We're Watching These Trends At TechnipFMC (NYSE:FTI)

What trends should we look for it we want to identify stocks that can multiply in value over the long term? In a perfect world, we'd like to see a company investing more capital into its business and ideally the returns earned from that capital are also increasing. Ultimately, this demonstrates that it's a business that is reinvesting profits at increasing rates of return. Although, when we looked at TechnipFMC (NYSE:FTI), it didn't seem to tick all of these boxes.

Return On Capital Employed (ROCE): What is it?

For those that aren't sure what ROCE is, it measures the amount of pre-tax profits a company can generate from the capital employed in its business. Analysts use this formula to calculate it for TechnipFMC:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.097 = US$939m ÷ (US$20b - US$9.9b) (Based on the trailing twelve months to June 2020).

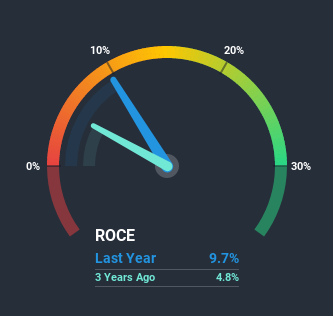

So, TechnipFMC has an ROCE of 9.7%. In absolute terms, that's a low return, but it's much better than the Energy Services industry average of 8.0%.

Check out our latest analysis for TechnipFMC

Above you can see how the current ROCE for TechnipFMC compares to its prior returns on capital, but there's only so much you can tell from the past. If you'd like, you can check out the forecasts from the analysts covering TechnipFMC here for free.

What Can We Tell From TechnipFMC's ROCE Trend?

In terms of TechnipFMC's historical ROCE trend, it doesn't exactly demand attention. The company has employed 35% more capital in the last five years, and the returns on that capital have remained stable at 9.7%. Given the company has increased the amount of capital employed, it appears the investments that have been made simply don't provide a high return on capital.

Another thing to note, TechnipFMC has a high ratio of current liabilities to total assets of 51%. This effectively means that suppliers (or short-term creditors) are funding a large portion of the business, so just be aware that this can introduce some elements of risk. Ideally we'd like to see this reduce as that would mean fewer obligations bearing risks.

The Bottom Line

As we've seen above, TechnipFMC's returns on capital haven't increased but it is reinvesting in the business. It seems that investors have little hope of these trends getting any better and that may have partly contributed to the stock collapsing 71% in the last three years. In any case, the stock doesn't have these traits of a multi-bagger discussed above, so if that's what you're looking for, we think you'd have more luck elsewhere.

If you want to continue researching TechnipFMC, you might be interested to know about the 2 warning signs that our analysis has discovered.

If you want to search for solid companies with great earnings, check out this free list of companies with good balance sheets and impressive returns on equity.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

Yahoo News

Yahoo News