SoftBank confirms talks to sell Arm as it reports $12bn profit

SoftBank has confirmed it is looking at a float or sale of Arm, the Cambridge microprocessor company, as it swung into the black on an $11.7bn (£8.9bn) profit following a record loss earlier this year.

In an investor presentation, Masayoshi Son, SoftBank’s chief executive, confirmed Arm was looking at a sale, float or partial sale.

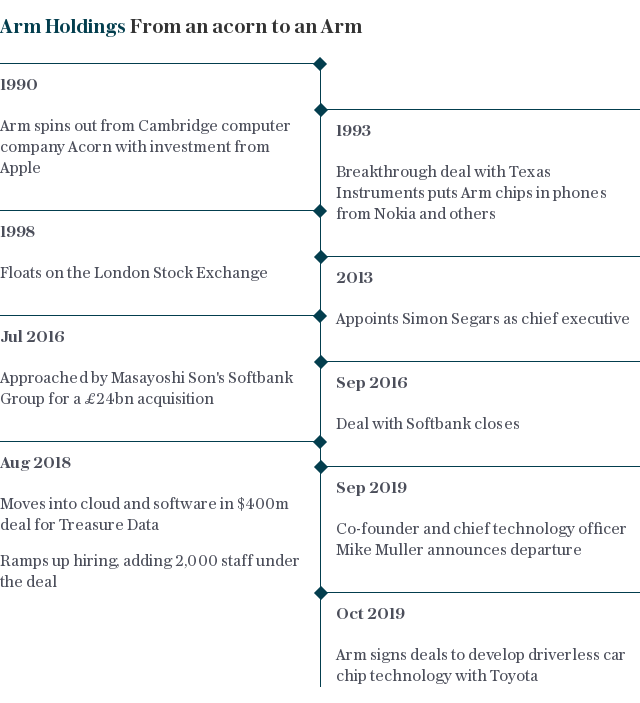

SoftBank has been looking at options for Arm, the Cambridge company it snapped up for £24bn in 2016. It is understood to be in talks with Nvidia, the US graphics chip company, while The Telegraph reported last month it was considering re-listing the company earlier than 2023 it had initially planned.

Mr Son would not confirm the name of the company it was in talks with, but said: “We are having a negotiation and within this negotiation... going public is one of the options, partial sale is one of the options, selling whole is one of the options.”

In its sprawling accounts, the Tokyo-headquartered giant reported a profit after the sale of its US telecoms business Sprint, which completed earlier this year.

The valuations of its technology start-ups and listed companies recovered despite the coronavirus pandemic. Its profits were up 12pc compared to the same three months the previous year.

Earlier this year, SoftBank reported a $13bn loss on the back of the slumping price of Uber shares and the cost of rescuing WeWork, the office co-working company.

In a video call with investors on Tuesday, chief executive Mr Son compared his coronavirus strategy to rifle-wielding Samurai. “Every day is like a war,” he said. “For us, cash is the defence for us.”

The Japanese company has been under pressure to return cash to shareholders from US activist fund Elliott Management. This has seen it sell shares in Alibaba, the Chinese e-commerce giant, and launch a share buyback programme.

Last year, its bet on WeWork saw it spend more than $10bn rescuing the company from collapse after its failed attempt to float.

Now, SoftBank is considering the future of Arm. Arm designs core technology that goes into chips used in billions of smartphones and other devices. SoftBank had hoped a surge of trillions of new gadgets as part of the “internet of things” would see Arm’s value increase.

However, that take-off has proved slower than hoped. SoftBank has grown Arm’s headcount substantially, but it recently decided to spin off its two internet of things divisions it had developed under Arm, leaving the business more focused on its core chip designs.

SoftBank shares fell 2.4pc in Tokyo.

Yahoo News

Yahoo News