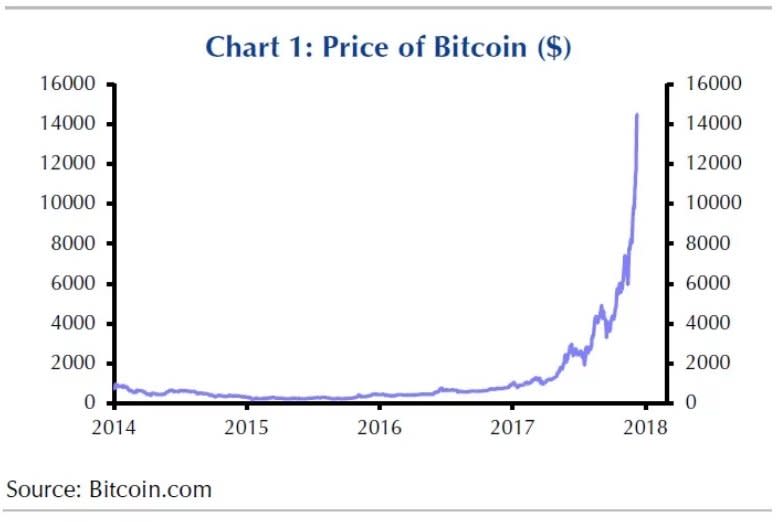

Why investors have nothing to fear from a bursting of the bitcoin bubble, in one chart

Bitcoin remains the talk of financial markets.

Its stratospheric price rise this year, shown in the chart below from Capital Economics, helps explain why there’s just so much interest at present.

Capital Economics

Phenomenal, right?

Aside from speculation as to why prices have surged so far so fast, the other major talking point is whether bitcoin is a bubble, destined to pop like other asset bubbles such as tulip prices and tech stocks in the past.

While that debate is unlikely to be resolved in the near-term, to Andrew Kenningham, chief global economist at Capital Economics, even if bitcoin is in a bubble, its subsequent popping — should that actually eventuate — will have little ramifications for broader asset markets, the banking system or the global economy.

“There are several channels through which a bursting asset price bubble can, in principle, have macroeconomic consequences, but none are a major risk in the case of bitcoin,” he says.

“First, there may be a hit to household spending as people who have invested suffer losses. But bitcoin’s market capitalization is too small for this to be a worry. It is currently around $240 billion, which is much smaller than the total value of gold outstanding at $US8 trillion or the value of Apple at $900 billion.

“If the price of bitcoin fell to zero today, the paper losses would be equivalent to a 0.6% fall in US equity prices. As most investors have bought bitcoin at much lower prices, the relevant losses would arguably be smaller.”

This chart from Capital Economics compares the current net value of Bitcoin compared to other more established asset markets.

Capital Economics

Given its relatively small value in the broader scheme of things, Kenningham says a popping of the bitcoin bubble will have few, if any, ramifications for the global banking system.

“While a bursting bubble can affect the economy via the banking sector, this is not much of a risk either, precisely because bitcoin is held and traded outside the banking sector,” he says.

“Also, there is no evidence that people are taking out huge, sub-prime mortgages to finance their speculation in cryptocurrencies.”

And, given that view, Kenningham says any unwind in the bitcoin price is unlikely have any broader consequences for financial markets or the economy.

“A slump in bitcoin prices should not have much effect on wider investor and business confidence either,” he says.

“As we have pointed out elsewhere, there is no correlation between the prices of bitcoin and other risky assets, so a fall in its price should not affect wider financial conditions. And nor would it tell us anything about wider market sentiment.

“Unlike the bubbles in the tech sector in the late-1990s and in US residential property a few years later, a bursting of the bitcoin bubble should not have systemic, macroeconomic implications.

“The total value of bitcoin is still too small, and it has few links with the wider economy,” he concludes.

NOW WATCH: How couples improved their sex lives in just one week

See Also:

Yahoo News

Yahoo News