Amazon could lead US apparel retail by the end of this year (AMZN)

This story was delivered to Business Insider Intelligence "E-Commerce Briefing" subscribers hours before appearing on Business Insider. To be the first to know, please click here.

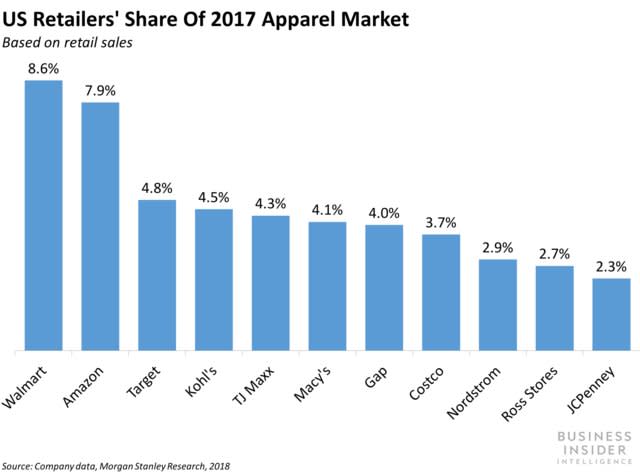

Amazon is expected to be the leading US apparel retailer in 2018, according to a report from Morgan Stanley cited by CNBC. It had 7.9% in market share in US apparel retail sales in 2017, coming in second to Walmart’s 8.6%. Both retailers are far ahead of the rest of the field, with third place Target holding only 4.8% market share.

BI Intelligence

Amazon’s market share gained 1.5 percentage points in 2017, and Morgan Stanley expects it to continue to rise as department stores flounder and brands look to Amazon for help.

The report predicts that department stores will only make up 8% of the apparel market in 2022, down from 24% in 2006, enabling Amazon to steal sales. Amazon is a leading beneficiary of department stores’ struggles. For example, 42% of the consumers who reported spending less with Macy’s on apparel in the last three years said they moved that spending to Amazon, which was more than any other retailer, according to a study from Coresight Research.

Apparel brands are deepening their relationships with Amazon, bolstering its prestige and product selection. Nike started selling directly through Amazon for the first time this year, while Calvin Klein began selling new products exclusively on the site. These brands, among others, appear to be looking to Amazon to improve their direct-to-consumer performances, especially as traditional brick-and-mortar retailers struggle. As those issues continue, more brands may strike similar deals with Amazon, driving its market share higher.

Building out its product selection with new brands should help Amazon’s apparel business take off, as its reputation for having everything has helped it succeed in other segments. The second most popular reason consumers start their product searches on Amazon is because it's most likely to have the products they want, according toBusiness Insider Intelligence’s Amazon Commerce Competitive Edge 2018 survey. However, the e-commerce titan’s apparel offerings previously couldn't live up to the same expectations. With more brands coming to its marketplace, and potentially new exclusive offerings, Amazon may be able to build up the same reputation in apparel.

Meanwhile, Prime subscribers are Amazon’s key apparel consumers. Prime subscribers are now two times as likely to buy apparel from Amazon as those without a subscription, up from 1.5 times a year ago, according to Morgan Stanley. And with over 100 millionmembers, Prime subscribers are a strong base to be working from. In order to capitalize, Amazon is developing Prime Wardrobe, an apparel service exclusive to subscribers. The service, which is still being tested but has been rolled out to more consumers, allows subscribers to order up to eight apparel items at a time, send back what they don’t like, and only pay for what they keep, all for free with a Prime account. This encourages new sales among its core customers, and when it's fully launched, it could propel Amazon’s apparel business to new heights.

To receive stories like this one directly to your inbox every morning, sign up for the E-Commerce Briefing newsletter. Click here to learn more about how you can gain risk-free access today.

See Also:

Yahoo News

Yahoo News