How The Interest Rate Rise Will Impact Your Mortgages And Credit

A woman cycling past the Bank of England. (Photo: Kirsty O'Connor via PA Wire/PA Images)

Raising and lowering interest rates is the blunt instrument used by central banks to control economies.

Hiking the “base” rate increases the cost of borrowing, making both credit and investment more expensive. The idea is to put the brakes on the economy and curb the soaring cost of goods and services – known as inflation.

Bringing rates down is an attempt to have the opposite effect – stimulate growth by making borrowing cheaper, and in turn, encourage investment.

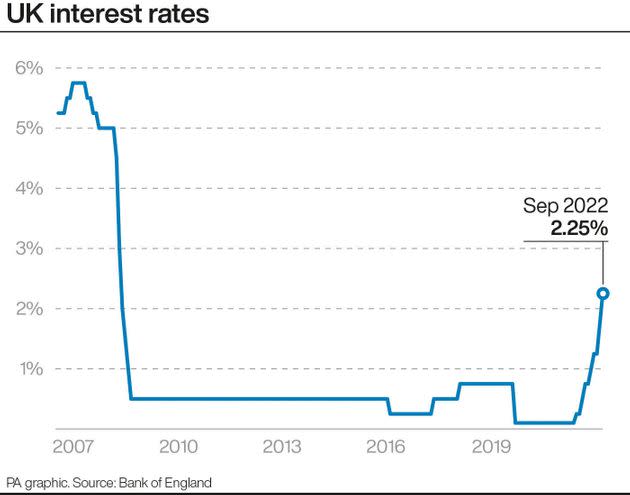

On Thursday, the Bank of England – the UK’s central bank – unveiled the biggest hike in interest rates for 33 years. The Bank has just increased them from 2.25% to 3%.

This marks the eighth consecutive rise since December last year.

Rates are now at their highest level since 2008, when the banking collapse forced monetary policy makers to slash the cost of borrowing.

Here’s what it means for households and why any gains will be modest.

Why are rates rising so much?

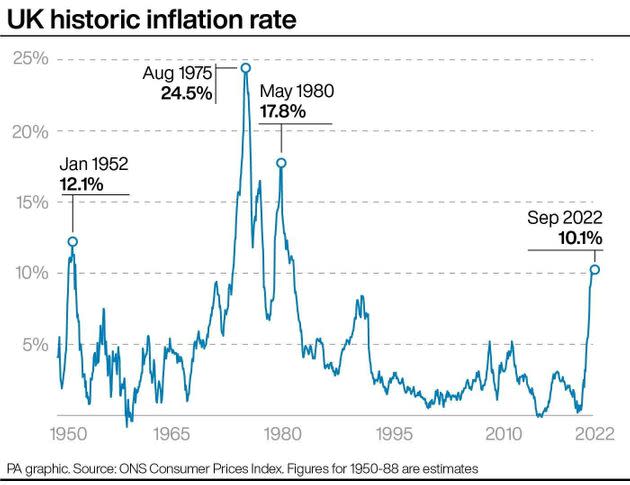

The Bank of England is tasked with keeping inflation under control, targeting 2% a year.

But this year inflation has started to run away, hitting 10.1% in September. While precisely how long government action to freeze energy bills will last is yet to be decided by new prime minister Rishi Sunak, the help will boost many people’s spending power – adding more inflationary pressure.

UK interest rates. (Photo: PA Graphics via PA Graphics/Press Association Images)

Last month Bank of England governor Andrew Bailey said it was likely the hike in interest rates could be bigger than the 0.5 percentage point increase to 2.25% seen at the previous meeting.

He said on October 15: “As things stand today, my best guess is that inflationary pressures will require a stronger response than we perhaps thought in August.”

By increasing interest rates, the Bank makes it more expensive to borrow money, so people are therefore likely to spend less.

If people – and businesses – are forced to spend less, demand will decrease, and prices will fall, or at least the rises will mellow, and in theory inflation is brought to heel.

But the Bank, which has already indicated it believes the economy is in recession, is walking a tightrope: raising interest rates might help to combat inflation, but that could mean the economy stalls – making any recession potentially deeper and longer.

How will the interest rate hike impact people?

Mortgages

The most obvious impact is that it will become more expensive for people to pay off their mortgages.

People taking out a new loan will soon be quoted a higher interest rate as a result of the Bank’s change.

And those whose mortgages are being renegotiated will likely have to deal with larger bills than they had in the past.

Mortgage rates had already spiralled after the political turmoil caused by Liz Truss’s government, which drove up the cost of borrowing. But British banks are now cutting home loan prices after Sunak took power.

Credit

Those with other types of debts will also feel the squeeze.

Anyone with an existing fixed-rate personal loan, credit card or car loan will be unaffected as the terms of their loan have already been agreed.

But new borrowers shopping around for credit may find the cost of debt higher.

Why is the cost of living soaring so much?

Inflation is a measure of how much the price of the things that the average household buys is changing, with the Ukraine war compounded a crippling cost-of-living crisis where wages are failing to keep pace.

Inflation is likely to peak in October, largely due to the amount that people pay for the energy they use to run their homes. Energy prices will contribute around 40% of the inflation that the Bank is expecting in October.

UK historic inflation rate. (Photo: PA Graphics via PA Graphics/Press Association Images)

Who benefits from the interest rate hike?

Savers will benefit a little from the rate hike as the banks they keep their money with are likely to increase the amount of interest they pay on deposits.

The average rates being offered on some savings accounts have reached their highest level in nearly a decade.

However, many savings accounts have not seen their rates lifted yet towards the levels of interest rate rises.

The impact of the increased interest that savers get will also be more than offset by inflation, which is more than decimating savings.

This article originally appeared on HuffPost UK and has been updated.

Yahoo News

Yahoo News