Rebel Tories will vote against Budget if tax rises go ahead, Sunak is warned

Conservative backbench MPs are plotting to vote against parts of this autumn's Budget if Rishi Sunak goes ahead with threatened tax rises, it has emerged.

The news came as senior Tories Sir Graham Brady, Sir John Redwood and Ian Liddell-Grainger warned the Chancellor that increasing taxes will threaten the recovery after the coronavirus pandemic has passed.

Mr Sunak and Boris Johnson, the Prime Minister, met with new Tory MPs who were elected at last December's general election for the first time this week to soothe nerves about the prospect of tax rises in the Budget, expected in November.

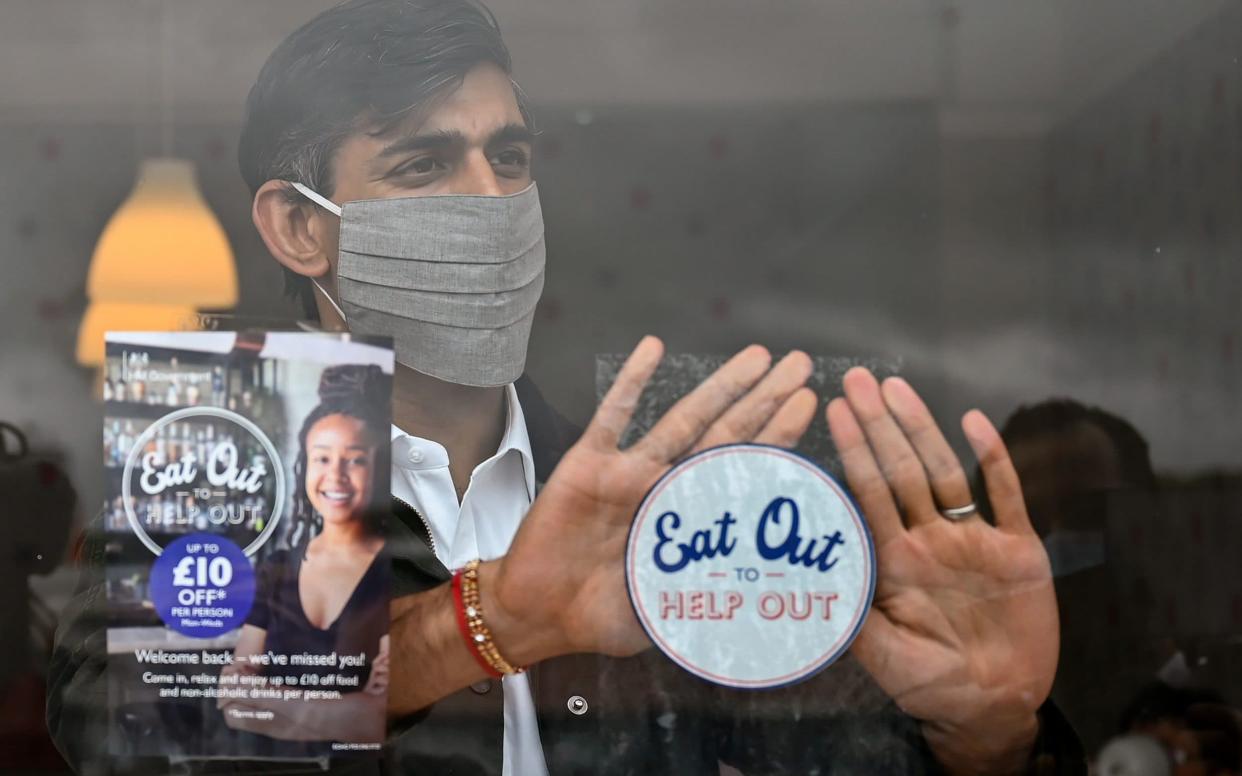

The Chancellor, who has won praise for supporting pubs and restaurants through the Eat Out to Help Out scheme and a time limited cut in stamp duty, warned the MPs to expect tax rises as he said it was time to be “honest” with the public about how the cost of the coronavirus response will be met.

The speculation about increased taxes has privately infuriated Tory MPs with one threatening to table amendments to the Budget or vote against parts of it in protest in a highly unusual move.

A former Tory minister said: "I won't be voting for the Budget ... I am not voting to put taxes up on entrepreneurs so people can eat half price f------ burgers. Tory MPs are going absolutely insane in the backbench WhatsApp group."

One Tory said they were considering putting down an amendment to the Finance Bill, to tax grace and favour houses like Chequers, Chievening and Dorneywood as a benefit in kind to embarrass Number 10.

Another experienced Conservative MP confirmed they had also heard of threats from Tories to protest at the Budget, but hoped that it would not be necessary if Mr Sunak listened to their concerns.

Newly elected 'red wall' Tory MPs said they suspected that it was MPs from the Home Counties, with constituents who will be hit harder by tax rises, who will be leading the protests.

Separately Sir Graham Brady, the chairman of the Conservative party's backbench 1922 committee, told The Telegraph: "An increase in the wrong taxes - capital taxes - can stifle economic recovery rather than support it."

Earlier he told the BBC: “The necessity is to make sure we don’t make this crisis any worse than it has to be.

“We have to be aware that raising taxes, and raising the wrong types of taxes especially, can be a way in which you stifle economic growth and prospects rather than guaranteeing them. I think we should be very, very cautious in exploring tax increases.”

Writing for the Telegraph, Sir John Redwood, the chairman of the 1922 committee's Treasury group, said that "tax cuts, not increases" were the answer.

Sir John pointed to the example of the temporary cut to stamp duty which has meant that the housing market has surged after the lockdown.

He said: "The Government has just shown how a tax cut can provide a good boost to activity, jobs and incomes... as a result housing transactions have just exceeded the pre pandemic levels.

"When people move it creates work for the estate agents, conveyancers, mortgage businesses, removal firms, painters and decorators, builders doing small works and many others.

"The Inland Revenue will probably be a winner too from taxing all that extra activity as well as getting a Stamp duty boost from more transactions as an offset to the lower rates."

He continued: "Government works best for people when it respects their wishes, helps them achieve their ambitions and extends their effective choices. We need a series of policies that do just that."

On Thursday night Sir John added that the "only way" Mr Sunak can pay down the borrowing caused by the coronavirus was through "tax reductions and assistance".

Ian Lidell-Grainger, the Tory chairman of the All Party group on taxation, also urged the Government to consider cutting VAT rates to 10pc to encourage more spending.

He told The Telegraph: "When you put up taxes people are less inclined to spend for obvious reasons - if you keep tax at a sensible level people spend.

"Reducing VAT is an easy way of boosting the economy and really charging it forward... Reducing VAT to 10pc or 15pc. Once we are out of Europe it is moot whether we keep it."

He accepted there could be increases in Corporation Tax or Capital Gains Tax as they are "very specific taxes to a specific time. If you are doing income, it hits directly".

He said: "You just have to look at the success of the £10 eat out - you give them a break and they will use it."

Yahoo News

Yahoo News