Sir Ralph Halpern, flamboyant chief of the Burton Group who built it into a ‘multi-niche’ retail empire – obituary

Sir Ralph Halpern, the businessman, who has died aged 83, was the colourful chief executive of the Burton Group during the 1980s who turned the ailing tailor into a “multi-niche” high-street retailing group valued at £1.6 billion; to tabloid readers, however, he was the “Bonking Burton Boss” who featured in a notorious kiss-and-tell story that painted him as a “five-times-a-night” stallion.

From making a loss of £100 million in 1977, the Burton Group, as it became, went to pre-tax profits of more than £180 million in 1987. It owned Topshop, Topman, Topgirl, Dorothy Perkins, Evans, Principles, Harvey Nichols, Debenhams, employed 35,000 staff at some 2,000 outlets and had interests in property and credit cards. At one time £1 in every £8 spent on clothes in Britain were spent at Burton Group stores.

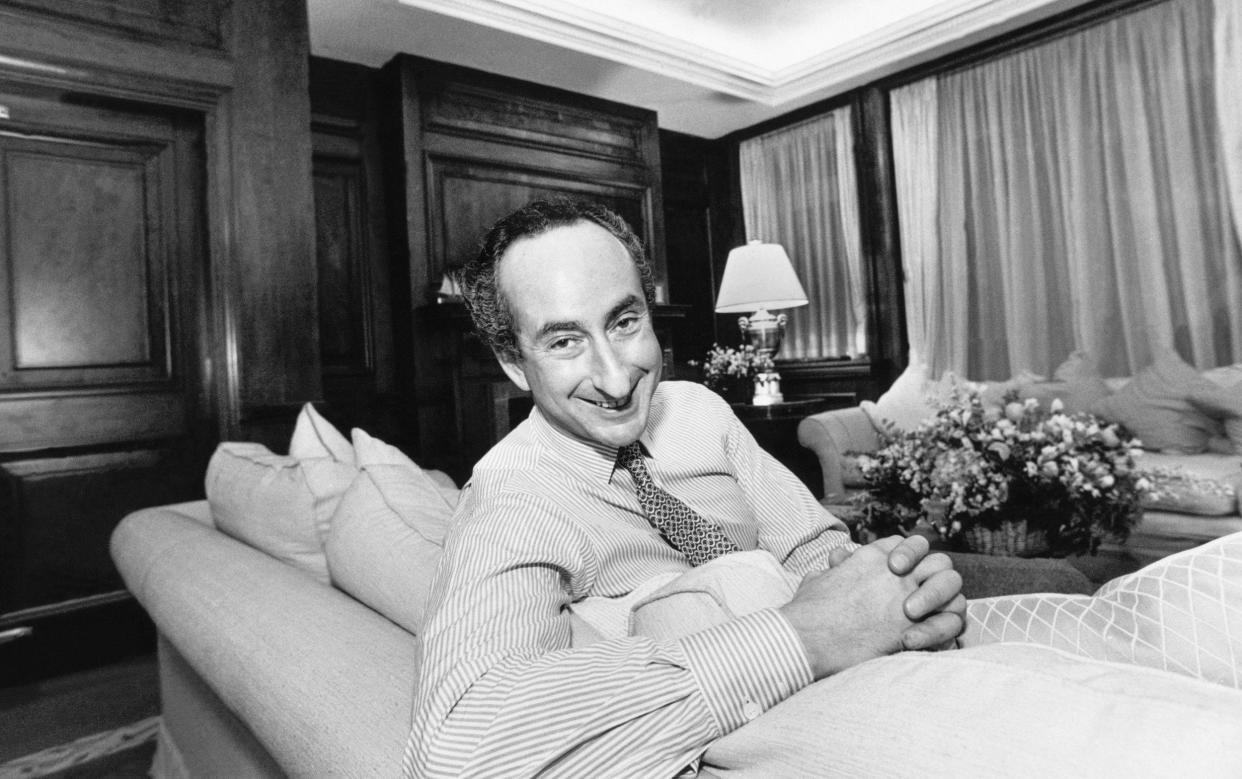

A dapper, twitchy figure in his Burton suit, 5ft 10in tall and a mere 12 stone – “10 stone without his wallet,” his minder remarked – Halpern led the company in unquestionably virile fashion, intent on creating a rival to the American Sears Corporation.

