How 5G will drive the adoption of self-driving cars

BI Intelligence

This story was delivered to BI Intelligence Transportation and Logistics Briefing subscribers. To learn more and subscribe, please click here.

Dead zones in 5G coverage could limit self-driving cars to dense, urban population centers in the coming years, according to a new article from Motherboard.

That scenario could pose problems for autonomous vehicles relying on 5G connectivity, particularly as the cars become more affordable for consumers.

However, telecoms could actually take advantage of a slew of revenue opportunities by providing 5G connectivity in more rural areas, which will likely push them to extend coverage to those places eventually.

As mobile network operators begin to introduce 5G technology into their networks, they will focus on urban areas. 5G technology is expected to greatly improve mobile wireless networks' capacity and data speeds, allowing network providers to offer much more robust internet connections to devices.

This will allow those network providers to meet growing demand for data-intensive services, like streaming video, in urban areas. 5G’s greater networking capabilities are also expected to play a central role in the proliferation of self-driving cars, which will produce enormous amounts of data themselves, and will also become platforms for consuming digital video and other streaming media services. As 5G networks take hold in cities, they will help enable the autonomous urban ride-hailing services most self-driving car players, including Waymo, GM, and Uber, are focusing their commercialization efforts on.

Experts interviewed by Motherboard argue that telecoms will have little incentive, though, to provide expensive and fast 5G coverage in rural areas, making them hard to reach for self-driving cars that rely on 5G connectivity. In that scenario, dead zones in coverage would make self-driving cars that rely on 5G connectivity incapable of inter-city highway travel, according to the Motherboard article. While this wouldn’t impact urban ride-hailing programs, it could become an issue once the cost of self-driving cars gets low enough for consumers to purchase their own autonomous vehicles, which Kevin Clark, CEO of auto supplier Aptiv (formerly Delphi), recently said would happen by 2025.

However, network service providers could potentially find many ways to monetize investments in 5G networks that cover rural road networks. Telecoms could use those networks to offer a wide variety of services to automakers, including media streaming services for passengers in the car, navigation and weather updates, and cybersecurity services to monitor vehicles for intrusions.

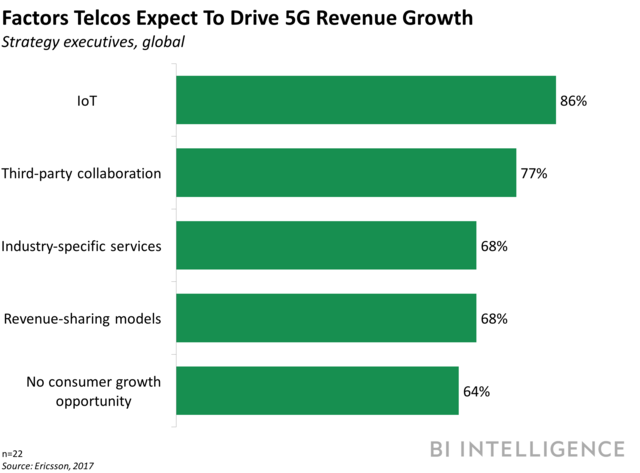

To make many of those services valuable, telecoms would need to ensure they can provide reliable connections along the most trafficked highways and many rural areas, which will push network operators to gradually expand their 5G networks to cover them. Autonomous cars and other new types of connected Internet of Things (IoT) devices are expected to be major revenue drivers for 5G networks, and offering these types of services will be critical for telecoms to maximize that opportunity.

This wouldn’t preclude them from leaving a few dead zones — the cars could fall back on GPS for navigation purposes in those instances, or download sections of maps ahead of time, as well as media for passengers to enjoy while out of range. Meanwhile, the most mission critical data processing and analysis functions of self-driving cars, including analyzing the data from their sensors about obstacles in their surroundings, will take place on the car’s own computing systems, and therefore won’t rely on network connections anyway. As such, it’s highly unlikely that dead zones in 5G coverage will significantly hamper self-driving car adoption.

The self-driving car is no longer a futuristic fantasy. Consumers can already buy vehicles that, within a few years time, will get software updates enabling them to hit the road without the need for a driver.

This autonomous revolution will upend the automotive sector and disrupt huge swaths of the economy, while radically improving energy efficiency and changing the way people approach transport around the world.

Automakers and tech companies are racing to develop the technology that will power self-driving cars in the coming years. That tech is advancing, but leaves observers with a bigger question: will consumers trust driverless car tech, and will they want to use autonomous cars?

Peter Newman, research analyst for BI Intelligence, Business Insider's premium research service, has compiled a detailed report on self-driving cars that:

Sizes the current and future self-driving car market, forecasting shipments and projecting installed base.

Explains the current state of technology, regulation, and consumer perception.

Analyzes how the development of autonomous cars will impact employment and the economy.

Interested in getting the full report? Here are two ways to access it:

Subscribe to an All-Access pass to BI Intelligence and gain immediate access to this report and over 100 other expertly researched reports. As an added bonus, you'll also gain access to all future reports and daily newsletters to ensure you stay ahead of the curve and benefit personally and professionally. >> Learn More Now

Purchase & download the full report from our research store. >> Purchase & Download Now

See Also:

Yahoo News

Yahoo News