Reflecting on Oportun Financial's (NASDAQ:OPRT) Share Price Returns Over The Last Year

This week we saw the Oportun Financial Corporation (NASDAQ:OPRT) share price climb by 10%. But in truth the last year hasn't been good for the share price. The cold reality is that the stock has dropped 19% in one year, under-performing the market.

See our latest analysis for Oportun Financial

Oportun Financial wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally expect to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

In the last year Oportun Financial saw its revenue grow by 8.9%. While that may seem decent it isn't great considering the company is still making a loss. Given this lacklustre revenue growth, the share price drop of 19% seems pretty appropriate. It's important not to lose sight of the fact that profitless companies must grow. But if you buy a loss making company then you could become a loss making investor.

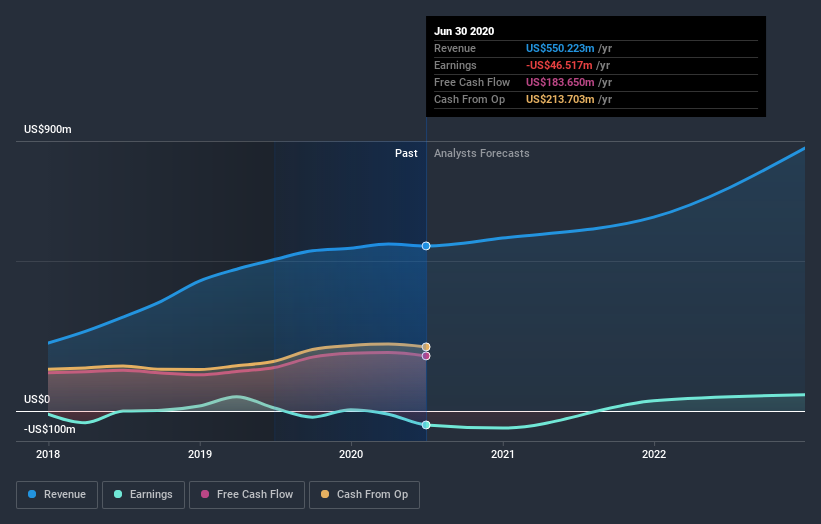

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We consider it positive that insiders have made significant purchases in the last year. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. So we recommend checking out this free report showing consensus forecasts

A Different Perspective

While Oportun Financial shareholders are down 19% for the year, the market itself is up 20%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. It's great to see a nice little 3.1% rebound in the last three months. Let's just hope this isn't the widely-feared 'dead cat bounce' (which would indicate further declines to come). It's always interesting to track share price performance over the longer term. But to understand Oportun Financial better, we need to consider many other factors. Even so, be aware that Oportun Financial is showing 1 warning sign in our investment analysis , you should know about...

Oportun Financial is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

Yahoo News

Yahoo News