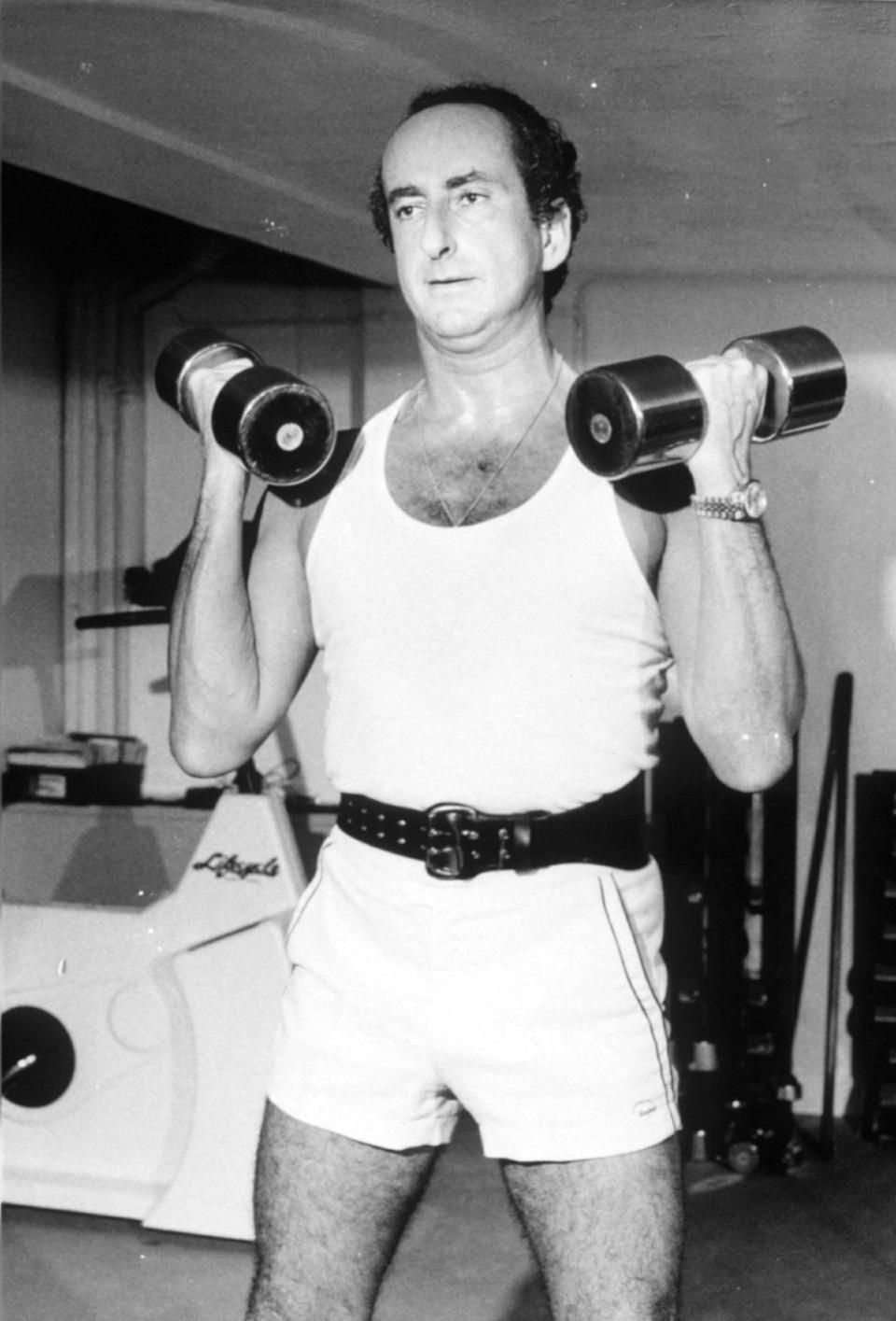

“Retailing is showbusiness,” he said. He emphasised the vigour of his enterprise by publicising his own punishing work-and-fitness regime. He rose at 6.15am for weight training and a 6,000-metre run on the treadmill, breakfasted on fruit and muesli and then did 12 hours in the office before enjoying some “light socialising” at Stringfellows or Tramp.

