda said the rate-setting panel views wage growth — as well as uncertainty over food and energy prices — as the primary risks to price increases this year. Still, she sees no grounds to raise rates.

Inflation, which slowed to 2% in February, may climb to about 5.5% at the end of the year as the effects of restoring a tax on food last month and a partial unwinding of energy caps from July are felt on consumer prices, she said.

Even as industrial output rebounds — helping economic output to potentially exceed 3% in 2024 — core inflation is likely to stay put at just above 4% by the end of 2024, the policymaker said. Slower inflation, rising wages and low unemployment will stimulate domestic demand, with Poland’s economic prospects looking “quite good,” Duda said.

--With assistance from Maciej Martewicz.

Most Read from Bloomberg Businessweek

A Hidden Variable in the Presidential Race: Fears of ‘Trump Forever’

The Dodgers Mogul and the Indian Infrastructure Giant That Wasn’t

©2024 Bloomberg L.P.

Yahoo News

Yahoo News