Starmer Can Raise Taxes on Banks, Pensions Without a Big U-Turn

(Bloomberg) -- Britain’s opposition Labour Party has ruled out a wide range of tax increases if it wins the election on July 4, but there’s leeway within that promise to increase levies in a few places.

Most Read from Bloomberg

Southwest Plane Plunged Within 400 Feet of Ocean Near Hawaii

Flesh-Eating Bacteria That Can Kill in Two Days Spreads in Japan

Wells Fargo Fires Over a Dozen for ‘Simulation of Keyboard Activity’

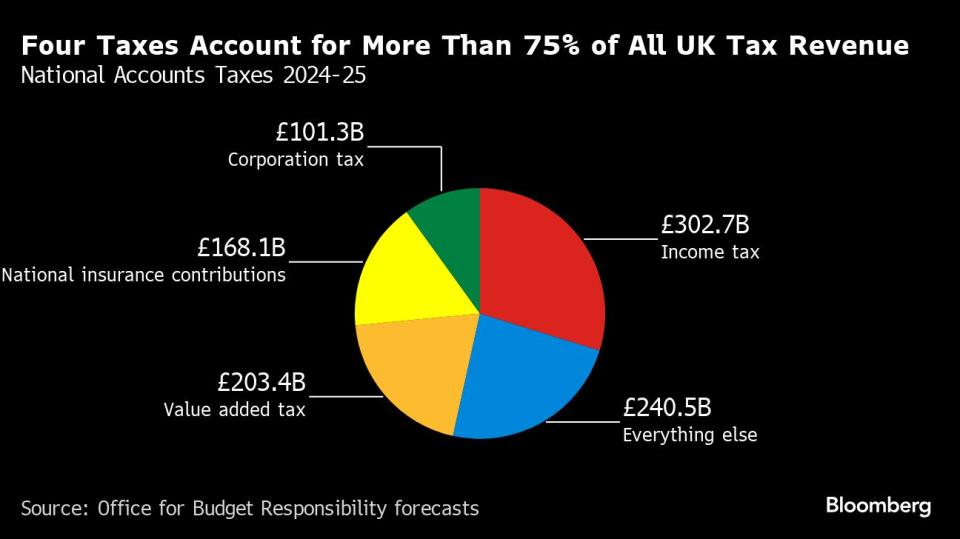

Party leader Keir Starmer this week put into writing pledges to leave unchanged the headline rates of income tax, corporation tax, national insurance and VAT, which together account for more than two thirds of receipts. For the rest, he would only say there are “no plans.”

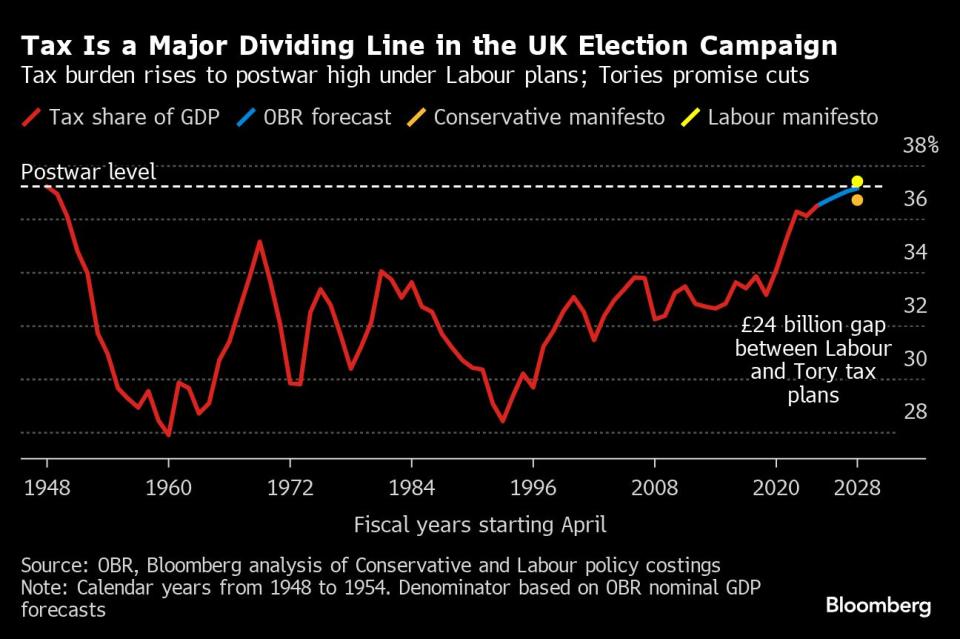

The linguistic difference is subtle but, in an election when promises become binding if the party wins, semantics is everything. It’s especially important in this election, since money is so tight that Labour and Prime Minister Rishi Sunak’s Conservatives have a very small margin to spend any money without boosting taxes, which are already at the highest levels since just after World War II.