The rewards were considerable. Halpern was the first chief of a public company to earn more than £1 million a year. He owned a Nash house in Regents Park, an estate in Surrey and a royal flush of fast cars.

Halpern was one of a number of racy but expansive mid-1980s businessmen who found favour with Margaret Thatcher. He was knighted in 1986 for “services to the retail industry”, although the Prime Minister’s confidant Woodrow Wyatt evidently thought him a “dangerous” connection for her.

Halpern was outspoken about the need for large financial incentives. “My wealth is minute in comparison with what I have created,” he said. “In this country we have two reactions to wealth 1: envy 2: let’s confiscate it in taxes.”

Burton’s staff were on performance related salaries, but none enjoyed the deal that Halpern pushed through for himself and fellow directors at an extraordinary board meeting in January 1987. He had proposed an executive options scheme that gave him the possibility of an £8 million windfall if Burton met his five-year target for “super-growth”.

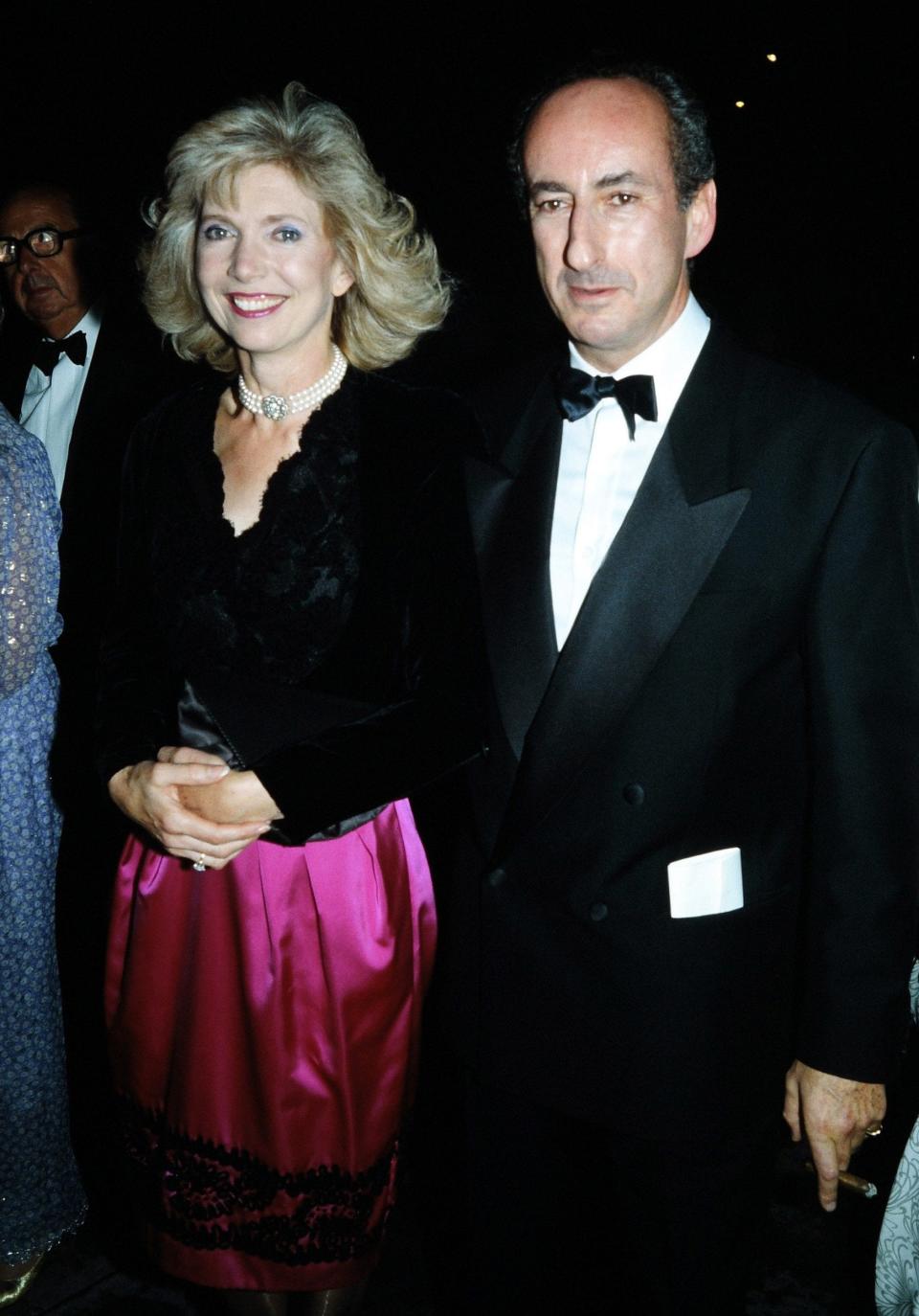

At the time this proposal was mooted, the News of the World published the revelations of a blonde 19-year-old “model”, Fiona Wright, who alleged that she and the married Halpern had had a passionate affair. Among other kiss-and-tell details, her claim that they had “done it five times a night” provided the tabloids with the perfect headline. (The story also did wonders for the sale of sunflower seeds, Halpern’s favourite energy snack.)

It was expected that Halpern would be roasted at the meeting. But, flanked by his family, he faced the music, unapologetic and unperturbed, admitting the affair but dismissing it as “an innocent little nothing”, and found that the shareholders cared not one jot about his morals, only about their dividends. The executive options scheme was passed, albeit in a reduced form that would benefit Halpern by £2.5 million.

