Russia’s Oil Exports Drop the Most in Three Months

(Bloomberg) -- Russia’s weekly crude exports fell by the most in more than three months in the seven days to June 23, with maintenance at key ports also trimming the less volatile four-week average.

Most Read from Bloomberg

Bolivia’s President Arce Swears in New Army Chief After Coup Bid

SpaceX Tender Offer Said to Value Company at Record $210 Billion

China’s Finance Elite Face $400,000 Pay Cap, Bonus Clawbacks

YouTuber Dr Disrespect Was Allegedly Kicked Off Twitch for Messaging Minor

Work at Primorsk on the Baltic Sea and Kozmino on the Pacific coast cut shipments through Russia’s two busiest oil terminals, with no departures from either for four days during the week. But flows should recover in the week to June 30, with loadings already restarted at both affected ports.

Separately, the vessels that Moscow relies on to transport its oil are increasingly being targeted by Western authorities seeking to deplete the Kremlin’s war chest. The European Union is the latest to slap sanctions on specific ships, identifying 17 crude oil and refined products carriers in its latest round of sanctions, as well as designating state-controlled shipping company Sovcomflot PJSC.

Three crude tankers recently sanctioned by the UK gathered in the Baltic Sea, where two of them feature in loading programs for the ports of Primorsk and Ust-Luga. It is unclear whether they will actually take on cargoes, though, with one seeming to have been replaced in the line-up already.

The slump in weekly export volumes was partly offset by a week-on-week increase in oil prices, which was particularly strong for shipments from western ports. As a result, the gross value of Russia’s crude shipments fell by 14% in the seven days to June 23, compared with an 18% drop in shipments.

The moves come as Moscow continues to test the effectiveness of sanctions imposed in response to its invasion of Ukraine in February 2022. Three of 21 tankers owned by state-controlled Sovcomflot PJSC have now loaded cargoes of crude after lying idle for several months.

The first, the SCF Primorye, switched its cargo to the Ocean Hermana while anchored in the Riau archipelago east of Singapore. The cargo has subsequently been moved to a third ship, identified as the VLCC Stellar Oracle by TankerTrackers.com, which specializes in interpreting satellite imagery to spot sanctions-busting tankers. The Stellar Oracle is identified by the US Treasury as also operating under the name Saint Light.

The second, the Bratsk, disappeared from automated tracking systems west of Sumatra on June 13 and seemed at the time to be heading for the Sunda Strait between the island and Java, perhaps to reach the Riau archipelago without passing through the Strait of Malacca, where it is required to activate its automatic tracking system. The Belgorod, the third sanctioned tanker to load a cargo, was last seen near the southern tip of India on Monday.

