Should You Worry About YPB Group Limited's (ASX:YPB) CEO Pay?

In 2017, John Houston was appointed CEO of YPB Group Limited (ASX:YPB). This analysis aims first to contrast CEO compensation with other companies that have similar market capitalization. Next, we'll consider growth that the business demonstrates. Third, we'll reflect on the total return to shareholders over three years, as a second measure of business performance. The aim of all this is to consider the appropriateness of CEO pay levels.

View our latest analysis for YPB Group

How Does John Houston's Compensation Compare With Similar Sized Companies?

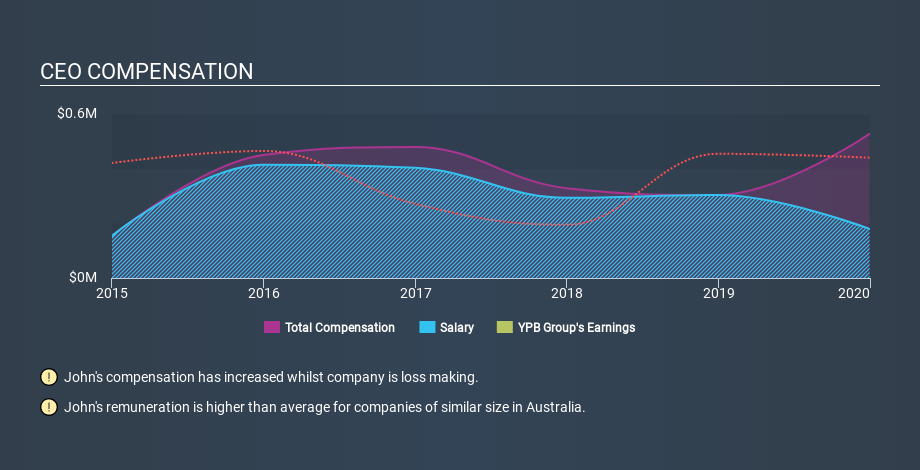

According to our data, YPB Group Limited has a market capitalization of AU$5.1m, and paid its CEO total annual compensation worth AU$527k over the year to December 2019. Notably, that's an increase of 74% over the year before. While we always look at total compensation first, we note that the salary component is less, at AU$180k. We note that more than half of the total compensation is not the salary; and performance requirements may apply to this non-salary portion. We took a group of companies with market capitalizations below AU$306m, and calculated the median CEO total compensation to be AU$384k.

Pay mix tells us a lot about how a company functions versus the wider industry, and it's no different in the case of YPB Group. Talking in terms of the sector, salary represented approximately 78% of total compensation out of all the companies we analysed, while other remuneration made up 22% of the pie. YPB Group sets aside a smaller share of compensation for salary, in comparison to the overall industry.

It would therefore appear that YPB Group Limited pays John Houston more than the median CEO remuneration at companies of a similar size, in the same market. However, this fact alone doesn't mean the remuneration is too high. A closer look at the performance of the underlying business will give us a better idea about whether the pay is particularly generous. You can see, below, how CEO compensation at YPB Group has changed over time.

Is YPB Group Limited Growing?

Over the last three years YPB Group Limited has seen earnings per share (EPS) move in a positive direction by an average of 78% per year (using a line of best fit). Its revenue is down 44% over last year.

This shows that the company has improved itself over the last few years. Good news for shareholders. Revenue growth is a real positive for growth, but ultimately profits are more important. You might want to check this free visual report on analyst forecasts for future earnings.

Has YPB Group Limited Been A Good Investment?

Since shareholders would have lost about 96% over three years, some YPB Group Limited shareholders would surely be feeling negative emotions. This suggests it would be unwise for the company to pay the CEO too generously.

In Summary...

We examined the amount YPB Group Limited pays its CEO, and compared it to the amount paid by similar sized companies. As discussed above, we discovered that the company pays more than the median of that group.

However we must not forget that the EPS growth has been very strong over three years. Having said that, shareholders may be disappointed with the weak returns over the last three years. This contrasts with the growth in CEO remuneration, in the last year. Considering positive per-share earnings movement, but keeping in mind the weak returns, we'd need more time to form a view on CEO compensation. Shifting gears from CEO pay for a second, we've spotted 5 warning signs for YPB Group you should be aware of, and 4 of them are concerning.

If you want to buy a stock that is better than YPB Group, this free list of high return, low debt companies is a great place to look.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

Yahoo News

Yahoo News