Halpern was able to carry on jogging and making money for another three years. But in 1989 Burton shares began to tumble amid a welter of speculation about the group’s liabilities, and as the new decade was rung in Halpern was drummed out.

The son of Viennese refugees, Ralph Mark Halpern was born at Belsize Park on October 24 1938. He was secretive about his background and education, and refused to supply Who’s Who with a curriculum vitae. But he did relate that his father had been a banker and retailer before fleeing to Britain, where he had started a small garment manufacturing business; his mother designed clothes.

Young Ralph was educated at St Christopher’s School, Letchworth, and entered the clothing industry as a trainee for Selfridges in Oxford Street; he went on to join Peter Robinson, a subsidiary of Burton, as a trainee in 1961, and was then sent north to Leeds to manage a Burton outpost.

Montague Burton, Tailor of Taste, was then a fading brand, with loss-making factories producing off-the-peg suits for weddings and funerals; but it boasted 600 prime sites and Halpern saw his opportunity.

He began a relentless march up the ranks, persuading the company to go into niche marketing, targeting specific age and social groups. In 1964 he was involved in creating Topshop (which began as Top Shop), launched in Peter Robinson’s Sheffield branch, aimed at fashion-conscious teenage girls. In the late 1960s, as merchandise manager of Peter Robinson, he worked with Montague’s son Raymond Burton to expand Topshop into a chain of shops within shops which soon became stand-alone stores.

Burton closed its factories in 1977, becoming a purely retailing concern; the next year it bought Dorothy Perkins. Halpern became chief executive in 1978, managing director in 1980, and within 12 months he had ousted Cyril Spencer to become chairman and chief executive.

Spencer had made the mistake of telling Halpern that he intended to discuss a buy-out of the company with the petrol station and property tycoon Gerald Ronson. When the meeting happened, Halpern was at hand with a tape-recorder. The Burton board were unimpressed and Spencer was shown the door.