Crude Shipments

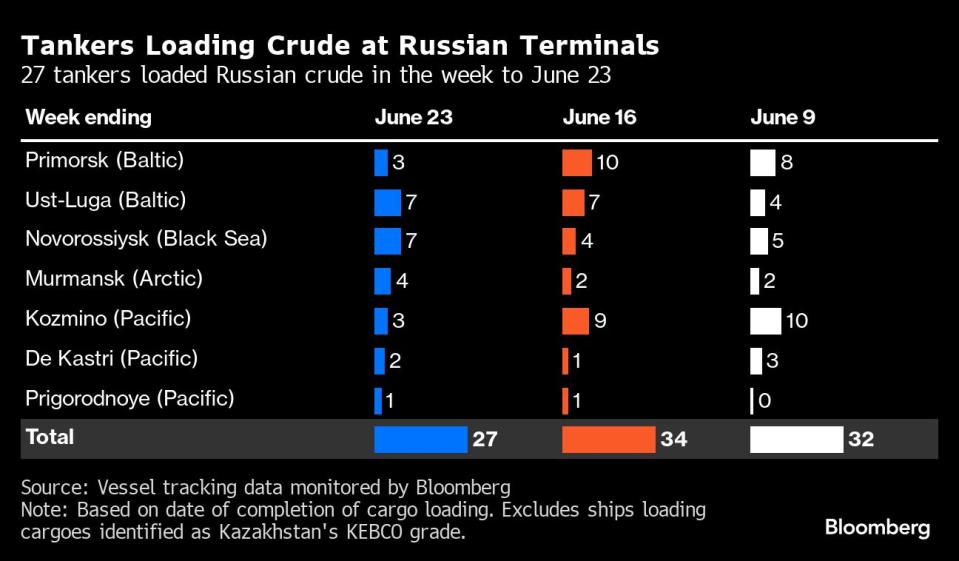

A total of 27 tankers loaded 21.29 million barrels of Russian crude in the week to June 23, vessel-tracking data and port agent reports show. That was down sharply from 25.91 million barrels the previous week.

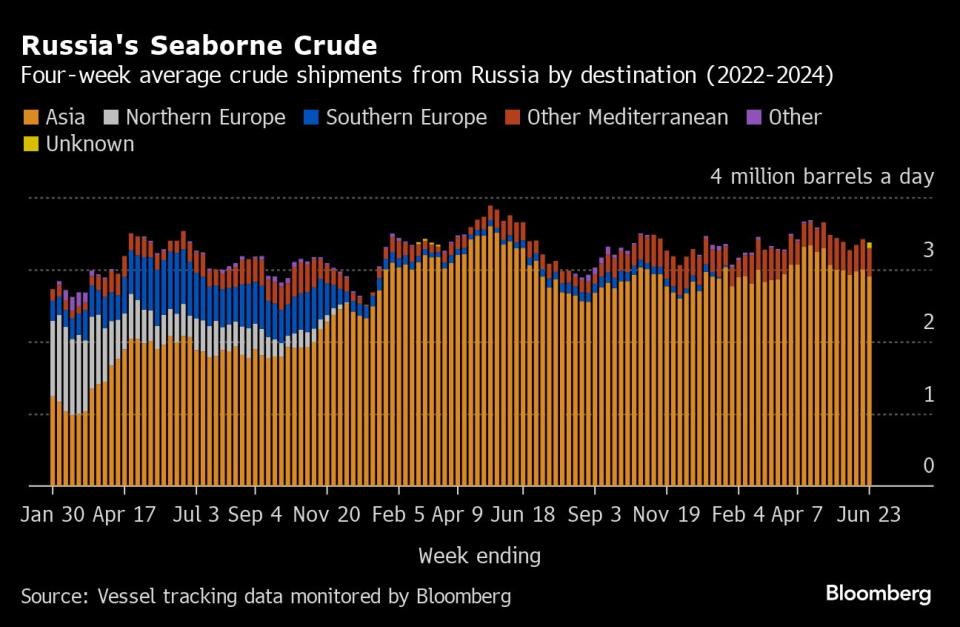

Russia’s seaborne crude flows in the week to June 23 dropped by 660,000 barrels a day to 3.04 million, the lowest in more than three months. The less volatile four-week average was also down, falling by about 45,000 barrels a day to 3.37 million.

A week-on-week slump in shipments from Russia’s two most important crude export ports — Primorsk on the Baltic Sea and Kozmino on the Pacific coast — was partly offset by more ships leaving Novorossiysk and the Arctic terminals at Murmansk.

The gap in the Primorsk loading program, with no loadings scheduled to commence between June 18 and June 22, suggests a period of maintenance work was the reason for the halt in flows from the port for most of the week. It’s likely that work was also behind the lower shipments from Kozmino, with no vessel activity at the port for several days. Flows from both ports are expected to rebound in the coming week.

After almost two months out of service, the Zaliv Vostok shuttle tanker arrived back at Sakhalin Island from a shipyard in China toward the end of the week, loading a cargo on Sunday.

After last week’s slump, crude shipments so far this year are running about 10,000 barrels a day above the average for 2023.

Russia terminated its export targets at the end of May, opting instead to restrict production, in line with its partners in the OPEC+ oil producers’ group. The country’s output target is set at 8.978 million barrels a day until the end of September, after which it is scheduled to rise at a rate of 39,000 barrels a day each month until September 2025, as long as market conditions allow.

No cargoes of Kazakhstan’s KEBCO were loaded during the week.