With Labour leading in polls, more scrutiny is turning to what Starmer could do if he wins office. Here’s some of the issues and options for Labour:

What Labour Has Promised

Labour has pledged both “no return to austerity” and a program of improvements to the public services.

Starmer has announced £8.6 billion of tax increases — on private schools, private equity, non-domiciled foreigners and oil companies. The extra money is earmarked for the National Health Service, education and green investment.

That leaves open the question how to fix services in other places hurting for cash and in line for further real-terms cuts — justice, transport and local government.

Analysts see difficulty for Starmer in squaring his numbers, with the International Monetary Fund putting the size of the gap at £30 billion. One major constraint is the fiscal rules, which limit how much debt the Treasury can run up — and Starmer’s promise to stick with the rules.

Stronger economic growth would help the calculations, but so far that’s not on the cards either.

Here’s some of the options he has on tax that won’t break his promises:

Bank windfall tax: £2 billion - £4 billion

Britain’s banks are a potential target. The four biggest high-street banks — NatWest Group Plc, Lloyds Banking Group Plc, Lloyds Banking Group Plc, Barclays Plc and Santander UK Plc — made £9.23 billion last year from interest paid by the Bank of England on central bank deposits they hold as reserves, according to Parliament’s Treasury Committee. That’s up by £5 billion in 2022.

The New Economics Foundation, a left wing research group, calls the money a “stealth subsidy to banks” that boosts profits. Politicians and economists, including two former Bank of England deputy governors, have suggested the central bank stop paying interest on some of the reserves, which total around £700 billion.

That move could raise £1.5 billion to £13.4 billion, according to the NEF, or alternatively a “windfall tax” on profits could be levied.

Both BOE Governor Andrew Bailey and the Treasury Committee say a windfall tax would be preferable to interfering with interest rate policy.

Changing Quantitative Tightening: £9 billion

The BOE is offloading £100 billion a year of bonds bought between 2009 and 2021 under its quantitative easing program. Some of that is through active sales of bonds, which are trading below face value. That crystallizes losses that could otherwise be spread across several years.

The Treasury could limit the cost of the BOE’s sales, known as quantitative tightening, by telling officials to move more slowly or halt the process.

The BOE’s estimates that ending active sales would save about £9 billion a year in lower debt interest. As a result, it techically wouldn’t be a tax hike.

Pensions tax relief: up to £15 billion

Currently, the tax relief employees get on contributions to their company pension scheme depends on the income tax they pay. People earning less than £50,270 get 20% relief for every £1 they put into their pension, while those on up to £125,140 get 40% relief. The highest earners get 45%. In effect, the system penalizes those on lower incomes who are saving.

Labour could put everyone on the same rate of 20% or 30% and say it’s removing an unfair distortion in the system. In 2018, Conservative Chancellor of the Exchequer Philip Hammond considered the idea after concluding UK pension reliefs were “eye-wateringly expensive.” The Institute for Fiscal Studies estimates that cutting the rate to 20% would raise £15 billion. A 30% flat rate for everyone would raise £2.7 billion.

Employer NICs Pensions Relief: up to £12.5 billion

Employers pensions contributions into staff retirement programs are eligible for relief on national insurance paid by both the employer and the employee. The IFS says removing the relief for employers, but leaving it in place employees, would save £12.5 billion. The Resolution Foundation says that the ultimate saving would be closer to £9 billion.

Wealth taxes: £1.5 billion

Starmer said Labour would be the party of wealth creation but that does not stop it taxing wealth once it has been created. One relief that may be targeted is business asset disposal relief, which gives entrepreneurs a lower 10% capital gains tax rate on the first £1 million of gains when winding up or selling their business. CGT is normally charged at 20%.

Before 2020, the tax break was known as entrepreneur’s relief and applied to the first £10 million of gains. When Sunak cut it, the acronym he chose spelled BAD. Scrapping the BAD relief would save about £1.5 billion a year, according to Arun Advani, assistant professor at the University of Warwick.

--With assistance from Andrew Atkinson.

Most Read from Bloomberg Businessweek

Grieving Families Blame Panera’s Charged Lemonade for Leaving a Deadly Legacy

Israeli Scientists Are Shunned by Universities Over the Gaza War

The World’s Most Online Male Gymnast Prepares for the Paris Olympics

©2024 Bloomberg L.P.

Yahoo News

Yahoo News