Bob Iger’s Disney Self-Evaluation Revealed in Pay Discrimination Fight

In 2019, Disney just couldn’t miss. The company’s stock had catapulted to a then-all time high off the back of Disney+’s debut, the acquisitions of 21st Century Fox and operating control of Hulu, and a record year at the box office led by Avengers: Endgame.

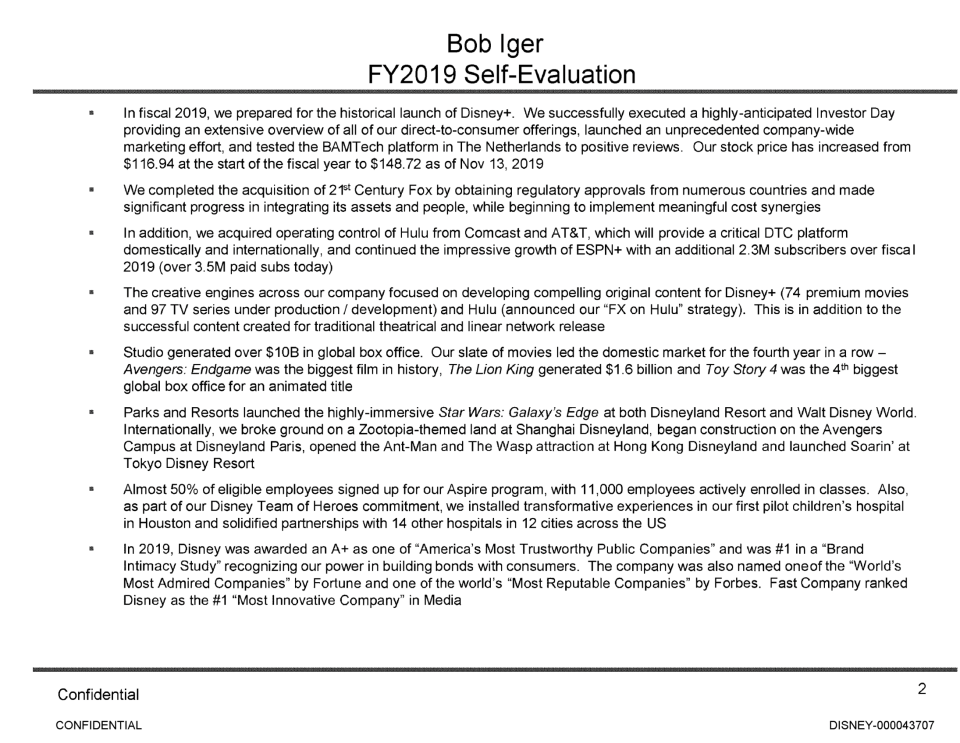

The board thought Bob Iger had a fantastic year stewarding the company and, apparently, he did too. In a self-evaluation, he stressed Disney’s triumphant year for approval of a bonus payout and his 2020 base salary. The filing, which is embedded below, was unsealed Tuesday as part of hundreds of documents reviewed by The Hollywood Reporter in a class action claiming the company discriminates against female workers, who say they’re being paid less than their male counterparts.

More from The Hollywood Reporter

'Lord of Misrule' Director William Brent Bell Is Actively Developing 'Orphan 3'

Olivia Wilde to Direct 'Naughty' Christmas Comedy for Universal

Women Represented Majority of Amazon Originals Writers in 2022

Iger, in his self-evaluation, told the board that he “successfully executed a highly-anticipated Investor Day providing an extensive overview of all of our direct-to-consumer offerings” and “launched an unprecedented company-wide marketing effort.”

At the top of the list of his other success: The production of a fleet of original content for Disney+ (72 movies and 97 TV series in development); $10 billion in the global box office with Avengers: Endgame, The Lion King and Toy Story 4 leading the way; and Disney’s public perception as one of the country’s most trusted public companies.

Additionally, Iger underscored the launch of Star Wars: Galaxy’s Edge at Walt Disney World and Disneyland, as well as expansions at its theme parks in Shanghai, Hong Kong, Tokyo and Paris.

The self-evaluation was sent to a “committee” to determine Iger’s compensation recommendation, according to another unsealed document. The group then reviewed the information with the full board.

For his work, the board approved a compensation package of $47.5 million. He remained among the highest paid executives in the country.

In total, the company reported net income from continuing operations of $10.4 billion on revenue of $69.6 billion, up 17 percent from the previous year.

Unlike in 2019, Iger may now have little to point to as far as recent successes. In addition to a sagging stock price, Disney is also confronting a series of tepid performances at the box office due to quality control issues with its Marvel titles. The company’s down year culminated last month in a new proxy fight by Trian Partners. On Thursday, former Disney CFO Jay Rasulo and Nelson Peltz were nominated for seats on the company’s board. The firm stressed Disney’s underperformance relative to its competitors and potential.

“The root cause of Disney’s underperformance, in our view, is a Board that is too closely connected to a long-tenured CEO and too disconnected from shareholders’ interests,” Trian wrote.

Here’s Bob Iger’s self-evaluation in 2019:

Best of The Hollywood Reporter

Yahoo News

Yahoo News