Flows by Destination

Asia

Most Read from Bloomberg

Observed shipments to Russia’s Asian customers, including those showing no final destination, slipped back below 3 million barrels a day in the four weeks to June 23. Shipments averaged 2.96 million barrels a day in the period to June 23, from just over 3 million in the period to June 16.

About 1.03 million barrels a day of crude was loaded onto tankers heading to China. The Asian nation’s seaborne imports are boosted by about 800,000 barrels a day of crude delivered from Russia by pipeline, either directly, or via Kazakhstan.

Flows on ships signaling destinations in India averaged about 1.66 million barrels a day, unchanged from the revised figure for the period to June 16.

Both the Chinese and Indian figures are likely to rise as the discharge ports become clear for vessels that are not currently showing final destinations.

The equivalent of about 250,000 barrels a day was on vessels signaling Port Said or Suez in Egypt. Those voyages typically end at ports in India or China and show up as “Unknown Asia” until a final destination becomes apparent.

The “Other Unknown” volumes, running at about 30,000 barrels a day in the four weeks to June 23, are those on tankers showing no clear destination. Most originate from Russia’s western ports and go on to transit the Suez Canal, but some could end up in Turkey. Others may be moved from one vessel to another, with the majority of such transfers now taking place in the Mediterranean, most recently off Morocco, or near Sohar in Oman.

Russia’s oil flows continue to be complicated by the Greek navy carrying out exercises in an area that’s become synonymous with the transfer of the nation’s crude. These activities have now been extended to July 15.

Europe and Turkey

Most Read from Bloomberg

Russia’s seaborne crude exports to European countries have ceased, with flows to Bulgaria halted at the end of last year. Moscow also lost about 500,000 barrels a day of pipeline exports to Poland and Germany at the start of 2023, when those countries stopped purchases.

Turkey is now the only short-haul market for shipments from Russia’s western ports, with flows in the 28 days to June 23 stable at about 420,000 barrels a day.

Export Value

The gross value of Russia’s crude exports fell to $1.52 billion in the seven days to June 23 from about $1.79 billion in the period to June 16. The slump in flows was partly offset by the biggest week-on-week jump in prices for Baltic-loading crude since September.

Export values at Baltic and Black Sea ports were up week-on-week by almost $5 a barrel, while key Pacific grade ESPO rose by about $1.80 a barrel. Delivered prices in India also rose, up by about $4.70 a barrel, all according to numbers from Argus Media.

Four-week average income edged lower, slipping by about $6 million to $1.63 billion a week. The four-week average peak of $2.17 billion a week was reached in the period to June 19, 2022.

During the first four weeks after the Group of Seven nations’ price cap on Russian crude exports came into effect in early December 2022, the value of seaborne flows fell to a low of $930 million a week, but soon recovered.

NOTES

This story forms part of a weekly series tracking shipments of crude from Russian export terminals and the gross value of those flows. The next update will be on Tuesday, July 2.

All figures exclude cargoes identified as Kazakhstan’s KEBCO grade. Those are shipments made by KazTransoil JSC that transit Russia for export through Novorossiysk and Ust-Luga and are not subject to European Union sanctions or a price cap. The Kazakh barrels are blended with crude of Russian origin to create a uniform export stream. Since Russia’s invasion of Ukraine, Kazakhstan has rebranded its cargoes to distinguish them from those shipped by Russian companies.

Vessel-tracking data are cross-checked against port agent reports as well as flows and ship movements reported by other information providers including Kpler and Vortexa Ltd.

If you are reading this story on the Bloomberg terminal, click for a link to a PDF file of four-week average flows from Russia to key destinations.

(Corrects reference to the likely course of the tanker Bratsk in the 8th paragraph.)

Most Read from Bloomberg Businessweek

The FBI’s Star Cooperator May Have Been Running New Scams All Along

How Glossier Turned a Viral Moment for ‘You’ Perfume Into a Lasting Business

How Jeff Yass Became One of the Most Influential Billionaires in the 2024 Election

©2024 Bloomberg L.P.

Yahoo News

Yahoo News