A quarter of Amazon sellers’ revenue came from cross-border sales in 2017 (AMZN)

BI Intelligence

This story was delivered to BI Intelligence "E-Commerce Briefing" subscribers hours before appearing on Business Insider. To be the first to know, please click here.

Over a quarter of the global revenue generated by sellers on Amazon in 2017 came from cross-border sales, Eric Broussard, Amazon’s VP of International Marketplaces and Retail, told Reuters.

Though Amazon doesn't disclose total gross merchandise sales, analysts estimated cross-border sales to be between $50 billion and $75 billion.

Amazon sellers’ cross-border sales grew over 50% year-over-year (YoY) in 2017, faster than Amazon’s net sales growth, and, with cross-border e-commerce on the rise, this could be a boon to Amazon. Global cross-border e-commerce is projected to jump from $330 billion in 2016 to $1.18 trillion in 2021, so Amazon stands to benefit a great deal from its vendors’ cross-border success.

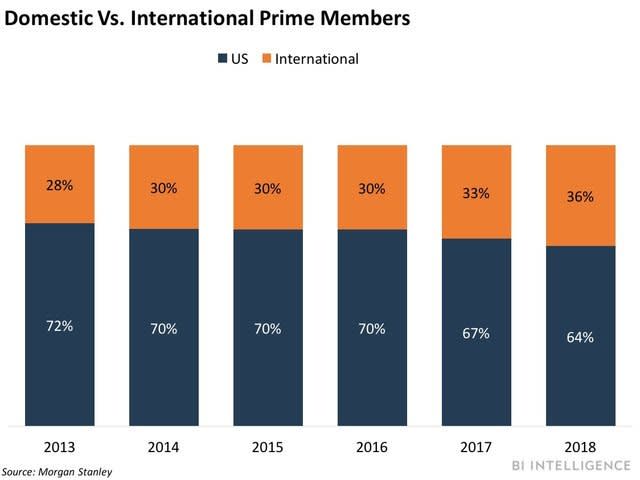

Pushing cross-border sales overseas could bolster Amazon’s international performance as it looks to diversify its business. A huge portion of Amazon’s sales come from the US, where it's based and most established, but as the US market for Prime members becomes saturated and other markets grow in value, the company has looked to foreign markets for growth, and cross-border sales can help in that process.

Emphasizing cross-border sales through its marketplace can give Amazon unique value in international markets. If Amazon can establish itself as a leading provider of international goods in a market, or even as an exporter for local merchants, it will immediately have value in the market. Given Amazon’s size and logistics capabilities, it may be positioned to facilitate cross-border transactions better than competitors.

This could prove particularly valuable in countries where Amazon has struggled to establish itself, like China. Amazon has carved out a tiny piece of e-commerce market share in China, as local companies are drawing more sales from consumers. If Amazon focuses on providing international goods to China and similar markets, it may be able to offer something its competitors can’t, boosting its performance and value to consumers in otherwise difficult markets.

Amazon has been seeking more control of its sellers’ inventory through Fulfillment by Amazon (FBA), which could bolster its cross-border capabilities. Additional control of its third-party vendors’ inventories should make it easier for Amazon to ship orders overseas and offer more cross-border goods to consumers, pushing its growth further. Through FBA, Amazon has previously offered to purchase merchants' inventories at full price so it can sell them overseas more easily. And given cross-border’s value to Amazon, it may continue to find ways to take control of more inventory to improve its cross-border logistics.

See Also:

Yahoo News

Yahoo News