Over the next decade, Halpern divided up the Burton Group into such niche retailing outlets as Principles, Topman and Topgirl, acquired new high street sites and diversified its activities. In doing so, wrote the retail guru Sir John Timpson who did business with him, Halpern “rescued Burton from almost certain closure and created a group that looked likely to dominate the high street”.

As consumer confidence grew, a credit-fuelled retail boom helped to hike Burton’s share price from 50p in 1981 to 250p in 1985, when Halpern launched his most ambitious take-over bid – for Debenhams (which also owned the upmarket Harvey Nichols store in London’s Sloane Street). This respected but ageing chain, he said, would be transformed with the help of Terence Conran into glittering “gallerias”.

He began his assault by remarking that he thought Debenhams shares a little over-valued at 450p; the price duly dropped, and he made a £560 million shares-swap bid, backed up with an intensive advertising campaign. When the original deadline closed, Burton did not have the necessary 50 per cent acceptance; the deadline was then extended and, to general surprise, Gerald Ronson and the carpet entrepreneur Sir Philip Harris (now Lord Harris of Peckham), threw their seven percent in on Burton’s side.

It was hailed as a coup, and Burton’s shares soared to 350p; but Ronson’s intervention made Halpern enemies, and the take-over would come back to haunt him.

Never unduly modest, Halpern showed signs of hubris. He talked of raising profits to £500 million; and, forgetting that his success had been built around the simple principle of buy-cheap-sell-dear, began to add to the company’s property portfolio even as prices peaked “like a Monopoly player buying every opportunity on the board”, as one observer put it. Burton made substantial investments at Coventry, Darlington, Dartford and Scarborough that would have to be written off at a reported cost of £150 million.

Personally, Halpern became obsessed with his safety (he had a bullet-proof car and two ex-SAS minders) and his publicity. He checked the camera lens when he was photographed to make sure that his nose was not going to come out “45ft longer than it is”. There were gymnasia everywhere; at his house in Surrey, in his house in London and one – “Busy Bodies” – at the Burton headquarters off Oxford Street.

“A fit executive is an efficient executive,” he said. Colleagues were not obliged to train with him, but he was prone to tweak their waist-bands in the office.

Nemesis came in 1989. The year before, city confidence had been shaken by a DTI investigation into the Debenhams take-over. Burton was cleared, but the share price, which had been declining after Black Monday, recovered only briefly. When the property market plummeted in 1989 Burton shares fell from 259p to 55p.

It was not just the property liabilities. The credit-card arm was a disaster and profits had plummeted on the high street; interest rates had squeezed consumer spending and Halpern had become complacent.

At a board meeting in early 1990, Halpern was asked to resign and his role was divided between his deputy Laurence Cooklin and the former Thatcher adviser Sir John Hoskyns. Halpern took a fat cushion with him, a package worth at least £2.4 million. Burton shares rose 12p on the news of his departure, but soon after, the group was forced into an ignominious rescue rights issue.

Afterwards, Halpern led a more low-key life as a fashion consultant and entrepreneur. He insisted he was not bitter, and he was proud of his role in nurturing the careers of the group of businessmen who became known as the “Burton Mafia”. Almost all the men who went on to shape British high street fashion in the 1990s and early 2000s – the Marks & Spencer chief Stuart Rose (now Lord Rose of Monewden) among them – learnt their trade at the Halpern school of management. “I think my achievements have been recognised,” Halpern said, “in a British sort of way.”

He was chairman of the British Fashion Council from 1990 to 1994 and liked to shoot – at large, slow clay pigeons.

In 1967 Halpern married Joan Donkin, with whom he had a daughter. The marriage was dissolved in 1999 and in 2003 he married Laura Blume, his former secretary, with whom he had a son and with whom he moved to Miami. That marriage, too, ended in 2007.

Sir Ralph Halpern, born October 24 1938, died August 10 2022

Yahoo News

Yahoo News