Uber Eats is the fastest-growing meal delivery service - but it faces stiff competition ahead

This story was delivered to Business Insider Intelligence Transportation and Logistics Briefing subscribers hours before it appeared on Business Insider. To be the first to know, please click here.

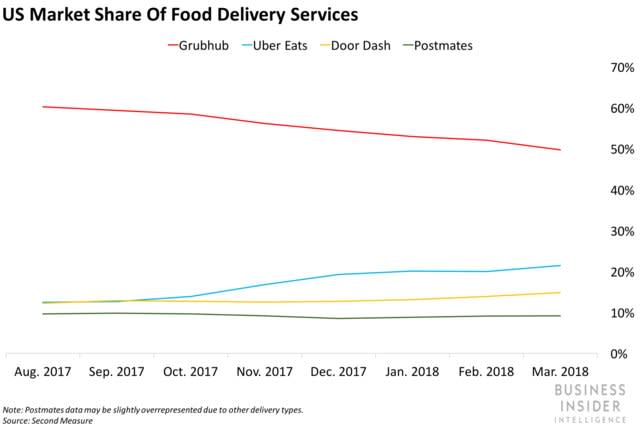

Uber Eats is the fastest-growing meal delivery service in the US, bringing in nearly as much new spending as industry leader Grubhub, according to Second Measure data.

BI Intelligence

Uber Eats doubled its sales and nearly matched Grubhub's dollar-for-dollar growth between August 2017 and February 2018.

This growth, which was aided by Uber bringing the service to more cities and adding highly visible merchant partners, like McDonald's, has helped the company close the gap between itself and Grubhub. As of August 2017, there was a 48% gap between Uber Eats and Grubhub in market share, but this difference had dropped to 28% by March.

Uber may seek to follow a similar strategy to GrubHub to further bridge this gap. GrubHub has used acquisitions to quickly build a network that expands across the US. Since 2011, the firm has acquired 11 companies, including Seamless, DiningIn, and Eat24.

This helped it become a staple of the food delivery industry — 12% of US consumers have spent money with Grubhub. Acquisitions have not been a part of Uber Eats' strategy; it's only acquired one company since launching in 2014. However, it's worth noting that this acquisition took place in January, which could be a sign of Uber adjusting its growth strategy, and perhaps bringing it more in-line with Grubhub's approach.

However, as Uber tries to overtake Grubhub's leading market position, it will have to contend with the likes of Door Dash, Postmates, and Caviar, which have all been making strategic moves in the space. Postmates and DoorDash are reported to be mulling a merger that would see the two unite in an effort to capture a much larger share of the food delivery space — combined, DoorDash and Postmates would have roughly 24% of the market, compared with Uber Eats' 21%.

Beyond a potential merger, both firms have been actively making moves to strengthen their positions. In March, DoorDash raised a $535 million Series D funding round led by SoftBank that valued the company at $1.4 billion. And, Postmates, which has already made over 35 million deliveries to customers leading to $1.2 billion in revenue, partnered with Walmart to expand the retailer’s Online Grocery Delivery option. Square, which owns food delivery service Caviar, recently acquired Zesty, a San Francisco-based catering platform, to strengthen Caviar's corporate catering offerings.

Business Insider Intelligence, Business Insider's premium research service, has written a detailed report on crowdsourced delivery that:

Details the factors driving investment and growth in crowdsourced delivery startups.

Examines the benefits and drawbacks of using crowdsourcing to deliver online orders.

Explains how crowdsourced delivery startups can improve their cost efficiencies to tackle greater delivery volumes

Explores the role that crowdsourcing will play in the future of delivery once automated delivery options, like drones and robots, arrive.

Interested in getting the full report? Here are two ways to access it:

Subscribe to an All-Access pass to Business Insider Intelligence and gain immediate access to this report and over 100 other expertly researched reports. As an added bonus, you'll also gain access to all future reports and daily newsletters to ensure you stay ahead of the curve and benefit personally and professionally. >> Learn More Now

Purchase & download the full report from our research store. >> Purchase & Download Now

See Also:

Yahoo News

Yahoo News