Volatility 101: Should Hudson Pacific Properties (NYSE:HPP) Shares Have Dropped 30%?

Hudson Pacific Properties, Inc. (NYSE:HPP) has rebounded strongly over the last week, with the share price soaring 35%. But that doesn't help the fact that the three year return is less impressive. Truth be told the share price declined 30% in three years and that return, Dear Reader, falls short of what you could have got from passive investing with an index fund.

View our latest analysis for Hudson Pacific Properties

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Although the share price is down over three years, Hudson Pacific Properties actually managed to grow EPS by 2.6% per year in that time. Given the share price reaction, one might suspect that EPS is not a good guide to the business performance during the period (perhaps due to a one-off loss or gain). Or else the company was over-hyped in the past, and so its growth has disappointed.

It looks to us like the market was probably too optimistic around growth three years ago. But it's possible a look at other metrics will be enlightening.

Given the healthiness of the dividend payments, we doubt that they've concerned the market. It's good to see that Hudson Pacific Properties has increased its revenue over the last three years. But it's not clear to us why the share price is down. It might be worth diving deeper into the fundamentals, lest an opportunity goes begging.

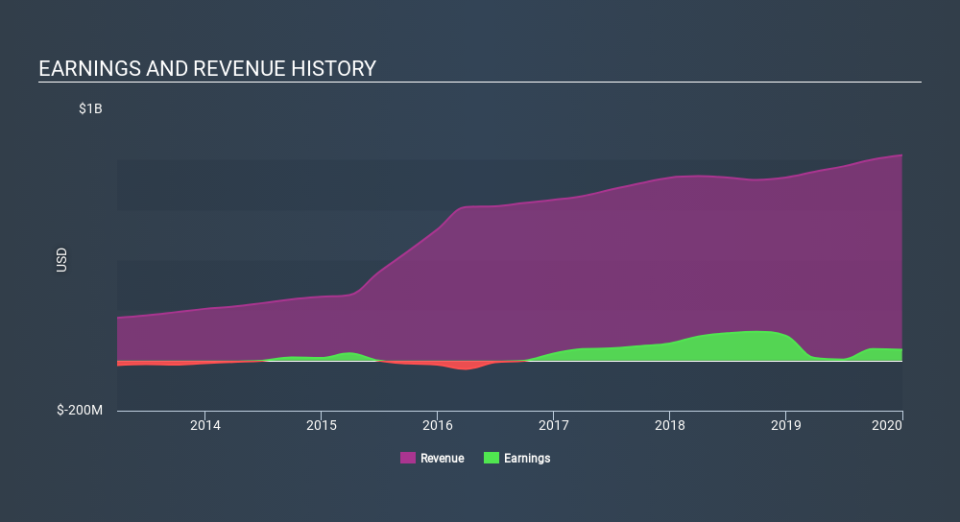

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

It's good to see that there was some significant insider buying in the last three months. That's a positive. That said, we think earnings and revenue growth trends are even more important factors to consider. This free report showing analyst forecasts should help you form a view on Hudson Pacific Properties

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. We note that for Hudson Pacific Properties the TSR over the last 3 years was -23%, which is better than the share price return mentioned above. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

While the broader market lost about 10% in the twelve months, Hudson Pacific Properties shareholders did even worse, losing 27% (even including dividends) . Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 3.6% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. It's always interesting to track share price performance over the longer term. But to understand Hudson Pacific Properties better, we need to consider many other factors. Consider risks, for instance. Every company has them, and we've spotted 2 warning signs for Hudson Pacific Properties you should know about.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo News

Yahoo News