Walmart’s e-commerce started to bounce back in Q1 (WMT)

This story was delivered to Business Insider Intelligence "E-Commerce Briefing" subscribers hours before appearing on Business Insider. To be the first to know, please click here.

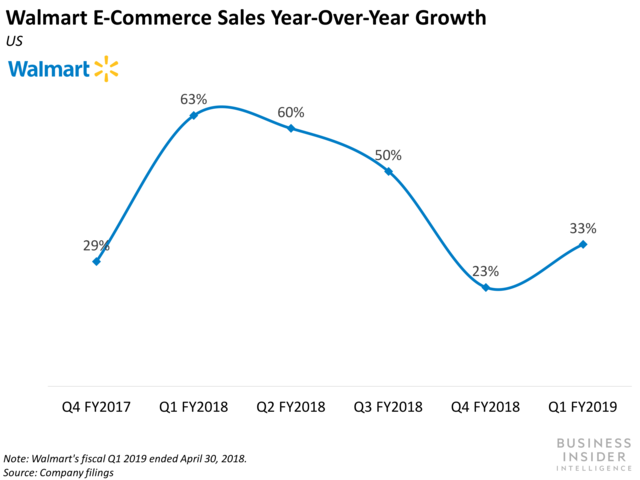

Walmart announced its earnings for its fiscal Q1 2019 (ended April 30, 2018), reporting total revenue of $122.7 billion, up 4.4% year-over-year (YoY), a slight acceleration from its 4.1% YoY jump in Q4 FY2018. That quarter also posted concerning e-commerce sales growth of only 23% YoY, dropping all the way from 63% YoY in Q1 FY2018 in just a few quarters. But Q1 may mark the beginning of a turnaround, as Walmart’s US e-commerce sales accelerated to 33% YoY, potentially putting it on track to meet Walmart’s guidance of 40% growth for fiscal 2019.

BI Intelligence

Its US grocery business helped drive its overall performance, as well as its e-commerce improvements. Walmart saw increases in the sales of fresh foods and packaged goods, bolstering its overall performance, according to The Wall Street Journal. At the same time, its online grocery business continued to grow, CFO Brett Biggs told CNBC.

This likely played a role in Walmart’s e-commerce rebound, and may drive it further in the future, as it expects to offer grocery delivery to 40% of the US population by the end of the year, according to WSJ. This will give more consumers options beyond click-and-collect, potentially increasing Walmart’s online grocery sales, as shoppers may be enticed by the ability to get their groceries without going to the store at all.

Walmart has been revamping its website, which could cause its e-commerce sales to take off. It has redesigned its site to create a better online shopping experience. The recent redesign is said to feature a more personalized site and new tools to make reordering products easy, and it's more image- and editorial-driven. Such changes could make shopping with Walmart more appealing, helping it become more consumers’ preferred e-tailer, an area where Amazon dominates.

It's working with Lord & Taylor to launch a fashion shop on its site in the coming weeks. The fashion section will feature Walmart’s “everyday brands,” with dresses priced between $9 and $20, and a Lord & Taylor-driven “premium brands” section, drawing from over 125 brands, with pricier dresses costing between $41 and $159, Business Insider reports. This will add higher-end fashion options that Walmart doesn’t currently feature to its assortment, which could draw purchases from current customers, but also attract new shoppers.

Walmart has shown that it covets more affluent consumers, as it's acquired a number of e-commerce brands that don’t match its low-price reputation, and this partnership with Lord & Taylor may bring more high-spending consumers to its site, which would help it improve its overall e-commerce performance.

To receive stories like this one directly to your inbox every morning, sign up for the E-Commerce Briefing newsletter.Click here to learn more about how you can gain risk-free access today.

See Also:

Yahoo News

Yahoo News