Strong Earnings Growth Will Fuel Tech Rally

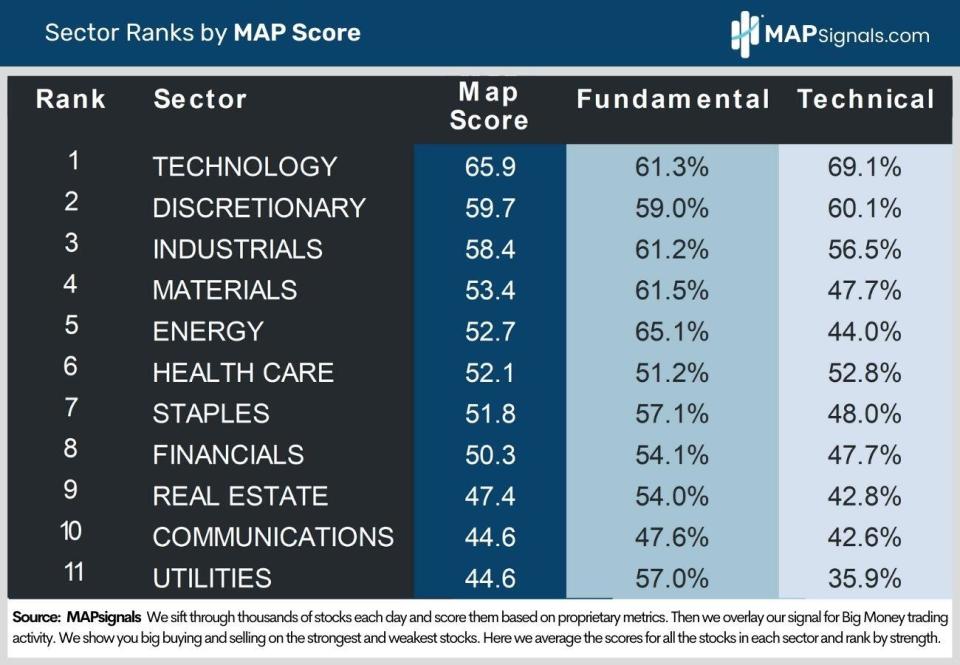

Large investors have positioned for an acceleration in earnings. Below plots our sector rankings with Technology in prime position:

It’s one thing when data favors growth. It’s another when earnings are accelerating.

Strong Earnings Growth Will Fuel Technology Rally

Letting your winners run is how you outperform markets over the long-run. Stocks follow earnings.. The forward earnings picture is brighter than many feared. But there’s more.

Why Tech Still Has Legs

When Growth is Scarce, Tech Shines: With recession fears still elevated, tech’s reliable, all-weather growth is attracting investors.

Less Fed Uncertainty: As inflation continues to gradually ease, the Fed’s tightening campaign is winding down. Since 1957, the FOMC has only waited an average of 3.4 months between ending rate hikes and beginning to ease policy. This favors Tech stocks

