Siebert Financial Corp. (NASDAQ:SIEB) Not Flying Under The Radar

Want to participate in a short research study? Help shape the future of investing tools and earn a $40 gift card!

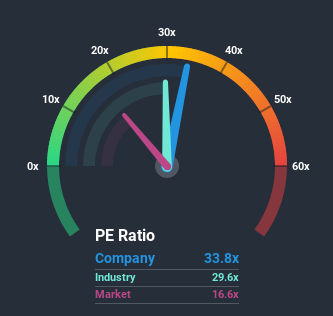

With a price-to-earnings (or "P/E") ratio of 33.8x Siebert Financial Corp. (NASDAQ:SIEB) may be sending very bearish signals at the moment, given that almost half of all companies in the United States have P/E ratios under 16x and even P/E's lower than 9x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

For example, consider that Siebert Financial's financial performance has been poor lately as it's earnings have been in decline. One possibility is that the P/E is high because investors think the company will still do enough to outperform the broader market in the near future. If not, then existing shareholders may be quite nervous about the viability of the share price.

View our latest analysis for Siebert Financial

How Does Siebert Financial's P/E Ratio Compare To Its Industry Peers?

We'd like to see if P/E's within Siebert Financial's industry might provide some colour around the company's particularly high P/E ratio. The image below shows that the Capital Markets industry as a whole also has a P/E ratio significantly higher than the market. So it appears the company's ratio could be influenced considerably by these industry numbers currently. In the context of the Capital Markets industry's current setting, most of its constituents' P/E's' P/E's would be expected to be raised up greatly. Nonetheless, the greatest force on the company's P/E will be its own earnings growth expectations.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Siebert Financial's earnings, revenue and cash flow.

What Are Growth Metrics Telling Us About The High P/E?

The only time you'd be truly comfortable seeing a P/E as steep as Siebert Financial's is when the company's growth is on track to outshine the market decidedly.

Retrospectively, the last year delivered a frustrating 70% decrease to the company's bottom line. Unfortunately, that's brought it right back to where it started three years ago with EPS growth being virtually non-existent overall during that time. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

Comparing that to the market, which is predicted to shrink 11% in the next 12 months, the company's positive momentum based on recent medium-term earnings results is a bright spot for the moment.

With this information, we can see why Siebert Financial is trading at a high P/E compared to the market. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the bourse. Nonetheless, with most other businesses facing an uphill battle, staying on its current earnings path is no certainty.

What We Can Learn From Siebert Financial's P/E?

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Siebert Financial revealed its growing earnings over the medium-term are contributing to its high P/E, given the market is set to shrink. Right now shareholders are comfortable with the P/E as they are quite confident earnings aren't under threat. We still remain cautious about the company's ability to stay its recent course and swim against the current of the broader market turmoil. Although, if the company's relative performance doesn't change it will continue to provide strong support to the share price.

You should always think about risks. Case in point, we've spotted 4 warning signs for Siebert Financial you should be aware of.

You might be able to find a better investment than Siebert Financial. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a P/E below 20x (but have proven they can grow earnings).

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

Yahoo News

Yahoo News