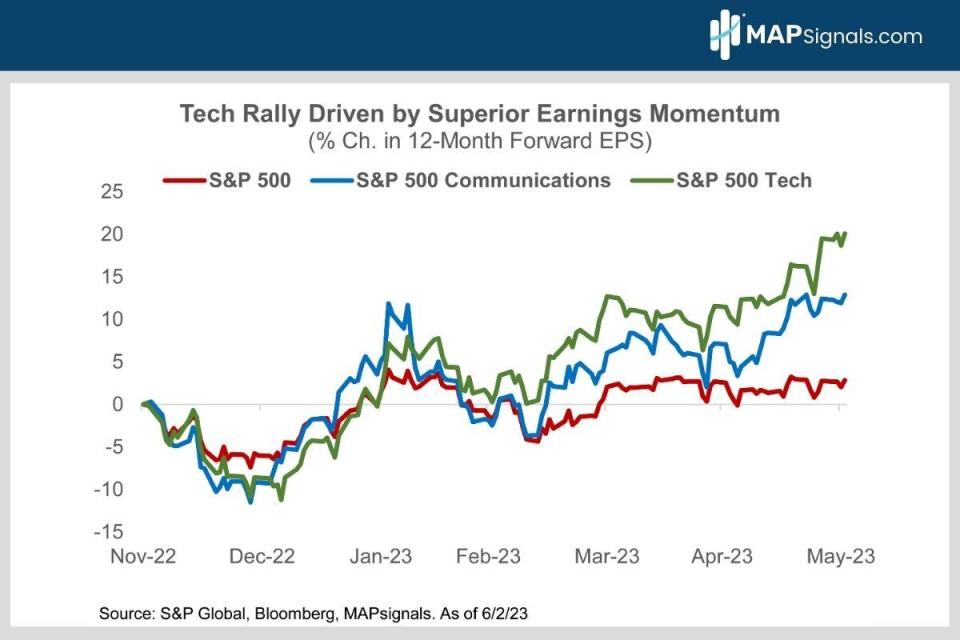

Top Notch Earnings Momentum: S&P 500 tech sector 12-month forward earnings forecasts have been revised up 20% since November vs. only 3% for the S&P 500. Even better, tech is seen posting 17% CY 2024 EPS growth vs. the S&P’s 11.3%. BOOM!

To drive it home, the tech rally is set to thrive as earnings momentum underpins the latest melt up:

But there’s more!

What else favors growth heading into the back half of 2023?

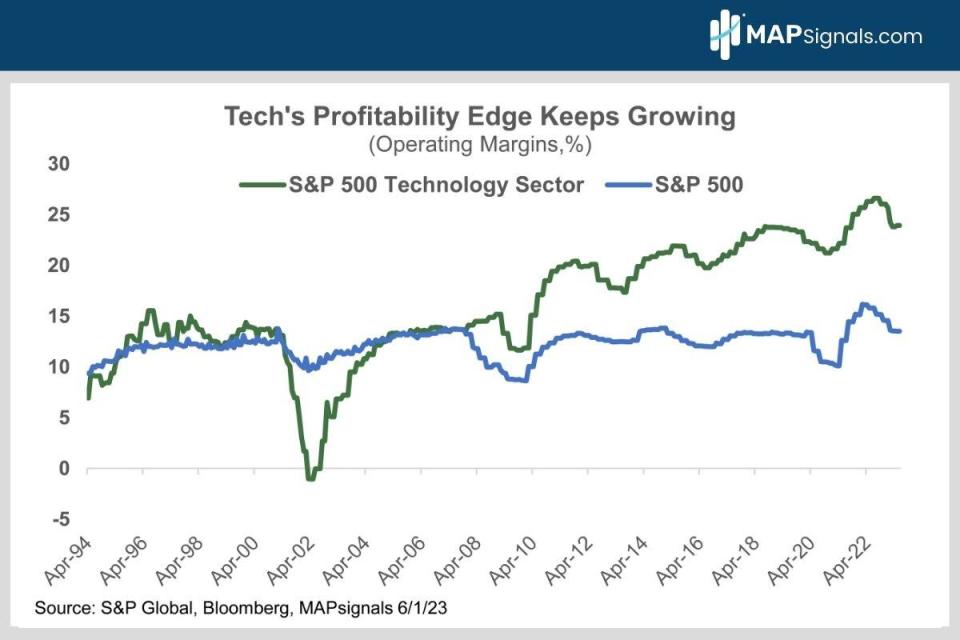

Fatter Profit Margins Tech’s 24% operating profit margin towers over the S&P’s 13%. The spread between the two has rarely been wider.

Growth at a Reasonable Price: Tech trades at 27X 12-month forward EPS vs. the S&P’s 19X. The premium valuation is justified by much faster earnings growth.

Below plots the spread in Tech profitability vs the S&P 500’s. This is why Technology stocks deserve higher valuations:

How to Play It

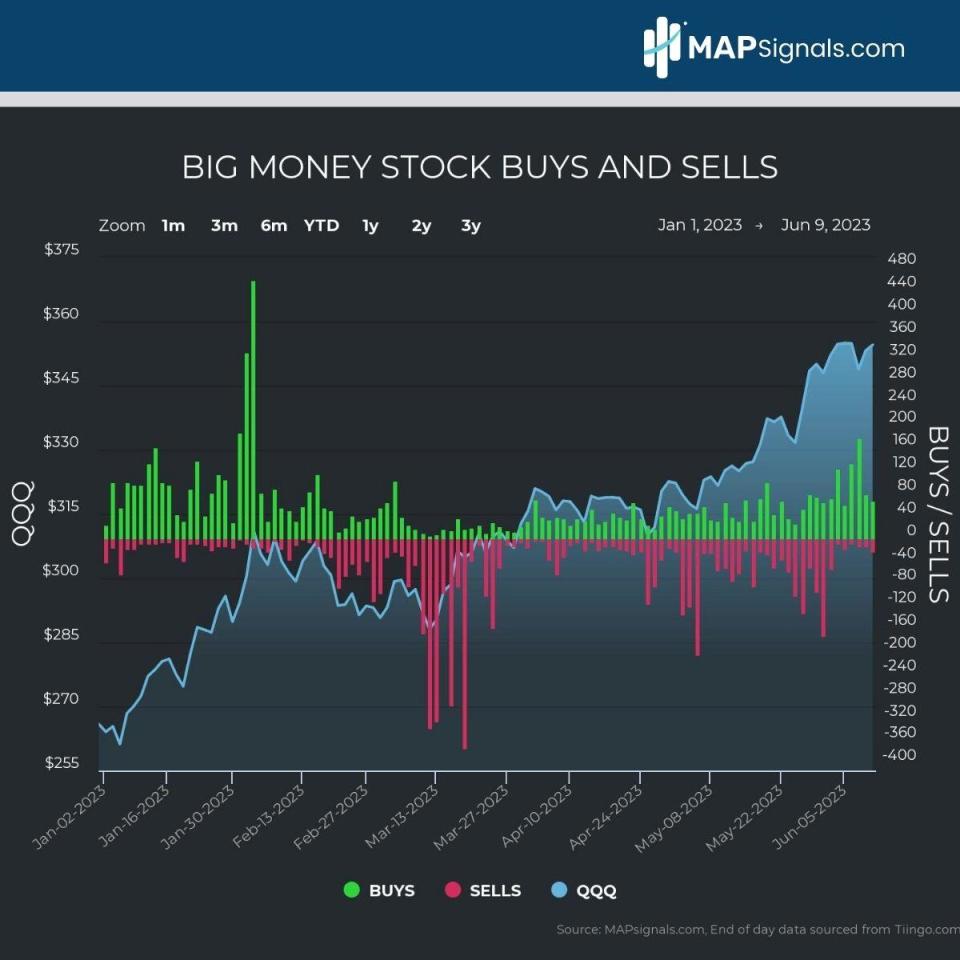

The Nasdaq 100 ETF, QQQ, is the best ETF to play large cap tech. It’s super liquid with $145B in assets, by far the biggest in the category. Even better, it sports a strong 69 map score and a low 0.2% expense ratio.

Top holdings include Microsoft, Apple, Amazon, Nvidia, Meta, Alphabet and Tesla, which account for roughly half of the QQQ’s market cap.

Big investors have also been along for the ride all year. The below chart shows the parabolic move in the ETF. Many of the green stocks keeping it bid are Technology companies:

The Bottom Line & Explanatory Video

Tech stocks have crushed it this year. Many think the party’s over. We disagree.

The rally is underpinned by an improving macroeconomic outlook as easing inflation gives the Fed scope to not only wind down tightening, but also begin cutting rates sooner than most appreciate. That, coupled with tech’s market leading earnings momentum justifies more upside.

QQQ is a great way to get broad tech exposure.

Subscribers know we specialize in specific stocks. That’s where the golden opportunity lies.

To outperform, use a map!

Tech’s had a great run but there’s more to go. Get started with a subscription here.

For a deeper dive on this writeup, you can read the longer version here.

Disclosure: the author holds no position in QQQ at the time of publication.

This article was originally posted on FX Empire

Yahoo News

Yahoo News